Over 1 million people hold at least one Bitcoin, here’s where BTC is headed

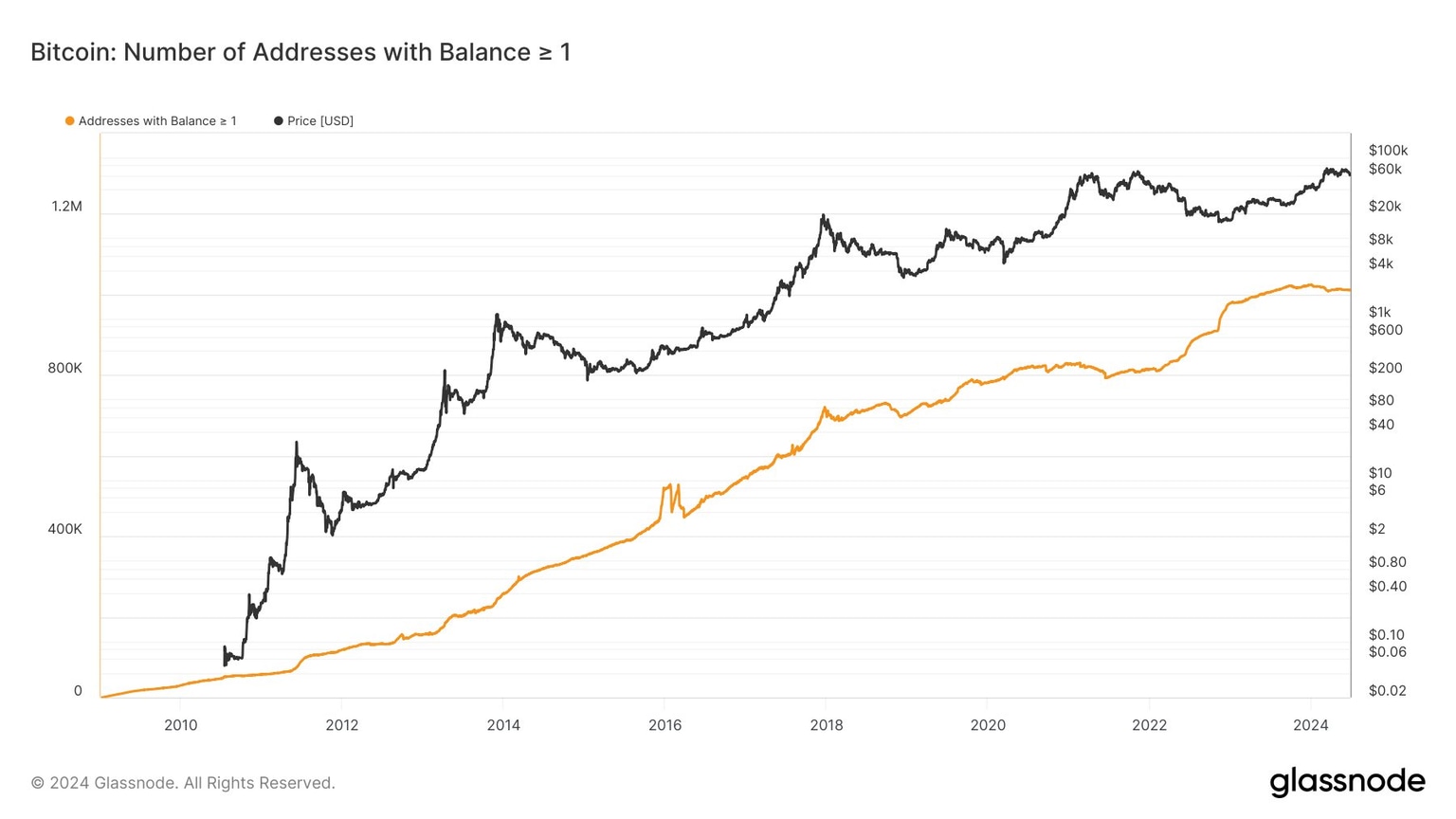

- Data shows over 1 million wallet addresses hold a minimum of one Bitcoin as of June 30, per Glassnode data.

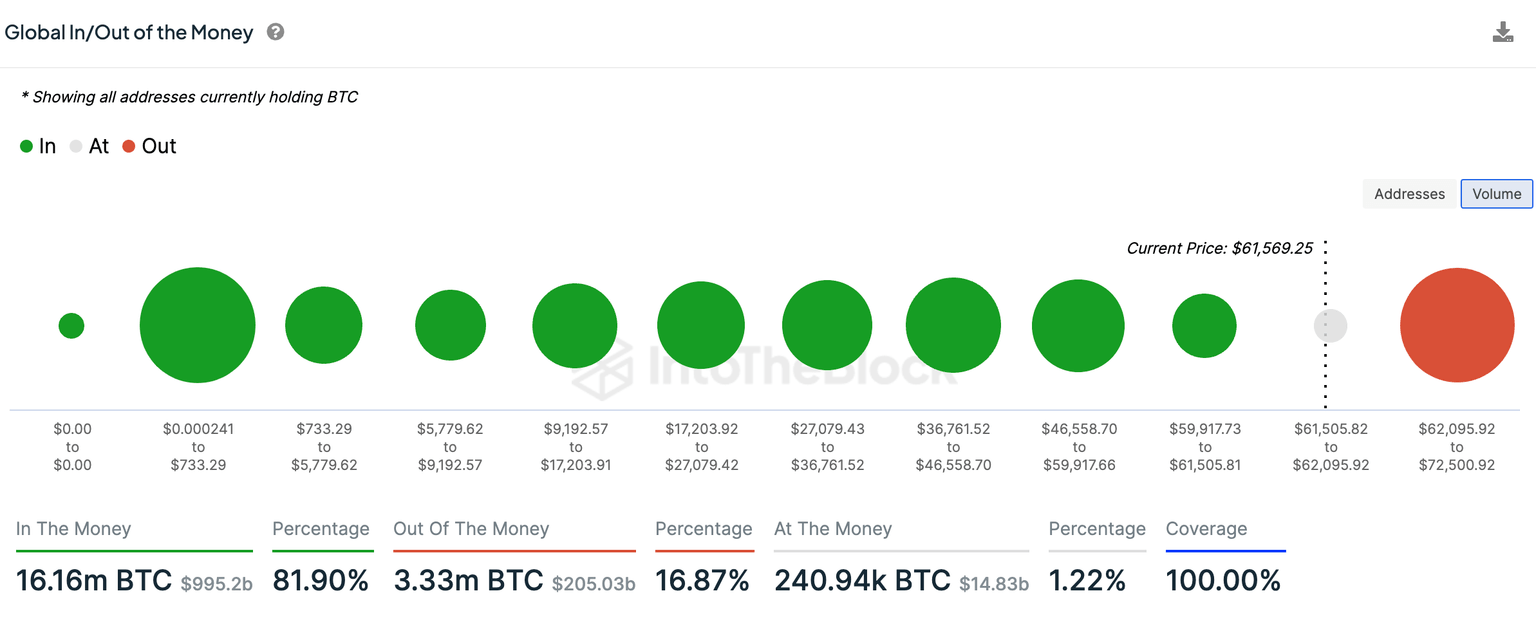

- Nearly 82% of Bitcoin holders are currently profitable as BTC holds steady above $61,500.

- Bitcoin faced a choppy week, analysts predict a BTC bull run.

Bitcoin (BTC) wallet addresses holding at least one Bitcoin has crossed 1 million, per Glassnode data on June 30. Majority of BTC holders are profitable at the current price and analysts predict a bull run in the largest asset by market capitalization.

Bitcoin on-chain data shows rise in BTC ownership, unrealized gains

Glassnode data shows a consistent increase in the number of wallet addresses holding at least one Bitcoin. Over a million wallets hold at least one Bitcoin, fueling a bullish thesis for the largest cryptocurrency.

Bitcoin: Number of addresses with balance greater than 1 BTC

Data from IntoTheBlock shows that nearly 82% of the wallet addresses are currently profitable as BTC sustains itself above $61,500. 16.16 million Bitcoins are currently being held in wallet addresses with unrealized gains.

Bitcoin wallets with unrealized gains

While it is likely that holders take profits, profit-taking activities in the past few months have failed to negatively impact Bitcoin price.

Analysts predict a bull run in Bitcoin

Quinten Francois, an analyst and trader evaluated the Bitcoin price trend and noted that 71 days post the halving event, BTC is on track for a 2016-2017 style bull run “on steroids.” The analyst’s thesis is backed by Bitcoin’s gains in the previous post-halving cycles.

71 days after the halving and #Bitcoin is still on track for a 2016-2017 bull run on steroids pic.twitter.com/8yBgnUoi8K

— Quinten | 048.eth (@QuintenFrancois) June 30, 2024

Data shows that Bitcoin has noted gains every cycle in similar timelines. Analyst behind the X handle @therationalroot identifies Q3 as a key time for Bitcoin price gains.

Q3. #Bitcoin pic.twitter.com/Wzgnh8vg7t

— Root (@therationalroot) June 30, 2024

Bitcoin trades at $61,670 at the time of writing, the asset is likely headed towards $63,943.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.