Polkadot suddenly makes its way to top-5 with the market capitalization over $5 billion

- Polkadot moved to the fifth position in the Conmarketcap's cryptocurrency rating.

- The project inflated the circulating supply by 10 times.

The Polkadot (DOT) coin is changing hands at $5.98 with the current market capitalization of $5 billion. However, according to the notice published on the CoinMarkertCap, the stats refer to a new coin that underwent a redenomination and 100x smaller from the original sale.

This page refers to New Dot which is 100x smaller than DOT (OLD) On 21 August 2020 at 16:40 UTC (block number 1,248,328), the DOT token underwent a redenomination from its original sale. New Dot is 100x smaller than DOT (OLD). There is no difference between New Dot and DOT (OLD) except for their denomination.

Notably, the denomination took place on August 21, which means that each DOT was divided into 100 new DOTs, consequently, the total supply increased from 10,000,000 at Genesis to 1 billion; however, the market cap growth from nowhere to over $5 billion was reflected on major data service providers only on Wednesday, September 2.

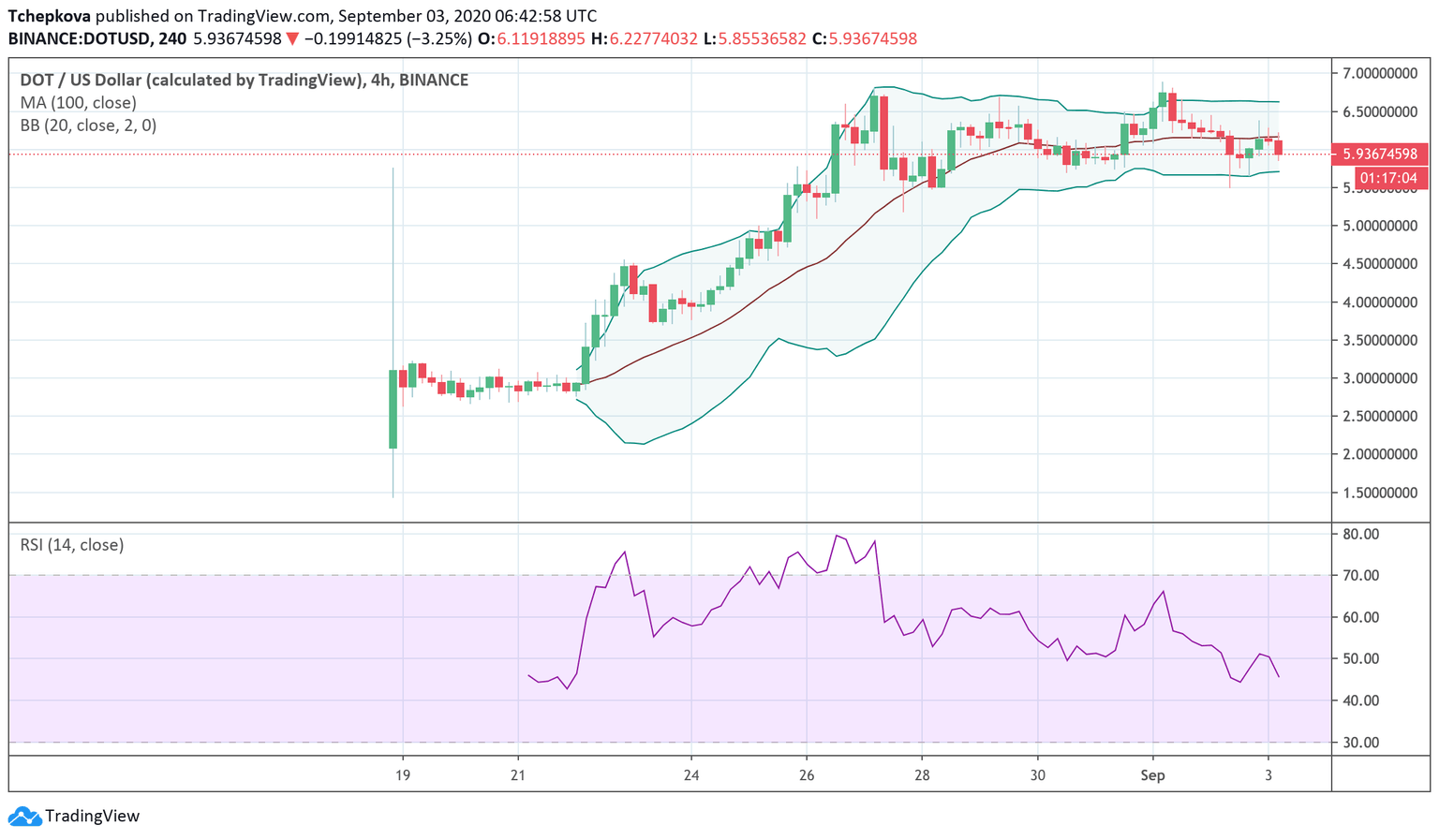

According to the official blog post devoted to the denomination day, the token should have devalued due to the increased supply; The OLD DOT's last price was registered at $292, while the new DOT was born at $2.90; However, the price has increased rapidly and hit the recent high of $6.84 on September 1.

Your DOT balance will be 100x higher and the price per DOT will be 100x lower. The percentage of the DOT you own relative to total supply will remain unchanged. This will not affect the total value of your position. DOT holders still own an equal share of the network as before.

The new DOT has the market dominance of 1.4%, while its average daily trading volume is close to $600 million. The coin is most actively traded at Binance, Huobi and OKEx against USDT.

Author

Tanya Abrosimova

Independent Analyst