Stellar Technical Analysis: XLM/USD at risk of dropping facing strong resistance ahead

- XLM/USD has dropped 11% in the past 24 hours after an overall market weakness.

- A cluster of indicators is showing that XLM is facing a strong resistance area in the short-term.

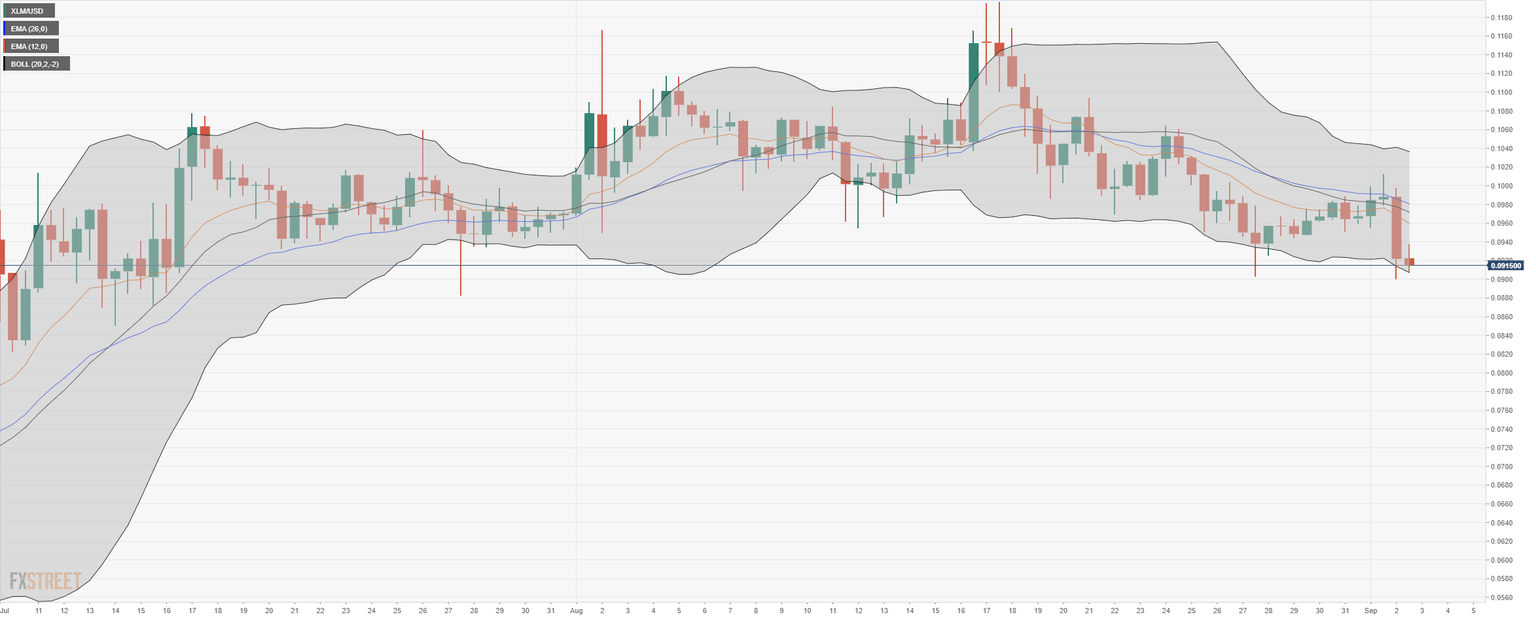

Stellar is currently trading at $0.091 after losing the daily uptrend. There has been a clear shift in momentum for the bears which are now in control and facing almost no support levels on the way down.

XLM/USD 12-hour chart

There is a huge area of resistance present above $0.096 from the EMAs and the upper band of the Bollinger indicator. The price was already rejected from $0.1 following the recent news of Bithumb’s fraud charges and seizure of its headquarters.

Bulls are currently trying to defend the lower band and we could see a bounce in the short-term, however, the overall selling pressure will continue existing.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.