Solana price action leaves behind top altcoins as it outshines on key metrics

- Solana's price gained nearly 26% in the past seven days, leaving behind top altcoins.

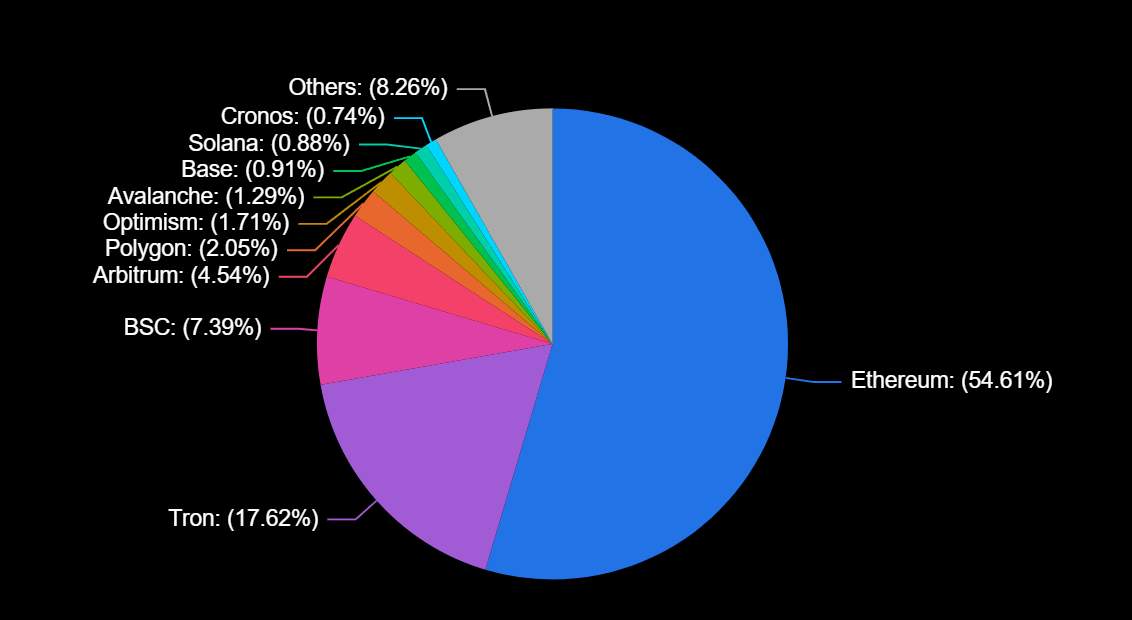

- The Layer 1 chain recently hit a new TVL record, marking a 0.88% chain dominance.

- The inflow of capital into altcoins, including SOL, suggests increased institutional interest.

Solana (SOL), the eighth-largest crypto by market capitalization, continues to outshine other altcoins due to Total Value Locked (TVL) growth and consistent inflows. The altcoin is trading at a price of $24.26 at press time. After gaining close to 26% in the past week, the rise in dollars locked on the blockchain is keeping the holders bullish.

Solana TVL hits new record

Solana's Total Value Locked – the total value of digital assets locked in a smart contract – recently reached new heights in 2023, surpassing $300 million in July. This was the first time this year Solana achieved such a TVL level since November 2022, after previously hitting an all-time high in 2021.

According to data from DefiLlama, Solana is home to 110 protocols, dominating a TVL of $338.27 million. Solana's TVL represents approximately 0.88% of the entire TVL across all chains. This is a significant metric, as it means Solana's prominence is growing among decentralized application platforms. As more projects choose to build on Solana, it could contribute to positive market sentiment.

Solana’s TVL increase

Solana inflows remain positive

Alternative asset manager CoinShares noted in a report on Monday that investment in digital assets saw inflows last week. This came after a six-week lull, with a total of $21 million flowing into the market.

Meanwhile, Solana has consistently attracted investments based on the report. The Layer 1 chain has witnessed 27 weeks of inflows against four weeks of outflows this year.

Solana has accumulated $5 million in month-to-date (MTD) inflows, bringing its year-to-date (YTD) total to $31 million. Additionally, Solana boasts of an Assets Under Management (AUM) of $84 million.

An influx of capital into Solana suggests that institutional investors are showing increased interest despite subdued activity in the altcoin space.

CoinShares report

Recently, Solana reiterated its commitment to environmental sustainability in a tweet. It highlighted its real-time energy emissions tracking to a socially conscious investor base.

Did you know that Solana was the first smart-contract L1 blockchain with real-time energy emissions tracking?

— Solana (@solana) October 2, 2023

Solana is climate conscious, carbon-neutral tech, and anyone can examine network emissions at any time

Learn more & get involved: https://t.co/MPCIDiCDEC pic.twitter.com/aa9fYvTuZ1

Notably, Solana has gained close to 26% in the past seven days. In contrast, other top altcoins like Ethereum and XRP have shown comparatively muted performance in the hourly and weekly time frames.

SOL/USDT 1-day chart

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.