Optimism price slips to four month-low despite OP holders exhibiting strong faith in the altcoin

- Optimism price continued declining for weeks now, trading at $1.52.

- OP investors are unbothered by this development as their decision to HODL until profits remain strong.

- However, this is also resulting in more tokens staying inactive in their wallets, bringing velocity to a yearly low.

Optimism price is not straying too far away from the broader market cues when it comes to charting its path. However, while the larger market may not have the support from its investors, OP seems to have never lost its.

Optimism price fails to take a turn

Optimism price trading at $1.51 fell by more than 7% over the last 24 hours bringing the cryptocurrency to a four-month low. Hanging above the $1.50 mark, the cryptocurrency is not too long away from potentially falling through the support level at $1.40.

OP/USD 1-day chart

Most of the investors in such a situation generally prefer to offset their losses by reducing their exposure to the asset. Consistent declines lead to either investors selling their holdings or exiting the market altogether. But OP holders seem to be far more resilient.

Over the last couple of weeks, despite Optimism price falling considerably, most of the investors have stood strong without selling. These holders have not only endured a 50% reduction in value since the all-time high of $3.10 in February but are still unbothered even as the altcoin approaches the critical support level of $1.40.

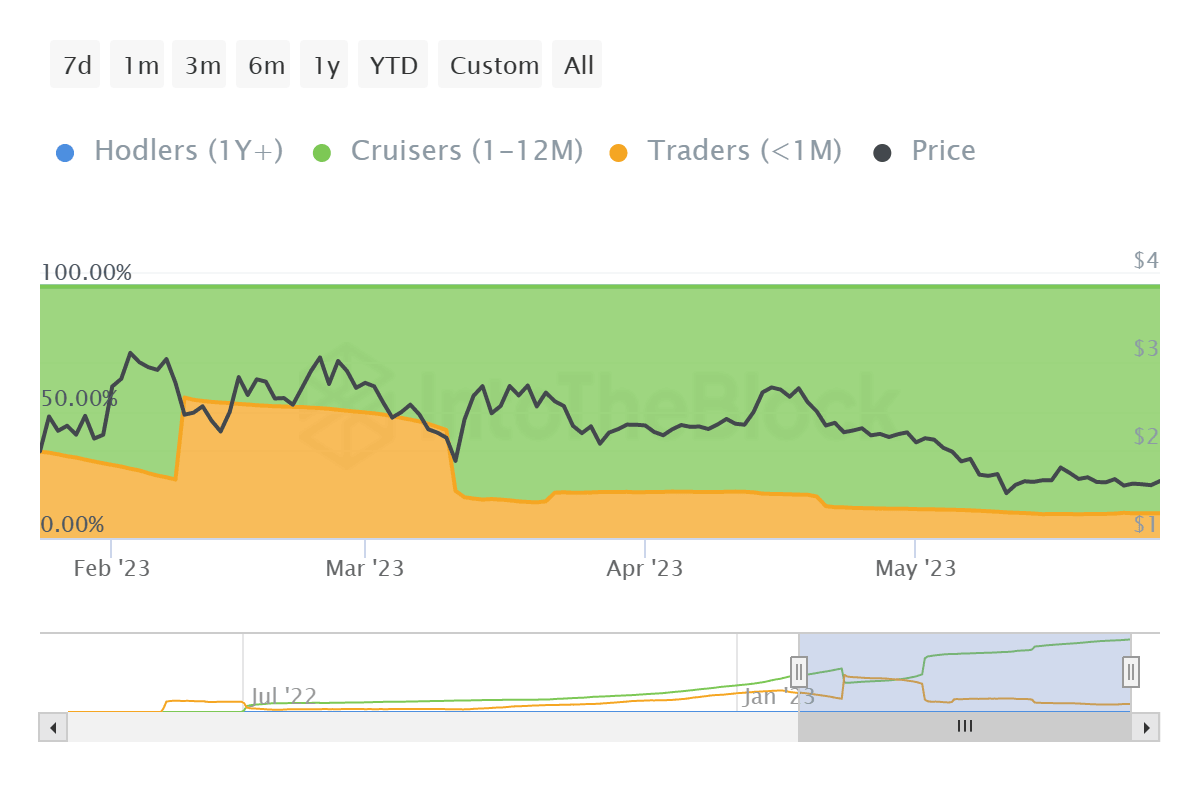

This is visible in the distribution of OP tokens per time held. Since mid-February, the domination of the supply shifted from short-term holders (Traders) to mid-term holders (Cruisers). Any address with a supply younger than a month falls in the former category, while those older than a month fall in the latter cohort.

Thus the Traders’ concentration declined from 55.87% in mid-February to 9.88% at the time of writing. The rest of the 90.12% of supply sits in the hands of mid-term holders, who seem to be in the mood of HODLing until they can find profit.

Optimism supply distributed by age

But while this is a boon for the investors, it is also a bane for the price action. A generally dormant supply of tokens makes it difficult for a cryptocurrency to chart recoveries, and in the case of Optimism, this issue is significant. This is visible in the yearly low velocity of OP, which shows the rate that a token changes addresses.

Optimism velocity

Thus for the Optimism price to start going back up again, this dormancy needs to subside. Only then can OP find the strength to rise to the critical resistance barrier at $1.88. This price is marked by the confluence of the 50- and 200-day Exponential Moving Averages (EMA). Flipping it into a support floor will enable the altcoin to note further recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B04.24.04%2C%252030%2520May%2C%25202023%5D-638210046120091799.png&w=1536&q=95)