Ripple Price Prediction: Assessing the impact of ETF approval on XRP price

- XRP steadies recovery above the 100-day EMA as bulls eye breakout beyond $3.00.

- Proposals to fast-track ETF approvals could increase the chances of an SEC green light for XRP ETFs.

- XRP meets two of the three approval conditions under the new criteria, along with Solana.

Ripple (XRP) maintains above a critical support level on Tuesday, buoyed by subtle tailwinds in the broader cryptocurrency market. A breakout past the $3.00 psychological level, followed by a rise to its record high of $3.66, is on the cards, backed by optimism for the approval of Exchange Traded Funds (ETFs) in the fourth quarter.

Fast-tracking crypto ETFs approvals

Cboe’s BZX exchange, NASDAQ, and NYSE Arca filed 19b-4 forms with the United States (US) Securities and Exchange Commission (SEC), proposing amendments to the current crypto ETFs listing standards.

The filings on July 30 came amid an influx of capital into existing Bitcoin (BTC) and Ethereum (ETH) spot ETFs. However, the SEC is sitting on over 90 crypto ETF proposals, according to Bloomberg analyst James Seyffart, creating a burdensome backlog.

A 19b-4 filing is a document used by self-regulatory entities, such as exchanges, to propose rule changes to the SEC.

The SEC has historically extended the ETF approval process to the maximum deadline of 240 days, significantly delaying new listings. However, with the proposed rule change, the SEC could fast-track the approval process amid a growing number of crypto ETF applications.

Cboe’s BZX exchange, NASDAQ, and NYSE Arca rule change proposal culminates in a three-condition listing criteria. According to a report by Galaxy Research, the first condition is that “the commodity trades on a market that is an Intermarket Surveillance Group (‘ISG’) member.”

The second condition provides that “the commodity underlies a futures contract that has been made available to trade on a designated contract market for at least six months.”

The third condition provides that the “ETF is designed to provide economic exposure of no less than 40% of its net asset value to the commodity lists and trades on a national securities exchange.” This applies only on an initial basis.

Based on the three-condition criteria, 10 tokens qualify for expedited listing, including Dogecoin (DOGE), Bitcoin Cash (BCH), Litecoin (LTC), Chainlink (LINK), Stellar (XLM), Avalanche (AVAX), Shiba Inu (SHIB), Polkadot (DOT), Solana (SOL), and Hedera Header (HBAR).

XRP and Cardano (ADA) are expected to meet the new listing criteria on September 20 and October 1, respectively, as they will have been trading on a designated contract market (DCM) for six months following their initial listing date.

Qualifying tokens | Source: Galaxy Research

Several organizations have already submitted comment letters to the SEC in response to the expedited listing criteria. The Digital Chamber and investment advisor Multicoin Capital Management both agree on a minimum market capitalization of $500 million and at least $50 million in trading volume over the last six months of trading.

“By adopting a comparable fast-track process, anchored in objective criteria, the SEC can manage the growing backlog of applications, provide clarity to issuers, and expand regulated access to digital assets,” Galaxy Research added in the report.

XRP stands to qualify for the expedited listing process, which would significantly increase the chances of ETF approval with the SEC. Exposure to alternative capital sources could enhance its legitimacy as an asset class and bolster the bullish case.

Technical outlook: XRP bulls defend key support

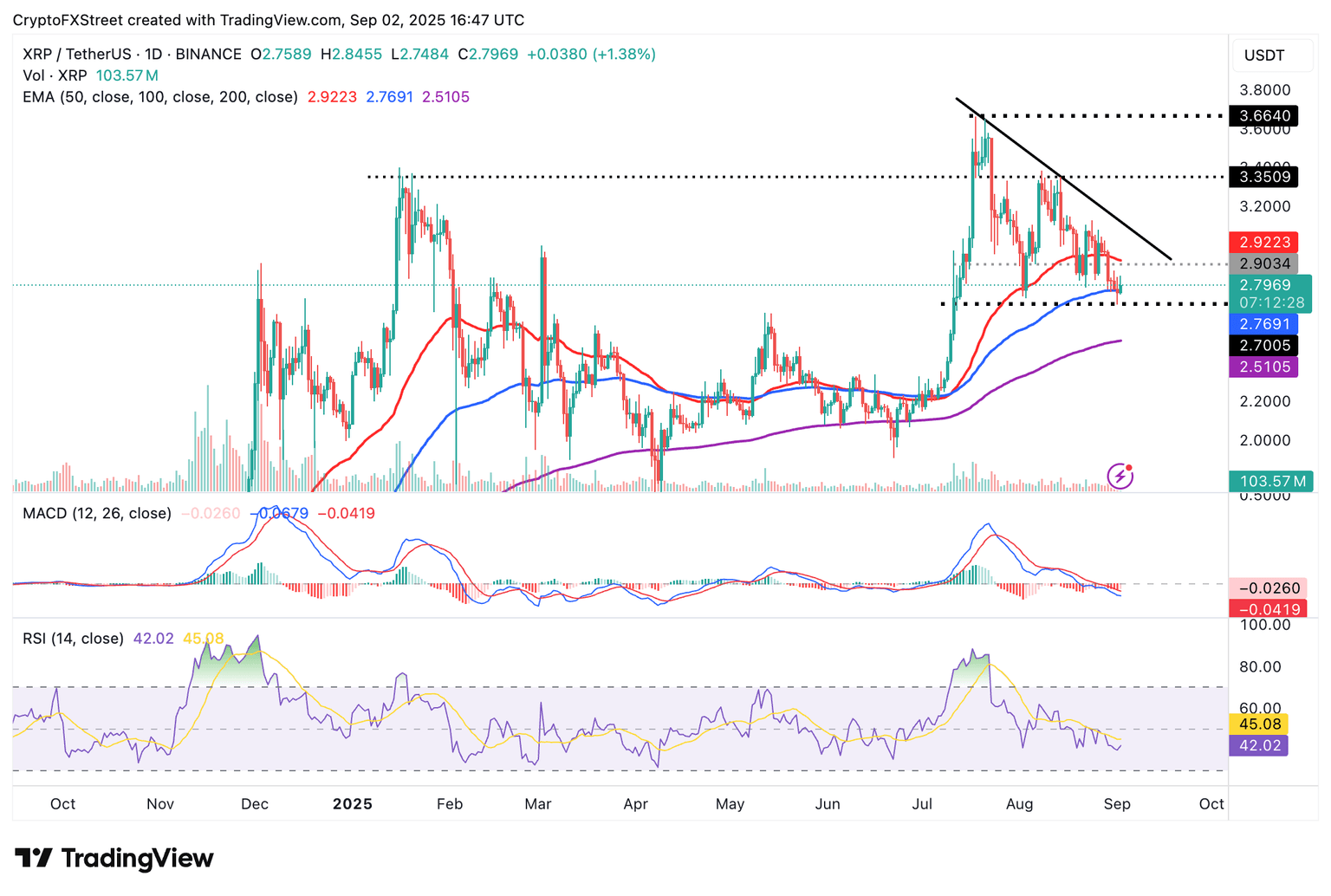

XRP price remains above the 100-day Exponential Moving Average (EMA) support at $2.76 as bulls aim at a breakout above the psychological resistance at $3.00. A reversal of the Relative Strength Index (RSI) at 41 on the daily chart backs the short-term bullish outlook.

If the RSI steadies the uptrend above the midline, the path of least resistance would remain upward, indicating an increase in buying pressure. A break above the $3.00 hurdle could also boost risk-on sentiment, as bulls target a breakout toward the record high of $3.66 reached on July 18.

XRP/USDT daily chart

Still, traders should exercise caution when managing risk, as the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since July 25. Losing the 100-day EMA support at $2.76 might accelerate the decline toward the 200-day EMA at $2.51.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren