- Shiba Inu price has collected liquidity resting below $0.0000283, signaling a new uptrend’s start.

- A swift recovery above $0.0000283 will likely restart a 20% ascent to $0.0000341.

- A breakdown of the daily demand zone, ranging from $0.0000269 to $0.0000293, will invalidate the bullish thesis.

Shiba Inu price has fumbled around a stable support level, flipping it into a resistance level multiple times. However, this development was a necessary evil required to collect the liquidity resting below it. Therefore, the recent downswing could be the key to kick-starting a new uptrend.

Shiba Inu price to pull a 180

Shiba Inu price tagged the $0.0000283 support level on December 20, 2021, and January 5, creating a double bottom setup. Soon after this pattern, SHIB sliced through this support level, collecting the sell-stop liquidity resting below it.

The sidelined buyers took this opportunity to accumulate Shiba Inu price at a discount, triggering a minor uptrend that allowed the meme coin to recover above $0.0000283. Going forward, SHIB needs to stay above this trend line to kick-start a 20% advance to $0.0000341 or the 50% retracement level and the buy-stop liquidity resting above it.

Although unlikely, Shiba Inu price could continue this rally and make a run for the double top formed around the range high at $0.0000399, doubling the total gain from 20% to 40%.

SHIB/USDT 4-hour chart

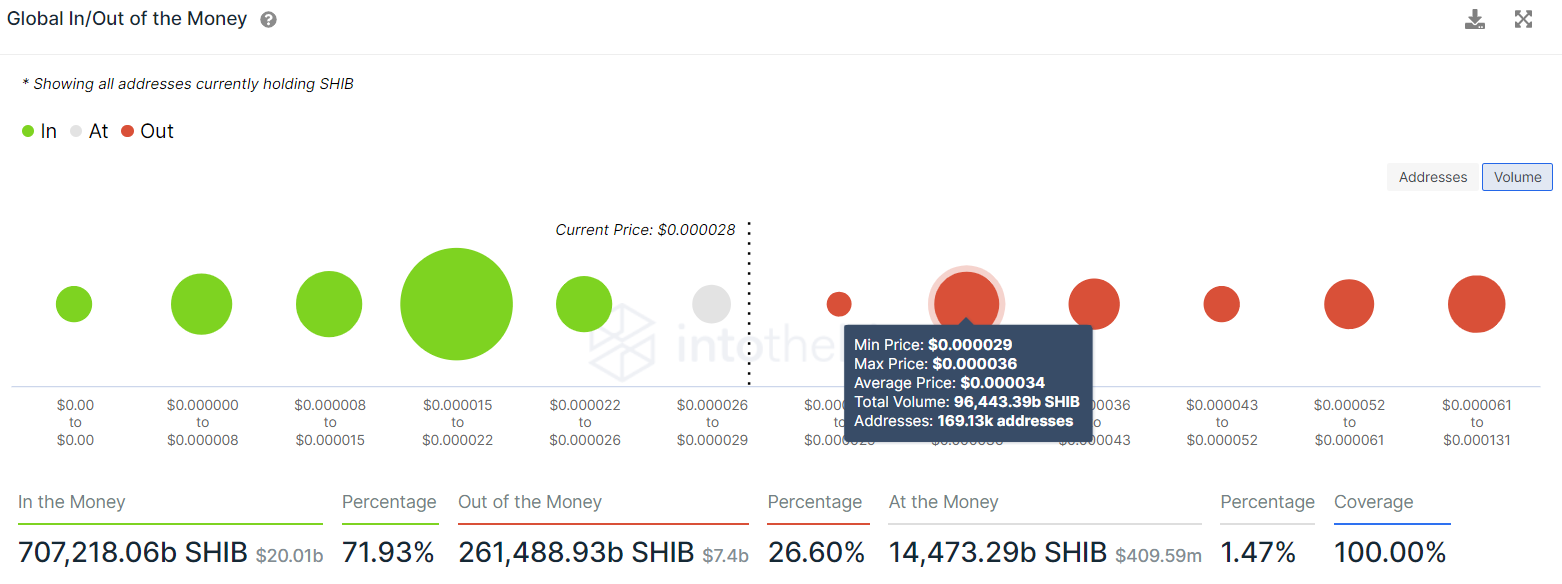

Supporting the bullish outlook up to $0.0000340 is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that the only resistance area that could prevent an uptrend for SHIB extends from $0.0000290 to $0.0000340. Here, roughly 170,000 addresses that purchased 96,443 billion SHIB tokens are “Out of the Money” and are likely to sell at break-even, resisting any advances for the meme coin.

SHIB GIOM

Further indicating a bullish outlook is the Market Value to Realized Value (MVRV) model.

This on-chain metric is used to determine the average profit/loss of investors that purchased SHIB over the past month.

Currently, the 30-day MVRV is hovering inside the opportunity zone at -14.8%, indicating that a majority of the short-term holders are at a loss. Long-term holders often accumulate around these levels, where the risk of a sell-off is less.

Therefore, investors can expect SHIB to see considerable buying pressure around the current levels.

SHIB 365-day MVRV

Regardless of the bullish outlook and the on-chain metrics, if Shiba Inu price fails to stay above the demand zone, extending from $0.0000269 to $0.0000293, it will indicate a weakness in buying pressure.

A four-hour candlestick close below $0.0000269 will create a lower low, invalidating the bullish thesis. In this case, investors can expect Shiba Inu price to crash 12%, retesting the $0.0000237 support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Avalanche set to gain wider reach with its Stripe integration

Stripe makes another move by integrating AVAX and Core into its platform. Users can purchase AVAX directly on Stripe, along with dapps and NFTs. The partnership may stir traffic into the Avalanche ecosystem and cause more interest in web3.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin (BNB) price, like most altcoins, is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price.

EigenLayer to launch airdrop in May following the introduction of the Eigen Foundation

EigenLayer announced it would launch season one of its airdrop on May 10. EIGEN tokens would play a key role in the recently introduced "intersubjective forking." Some crypto community members have expressed dissatisfaction with the airdrop vesting schedule.

Ethereum erases weekend gains as yearlong SEC investigation comes to light

Ethereum (ETH) began the week by posting losses of 4.2% on Monday after recent filings from Consensys revealed that the Securities & Exchange Commission (SEC) began formal investigations into ETH's security status since March 2023.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

[07.46.11, 10 Jan, 2022]-637773873154286004.png)