Pepe price eyes 20% gains as PEPE token goes live on BitMEX exchange, Coinbase listing next?

- PEPE token was listed on the BitMEX exchange on May 3, making the PEPE/USD and PEPE/USDT trading pairs available to users.

- Traders will enjoy up to 50X leverage, encouraging the trading of PEPE on the exchange.

- An increase in trading volume could fuel price growth, provoking a 20% uptick as the memecoin moves within a bullish formation.

- A decisive one-hour candlestick close below $0.000000886 would invalidate the bullish thesis.

Pepe (PEPE) token has secured a new listing on the BitMEX exchange, a development that could catalyze the new memecoin. According to experts, the listing could fuel a rally after PEPE emerged among the most profitable crypto coins in 2023.

Starting May 3 2023, at 04:00 UTC, BitMEX traders will be able to long or short PEPE via two new listings – PEPEUSD and PEPEUSDT. The best thing about trading these PEPE listings on BitMEX is- Users can enjoy up to 50x leverage and one of the highest max position sizes in the industry.

Also Read: PEPE holders realize massive profits as Pepe Coin rallies 300% over the weekend

PEPE making headlines right from exchange listings

PEPE token started making headlines after its initial listing on popular exchanges such as OKX, Huobi, Gate.io, and MEXC. In the latest development, the memecoin secured yet another listing on BitMEX on May 3, giving traders access to trade long and short PEPE positions through two available pairs, PEPE/USD and PEPE/USDT.

— BitMEX (@BitMEX) May 3, 2023

Our new $PEPE perpetual swap listings are now LIVE on BitMEX

You can now long or short $PEPE $USD and $PEPE $USDT …with up to 50x leverage + the best risk limits in the industry. Trade now

BTC marginedhttps://t.co/R5lOu4r8Zw

USDT margined https://t.co/oPDq5AJVuM pic.twitter.com/dmSkNTfpkB

Notably, with the USD and USDT paired against PEPE, the meme coin is bound to record more trading volume. This is expected as the listing comes with up to 50X leverage, which will encourage the trading of PEPE on the exchange.

It marks another watershed moment in the vowel frog-themed meme coin’s ecosystem. This adds to its already-established popularity after the novel altcoin recorded incredible numbers following its massive adoption. Despite being in its latency stages, as it only debuted weeks ago (April 15), PEPE boasts a bloated community alongside a burgeoning number of investors.

Thus far, Pepe price has risen significantly, from a floor price of $0.000000001 upon launch to the current $0.00000114. In between, Pepe recorded an all-time high of $0.00000148 on May 1. The astonishing rally earned PEPE a place among CoinGecko’s top 100 cryptocurrencies, at #98 as of press time, with a market capitalization of $482.37 million and a 24-hour trading volume of $209.12 million.

The latest listing on the BitMEX exchange is certainly not the last, with speculations of Coinbase exchange lining up to list PEPE. This possibility sprouts from the idea of the US-based crypto exchange setting up a page on its website titled “How to buy PEPE.”

$pepe going on Coinbase, bearish or bullish? pic.twitter.com/7QXxhE7TJQ

— xero (@xerocooleth) May 2, 2023

Pepe price forecast amid new exchanges listings

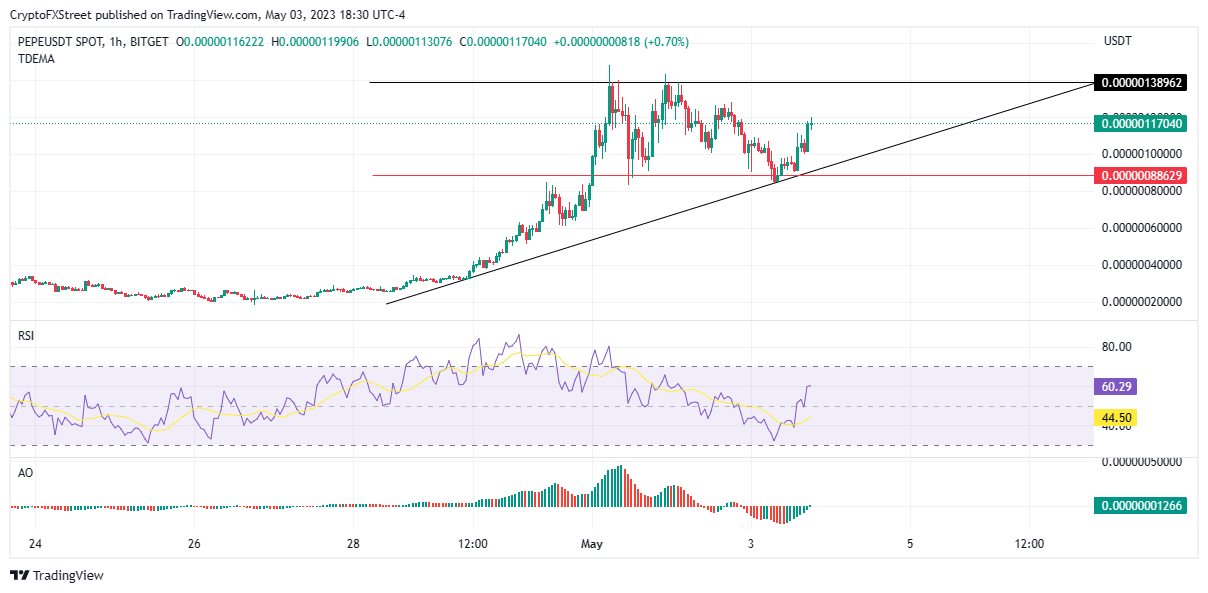

Pepe (PEPE) price is trading with a bullish bias, consolidating within an ascending triangle chart pattern. This chart pattern occurs in a mid-trend and signals a likely continuation of the overall bullish trend.

An increase in buying pressure could see Pepe price rise toward the upper boundary of the governing pattern at $0.00000138, denoting a 20% upswing. A breakout above this level could set the path for further gains.

The overall outlook of the Relative Strength Index (RSI) at 60 supports this bullish outlook, forecasting more room for the upside before PEPE is considered overbought.

PEPE/USDT 1-hour chart

Conversely, a breakout below the uptrend line of the governing chart pattern could see investors recording losses. Traders should watch for a decisive one-hour candlestick close under $0.000000886, as this support acts as the invalidation level for the bullish outlook.

Also Read: Binance exchange new TUSD/DOGE trading pair could be a bullish catalyst for Dogecoin price

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.