- XRP/USD remains primed for a big technical breakout.

- The No. 3 coin battles descending trendline resistance on the 12H chart.

- Acceptance above the key Fib 61.8% hurdle is critical to take on the $1 mark.

Ripple (XRP/USD) sellers have returned this Sunday, as the recent recovery from sub-$0.50 levels appears to lose steam.

XRP/USD: Technical setup favors the bulls

However, from a technical perspective, it looks like the bulls have taken a breather before the bullish reversal picks up pace.

XRP/USD: 12-hour chart

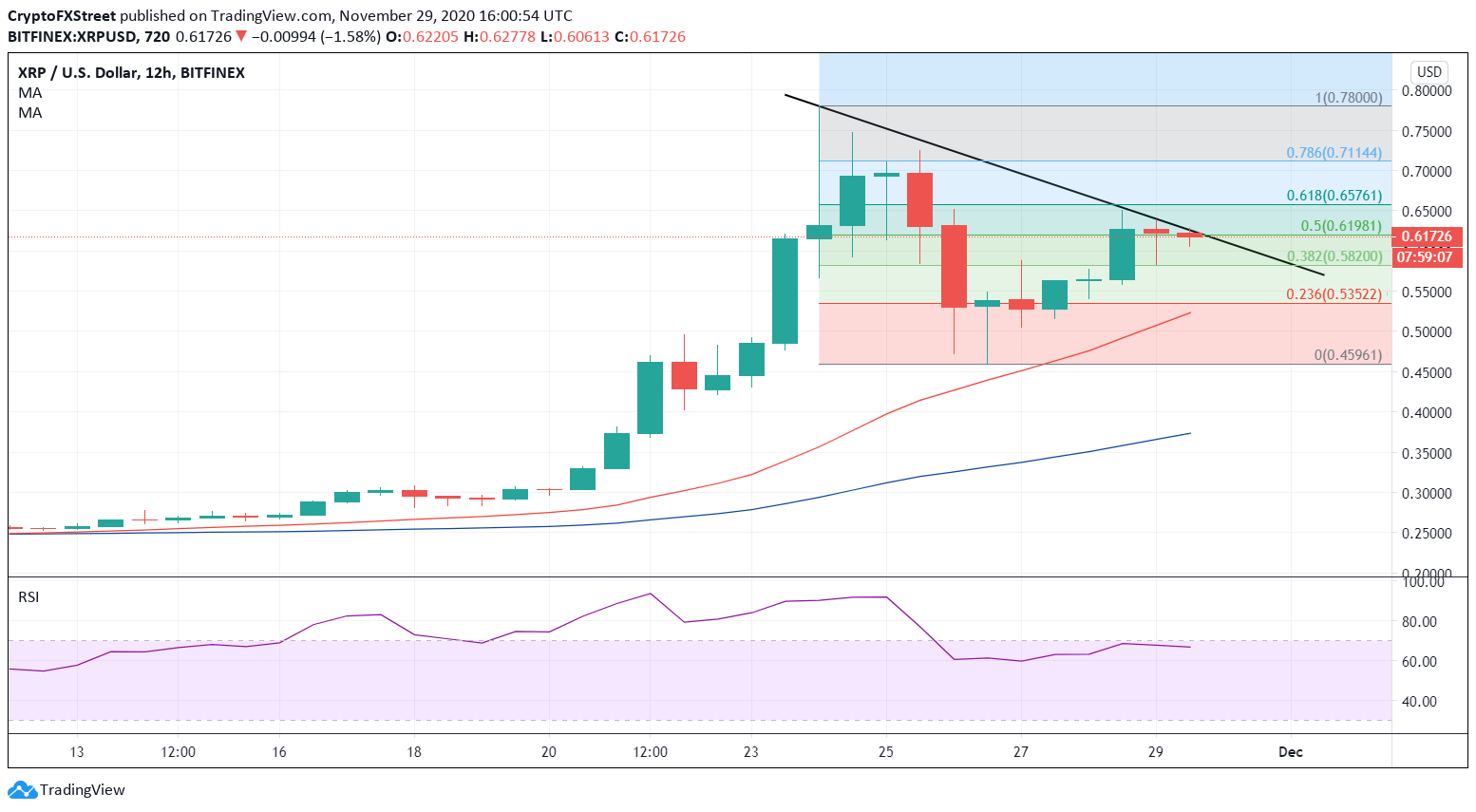

Looking at the 12-hour chart, Ripple continues to face strong offers at the one-week-old descending trendline resistance, now at $0.6262.

Closing on the candle above that level could trigger a fresh breakout, with the bullish Relative Strength Index (RSI) favoring the move higher. Although the follow-through buying interest could weaken at $0.6576, which is the critical resistance of the 61.8% Fibonacci Retracement of the pullback from the highest level since May 2018 reached at $0.7842 last Tuesday.

Acceptance above the latter is critical to reviving XRP/USD’s journey towards the $1 mark. Alternatively, the bullish 21-simple moving average (SMA) at $0.5226 is the level to beat for the bears. The next relevant downside target awaits at the 50-SMA of $0.3762.

All in all, the upside appears more compelling in the week ahead.

XRP/USD: Additional levels to consider

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink social dominance surged to a six-month peak on Friday as LINK holders increased their activity. LINK traders started taking profits, on-chain data trackers show. LINK price added 6% on Friday, extending its gains from mid-week.

Binance helps Taiwan crack a virtual asset money laundering case, BNB sustains above $570

Binance’s Financial Crimes Compliance (FCC) department joined forces with Taiwan’s Ministry of Justice and helped resolve a case of money laundering worth NT$200 million, or $6.2 million.

Bitcoin Weekly Forecast: Is BTC out of the woods? Premium

Bitcoin price shows signs of continuing its uptrend, providing a buying opportunity between $64,580 to $63,095. On-chain metrics forecast a bullish outlook for BTC ahead. If BTC clears $70,000, the chances of resuming the uptrend would skyrocket.

XRP trades steady at $0.50 as Ripple shares plan to expand services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US Securities and Exchange Commission and amid new commitments from the firm to expand its services in Africa.

Bitcoin: Is BTC out of the woods? Premium

Bitcoin (BTC) price action in the past two days has confirmed the resumption of the bull run. However, BTC needs to clear a few key hurdles before investors can go all-in.