Quantum computing threatens Satoshi’s $100 billion in Bitcoin, AVAX founder says

- Bitcoin held by anonymous creator Satoshi could be at risk with Google’s quantum computing chip launch, Ava Labs co-founder Emin Gün Sirer said.

- Avalanche founder asks the community to look into freezing Satoshi’s BTC holdings, while analysts say that security risks remain minimal.

- Bitcoin creator has left a solution to crack the quantum computing threat to the blockchain’s security in a 2010 post.

Bitcoin (BTC) creator Satoshi holds more than 1.1 million BTC tokens across 22 different public wallet addresses. These holdings have been dormant for a decade and are widely scrutinized because any sudden move could trigger wild swings in BTC price. Tuesday’s announcement that Google is developing a new quantum computing chip that solves within minutes the problems that classical supercomputers solve in billions of years has raised the alarm about the safety of Satoshi’s holdings.

Analysts and experts are divided on the threat this new development poses to the Bitcoin blockchain and Satoshi Nakamoto’s BTC holdings.

Bitcoin held by Satoshi could be at risk

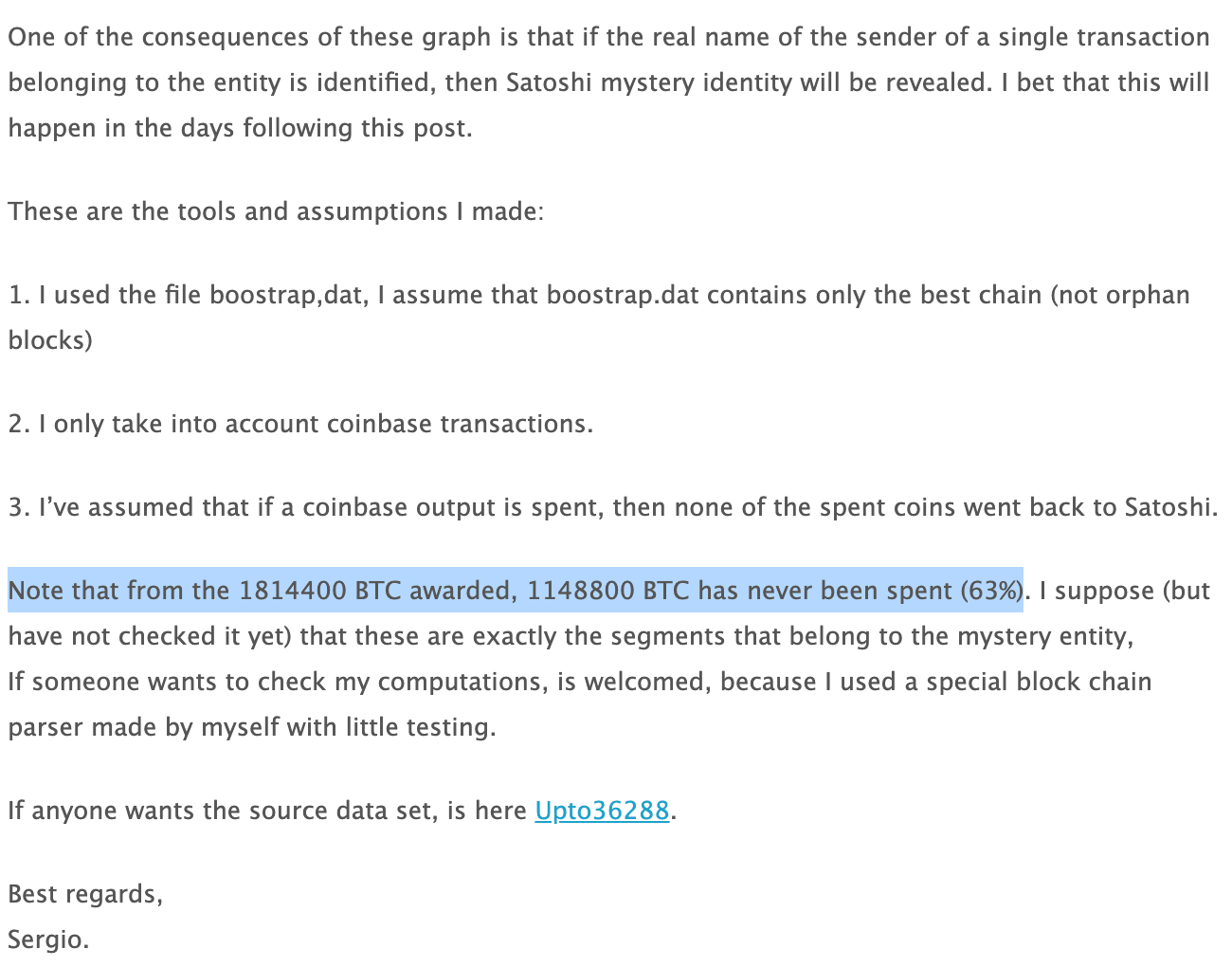

Based on a research paper titled “The Well Deserved Fortune of Satoshi Nakamoto, Bitcoin creator, Visionary and Genius,” by Sergio Demian Lerner, Satoshi holds more than 1.1 million Bitcoin tokens across 22 public wallet addresses.

Satoshi’s Bitcoin holdings are currently valued at close to $107 billion at the current price of $97,600.

Research on Satoshi Nakamoto’s Bitcoin holdings

While Satoshi’s wallets have remained inactive since 2010, the public wallet address is visible on-chain. Ava Labs co-founder Emin Gün Sirer said on Tuesday that the recent development in quantum computing chips by Google poses a threat to the creator’s BTC holdings.

In a tweet thread on X, Sirer explains that the Bitcoin tokens mined as early as the Satoshi era – when the creator was last seen online – used the Pay-To-Public-Key (P2PK) format, which reveals the public key and gives the attacker time to grind for cryptography bounties.

There is the issue of Satoshi's 1m Bitcoin. @hosseeb just reminded me that Satoshi's early minded coins used the very old Pay-To-Public-Key (P2PK) format, which reveals the public key and gives the attacker time to grind, for the mother of all cryptography bounties. P2PK isn't…

— egs9000⚔️ (@el33th4xor) December 9, 2024

With quantum computing advancements, there is no immediate threat to cryptocurrencies. However, old-mined coins could be at a disadvantage as malicious entities access computing power to crack the cryptographic codes and break into crypto wallets laying inactive for decades.

The Ava Labs co-founder explained that P2PK format is not used by modern Bitcoin wallets, meaning old wallets and BTC mined in the early days are those that are vulnerable.

Satoshi’s take on BTC security risks

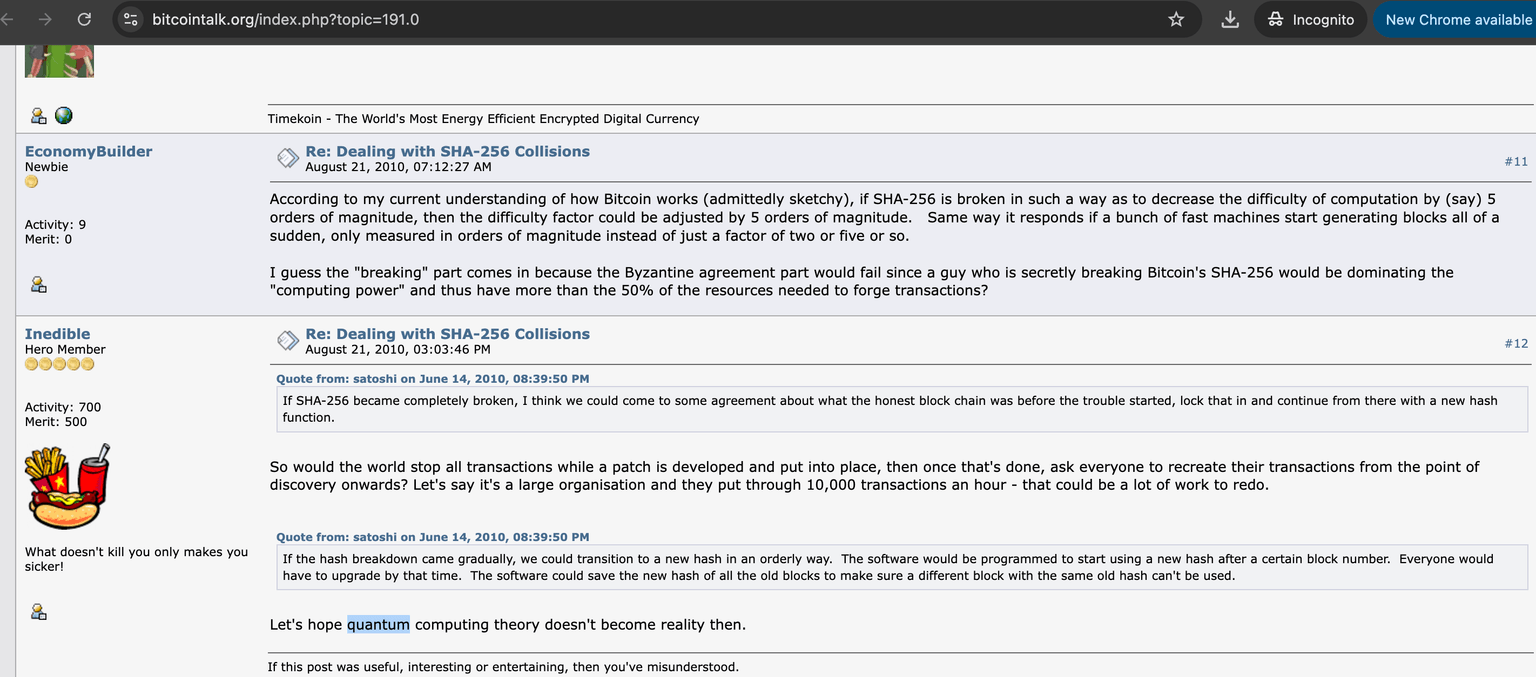

In the Bitcoin talk forum in 2010, Satoshi already discussed the likelihood of advancements in quantum computing.

“If SHA-256 became completely broken, I think we could come to some agreement about what the honest block chain was before the trouble started, lock that in and continue from there with a new hash function," Satoshi said.

Satoshi’s comments on Bitcointalk.org

SHA-256 represents the Secure Hashing Algorithm-256, a mining function used in Bitcoin to verify transactions and regulate public addresses. SHA-256 is a modification of the US National Security Agency's (NSA) SHA-2 algorithm and it is used to generate digital signatures, used by miners to calculate the hash of new blocks.

This helps maintain the integrity of the blocks in the chain. Satoshi recommended that the community come to some agreement about the honest version of the blockchain before the integrity of the chain is lost.

Is the threat real?

Ryan Lee, Chief Analyst at Bitget Research, said to FXStreet that there is no immediate threat

“Google's Willow chip, boasting 105 qubits, solves problems in minutes that would take classical supercomputers billions of years. Despite this breakthrough, Willow's current capabilities pose no immediate threat to Bitcoin's cryptographic security.”

The community of traders and crypto holders on X is divided. Some argue it is not right to freeze Satoshi’s coins as that would introduce censorship and challenge the basic principles of transparency on the Bitcoin blockchain. Others say that it is a feature and not a bug to be able to discover the bounty if the wallet is finally accessed by an individual or entity in the future.

Federico Ulfo, Founder and CEO of Flow AI, said in a tweet on X:

“Why freeze Satoshi’s coins? The possibility to access an old-format wallet is a feature, not a bug. In a hundred years, it might be like discovering a long-lost galleon filled with gold.”

why freeze Satoshi’s coins? The possibility to access an old-format wallet is a feature, not a bug. In a hundred years, it might be like discovering a long-lost galleon filled with gold.

— fed | flow ai (@feulf) December 10, 2024

Meanwhile, Ethereum researcher Charlie Thompson argues that nearly 40% of Bitcoin stored in addresses with exposed public keys are “in serious danger”

something like 40% of BTC are stored in addresses with exposed public keys, BTC is in serious danger https://t.co/U9hfzkZlE4

— soback.eth (@charlie______t) December 10, 2024

Thompson backs his argument in a Medium post in which the researcher explains that a powerful quantum computer can reduce the time required to tackle difficult computation and derive a private key from a public key.

“Any BTC address which has broadcast a transaction has an exposed public key, and all of Satoshi’s one million coins (...) are exposed to this type of attack,” Thompson said.

Over 40% of Bitcoin balances held by wallets with exposed public keys are facing the threat from developments in quantum computing, he added.

Bitcoin hovers around the $100,000 level on Wednesday.

Ryan Lee, Chief Analyst at Bitget Research predicted the following for Bitcoin price this week:

"As we saw with the recent fluctuations in Bitcoin (BTC), the market has undergone a healthy deleveraging phase, significantly reducing the funding rates in the contract market. We anticipate that, in the coming week, capital will likely flow back into the contract trading of mainstream assets. The influx of hot money should continue to provide support for Bitcoin. For the week ahead, we forecast Bitcoin's price range to be between $92,000 and $105,000."

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.