Ripple's XRP is in the verge of mass adoption - Eric Dadoun

- XRP liquidity index is growing, which can be interpreted as a positive signal for the coin.

- On the intraday charts, XRP/USD attempts recovery from critical support area.

Ripple's XRP is the third-largest digital asset with the current market value of $10.2 billion. The coin has lost over 2% of its value in recent 24 hours to trade at $0.2340. XRP/USD has been gaining ground since the beginning of the year in sync with the market.

XRP Liquidity Index at an all-time high

The XRP liquidity index in Mexico and the Philippines has been growing recently. Bitso, the largest Mexican exchange, registered a new all-time high at $13 million, leaving the previous record of 12,230,900 far behind.

According to a startup investor and XRP supporter Eric Dadoun, this trend illustrates Ripple's growing mass adoption and proves that XRP is used on a daily basis outside speculations. He wrote on Twitter:

The single largest daily use case for a digital asset outside of speculation ... and growing both in terms of volume and geographic coverage.

Then he further explained that utility leaders to high trading volumes, which, in turn, supports the liquidity growth, widens coin's use cases and finally increases its value. 'It's a long way, but we are well on our way," he added.

XRP/USD: technical picture

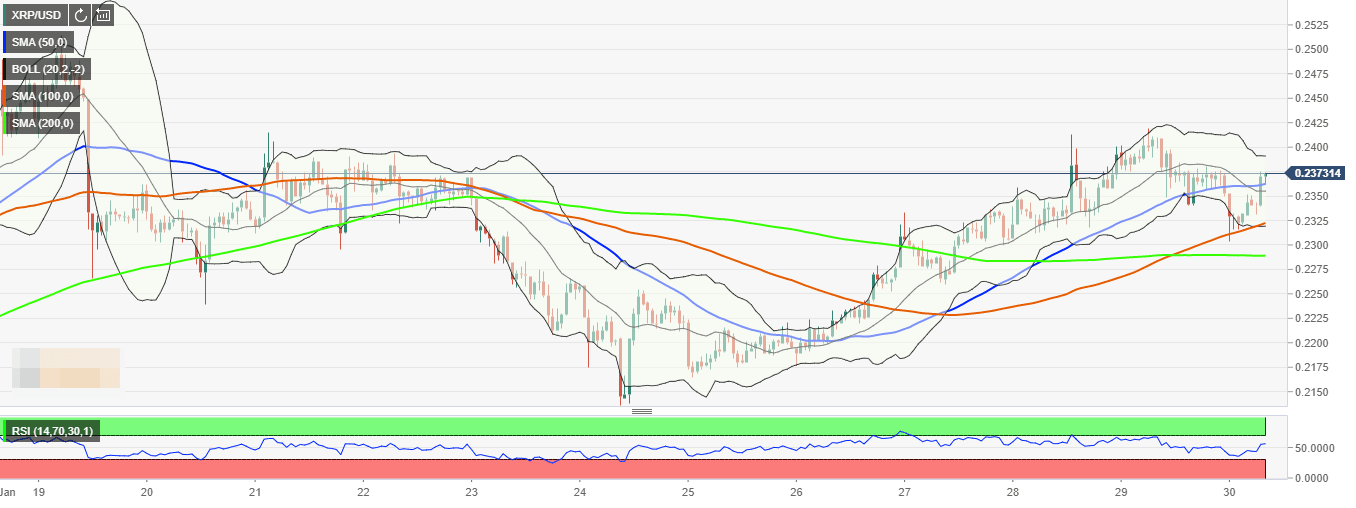

On the intraday charts, SMA100 1-hour has been providing strong support for the price. The price attempted to break it during early Asian hours but reversed to the upside as new buyers popped in on approach to psychological $0.2300. This development implies that the coin is still moving within a short-term bullish channel with the next recovery target created by SMA50 daily at $0.2360. Once it is out of the way, the recovery will gain traction and push the price towards $0.2400. This psychological barrier is reinforced by the upper boundary of the 1-hour Bolinger Band, which means it will be hart to take it from the first attempt.

On the downside, a sustainable move below $0.2300 barrier will worsen the technical picture and negate the bullish forecast. The next support is located at $0.2280 (SMA200 1-hour and SMA50 4-hour) and $0.2200.

XRP/USD 1-hour

Author

Tanya Abrosimova

Independent Analyst