Solana price rises after ChatGPT integration; Rally for AI-tokens may not be far away

- Solana integrated a ChatGPT plugin into the Layer-1 blockchain to allow developers to leverage AI in Dapp development.

- French President Emmanuel Macron held discussions with ChatGPT creator to use AI for various purposes in the country.

- Render price noted an 11% rally over the last 24 hours, suggesting AI tokens are still triggered by AI-related developments.

Artificial Intelligence (AI) has become a big focus of not only developers but also traders since the ChatGPT-induced AI hype took over the crypto market for a while. As AI-affiliated tokens began rallying, many assumed that this might be the next big thing for crypto, but the case may not be so.

Solana integrates ChatGPT

On May 23, the Solana Foundation announced the Layer-1 blockchain of Solana had integrated a ChatGPT plugin. With this integration, developers will now be able to leverage AI capabilities in developing Decentralised applications (Dapps).

The growth of AI in the crypto and web3 field has been notable as it holds the potential to reduce the workload for a developer significantly. In line with the same, Solana co-founder Anatoly Yakovenko stated,

“Every developer building consumer-oriented apps should be thinking about how their app is going to be interacted with through an AI model because this is a new paradigm for telling computers what to do.

In order to further the adoption, foster innovation and attract more developers to build on the blockchain, Solana has also launched an AI accelerator program. If successful, this integration could push Solana further ahead in the DeFi race.

But the growth of ChatGPT has not only furthered the adoption of AI in the crypto market but amongst countries and their governments too. Earlier on May 23, the President of France, Emmanuel Macron, had a meeting with ChatGPT creator, Sam Altman. Tweeting about the same, the President noted,

“Developing talents and technologies in France, acting for regulation at the French, European and global levels, these are our priorities in terms of artificial intelligence.

AI tokens to witness a rally

At the moment, AI tokens are acting similarly to how meme coins were at one point. This is because any development related to artificial intelligence tends to serve as a trigger for these cryptocurrencies.

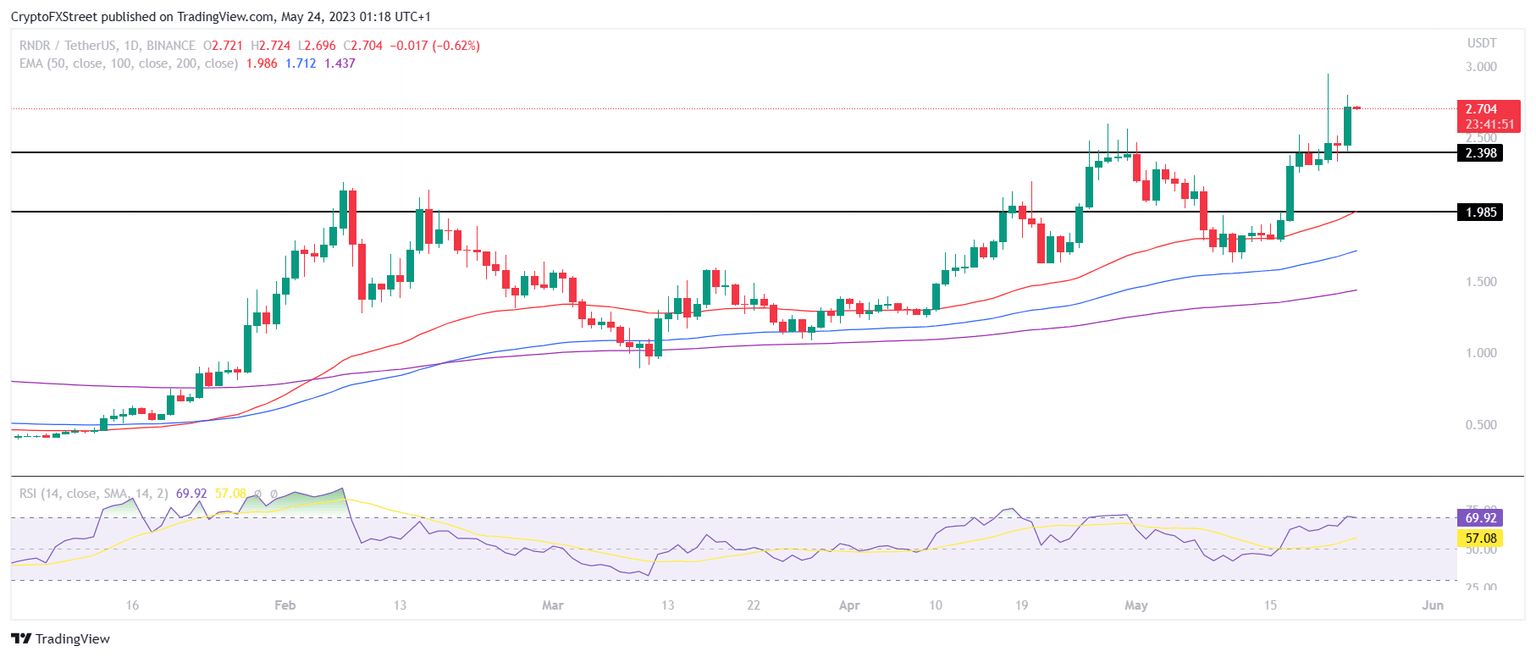

This was observed the best in Render token, which noted an increase in their prices. RNDR observed the most increase, rising by almost 11% in the span of 24 hours. Trading at $2.705, the cryptocurrency marked year-to-date highs, but the sudden rise also left it vulnerable to corrections.

The Relative Strength Index (RSI) is at the cusp of tipping into the overbought zone above the 70.0 mark. A breach into this zone suggests that the market is overheated and would need to cool down, which is usually accompanied by corrections.

RNDR/USD 1-day chart

This leaves Render price at the risk of declining to the current support level of $2.398, which is marked by the previous 2023 highs and April highs. However, falling through this level would further push the altcoin toward the critical resistance of $1.985. Coinciding with the 50-day Exponential Moving Average (EMA), losing this support would undo all the growth observed in the last few days.

However, on a larger scale, such triggers for AI tokens will eventually hit the point of saturation. The same happened with meme coins as well. After a while, these tokens stopped reacting to any meme coin-related development, such as Elon Musk’s comments and more. Thus investors must watch out for that moment.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.