SEC v. Ripple update: Regulator argues Hinman’s speech is not relevant to the lawsuit

- The US SEC hit Ripple Labs with a brief arguing that Hinman’s speech is irrelevant to any case claim or defense.

- The SEC argues that speech documents are pre-decisional and reflect personal opinions of the staff rather than agency policy.

- XRP price yielded 5% gains for holders overnight, fueling bullish sentiment in the community.

The SEC has filed a brief on the Hinman speech as its legal battle against Ripple drags on. The US SEC is fighting back in its lawsuit against Ripple Labs and arguing that the Hinman documents Ripple lawyers want brought into evidence are irrelevant to the case. The documents, from legal experts in the SEC, were used to inform Hinman’s speech arguing cryptos should not be treated as securities.

Also read: Three signs that XRP is a hot buy as Ripple bags another win against SEC

SEC v. Ripple lawsuit drags on

The US Securities and Exchange Commission has filed yet another brief in its battle against Ripple. The SEC is arguing that speech drafts are irrelevant to any claim or defense in this case. The SEC is claiming that the deliberative process privilege protects the documents. Further, the SEC still has yet to disclose drafts of a 2018 speech by former director William Hinman.

While the SEC attempts to shield William Hinman’s speech-related documents, XRP holders are bullish on a positive outcome for the lawsuit. Judge Netburn ruled in favor of Ripple’s motion requesting to serve non-party subpoenas to authenticate seven videos of SEC officials’ public remarks. The SEC has yet to authenticate the video and its contents.

James Filan, defense attorney, shared an update on the SEC v. Ripple case and informed the XRP community that,

The SEC has filed its Reply Brief in Further Support of its Objection to Magistrate Judge Netburn’s Orders Compelling the SEC to produce the Hinman Speech Materials.

Hinman’s speech has emerged as a major argument and disagreement between the SEC and Ripple, and the defendant seeks to bolster its fair notice defense.

XRP is ready to breakout, argue analysts

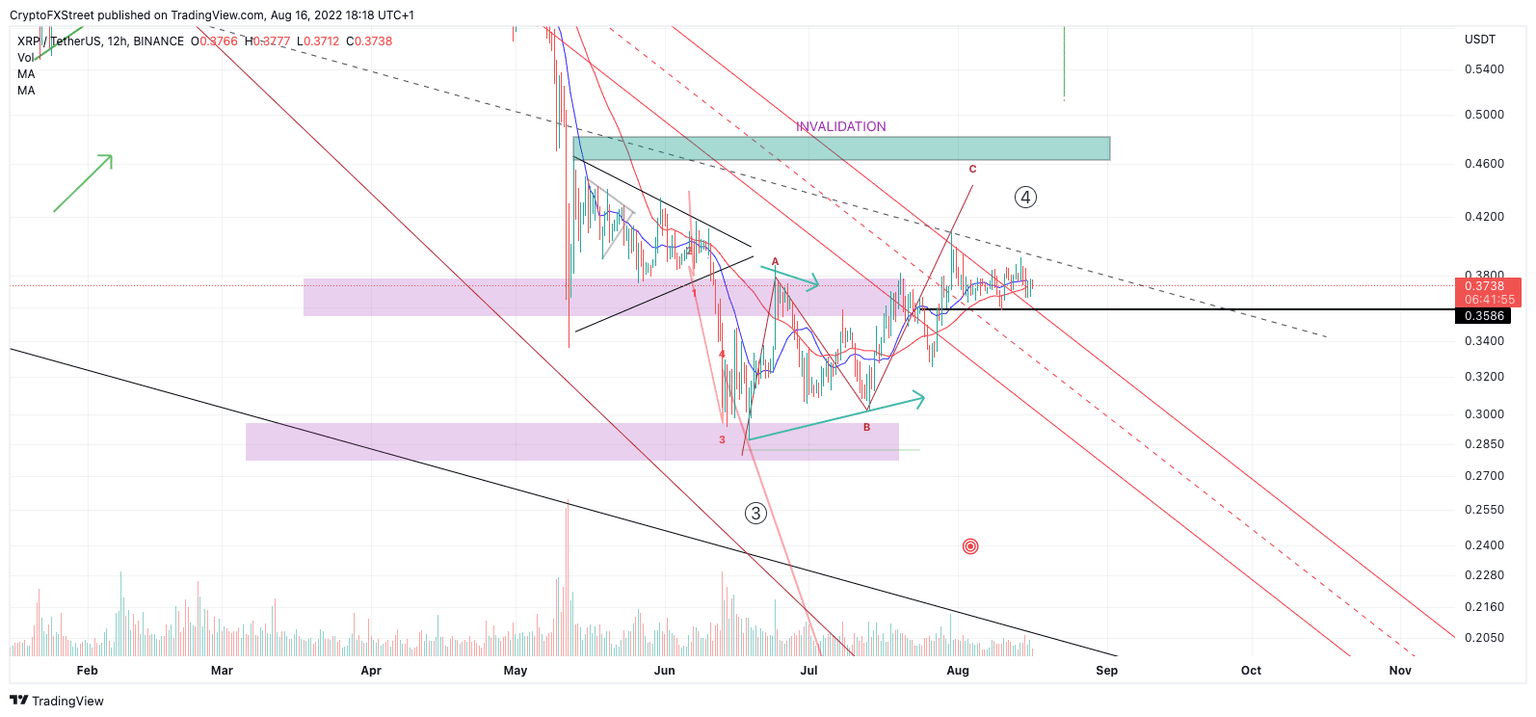

Meanwhile, analysts evaluating the XRP price trend have revealed a bullish outlook on the altcoin. Analysts at FXStreet argue that the XRP price is ready for a run up to $0.96. A decline below $0.37 could invalidate the bullish thesis.

If bulls push XRP price above the $0.41 barrier, a climb to $0.48 and $0.96 is likely. This marks a 150% rally in XRP price.

XRP-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.