Ripple Price Analysis: XRP primed for a rally towards $0.63 amid symmetrical triangle breakout

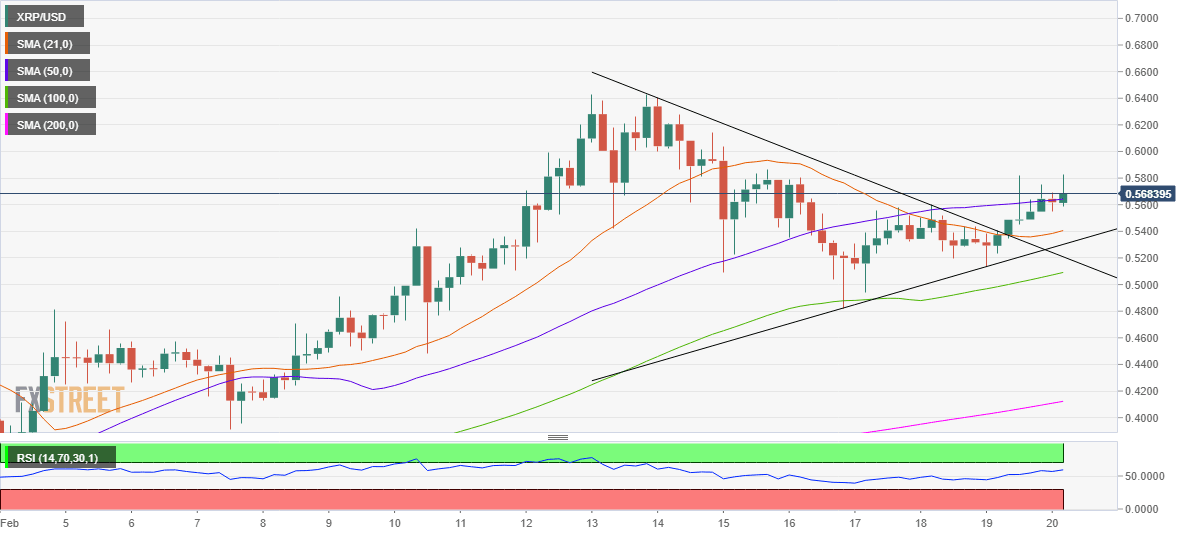

- XRP/USD confirms symmetrical triangle breakout on the 4H chart.

- XRP bulls storm through all the major averages, RSI looks north.

- Former SEC Chair White defends Ripple in pivotal crypto case.

The short-term outlook for Ripple (XRP/USD) appears bullish, with both the technical and fundamental factors supporting the No. 7 digital coin.

XRP/USD currently trades around $0.5730 adding over 1.50% on a daily basis. The coin, however, remains on track to book a weekly decline, as Bitcoin smashes through the 56,000 barrier for the first time on record.

Ripple could be drawing support from fundamental news, citing that a top American lawyer, Matt Stankiewicz, Managing Counsel at The Volkov Law Group, is looking at Ripple’s battle with the US Securities and Exchange Commission (SEC).

A settlement could ultimately prevent the XRP coin from trading within the United States, and Ripple will surely fight tooth and nail to prevent that from happening” Stankiewicz said.

Also, coming in support of Ripple in a crucial crypto case, former SEC Chair Mary Jo White said that the agency has made a blunder in suing Ripple for the alleged sale of unlicensed securities, in an interview with Fortune.

“There’s no way to sugarcoat it. They’re dead wrong legally and factually,” White said.

XRP/USD: Bulls cheer Friday’s technical breakout

XRP/USD: Four-hour chart

After charting a symmetrical triangle upside break on the four-hour sticks, Ripple eyes additional gains, as it recaptures the upward-sloping 50-simple moving average (SMA) at $0.5642.

The next critical barrier awaits at $0.60, which is the psychological magnate, beyond which the measured pattern target at $0.6360 aligns.

The Relative Strength Index (RSI) is on a steady rise towards the overbought territory, currently firming up around 59.25, offering additional zest to the XRP buyers.

On the flip side, any retracement below the 50-SMA resistance now support could expose the bullish 21-SMA cap at $0.5406.

Further south, the rising trendline support at $0.5209 could be put at risk. The next relevant line of defense for the bulls awaits at the upward-sloping 100-SMA at $0.5091.

XRP/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.