Ondo Finance passes BlackRock in value locked in tokenized treasuries, crosses $521 million

- Ondo Finance passed BlackRock in tokenized treasuries, crossing $521 million, according to recent data.

- BlackRock’s Securitize protocol lags behind by nearly $2 million, with a 12% increase in the total value of assets locked in the past month.

- ONDO’s value increased by 9% on Tuesday, likely to rally nearly 25% to $0.92 target.

Asset management giant BlackRock lags behind in the value of tokenized treasuries locked in their protocol, compared to Ondo Finance’s (ONDO). The project is the governance token of a cross-chain DeFi platform for tokenizing real-world assets (RWA).

BlackRock is one of the key entities focused on the tokenization of real-world assets and led a $47 million funding round for Securitize, the firm that ranks second in terms of market capitalization in the sector.

Ondo Finance ranks first, BlackRock’s Securitize second, in RWA sector

Ondo Finance enables the trade of tokenized versions of real-world securities in a regulated environment. The DeFi platform’s governance token ONDO added nearly 9% to its value on Tuesday.

Data shows that ONDO’s market capitalization is $521.28 million while asset management giant BlackRock’s Securitize stands at $519.31 million.

BREAKING $ONDO PASSES BLACKROCK IN TVL FOR TOKENIZED TREASURIES

— Joshua Jake (@itzjoshuajake) July 19, 2024

MEGA BULLISH pic.twitter.com/ZhOcnh89NK

This narrative has garnered much interest and attention from market participants. Even as the crypto market suffered a steep correction on Monday, the sector saw interest from traders and tokens sustained recent gains.

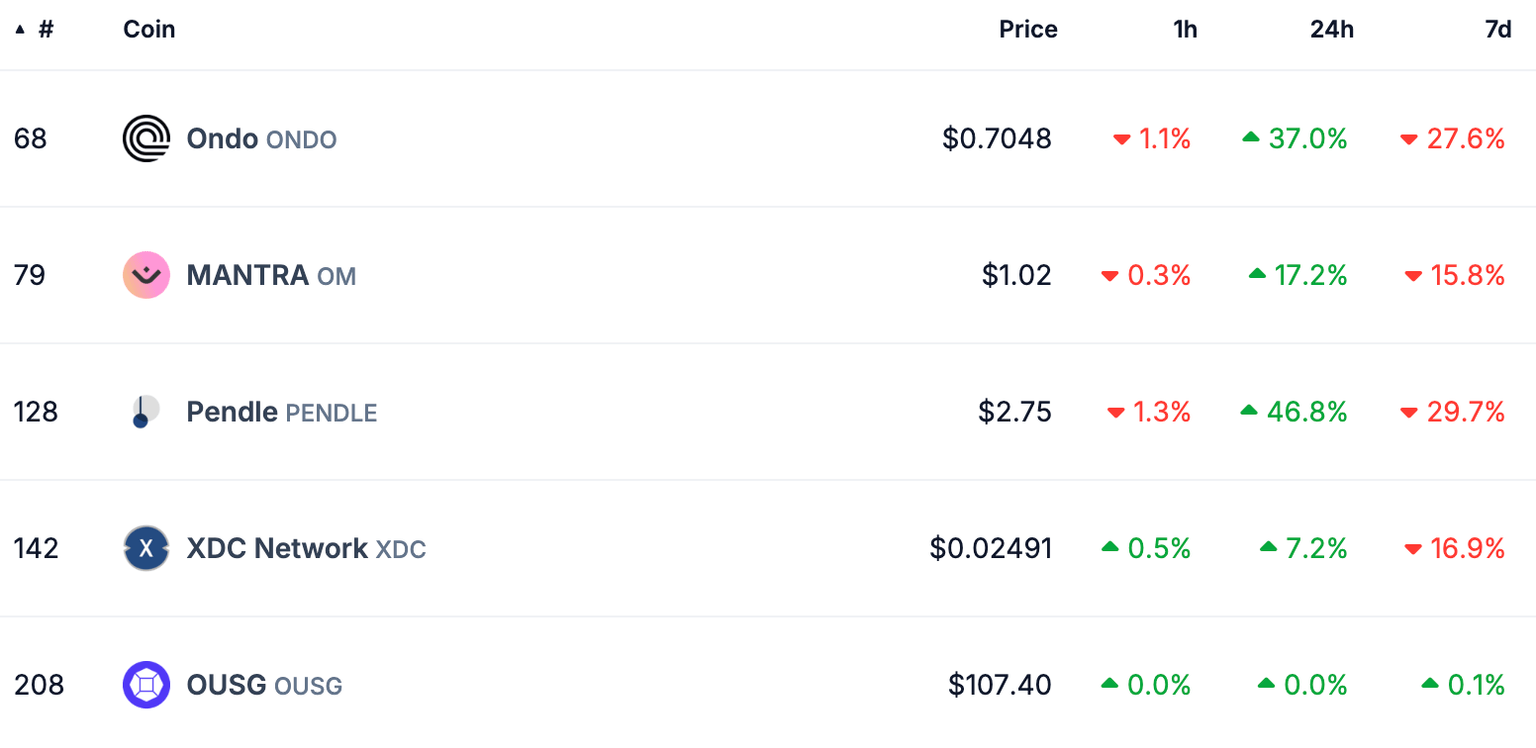

RWA market capitalization is $5.679 billion, according to CoinGecko data. The top five tokens in the category held on to their gains in the past 24 hours.

RWA sector tokens

Robert Mitchnick, BlackRock’s Head of Digital Assets, discussed Ethereum ETFs and tokenization in a recent interview with Bloomberg. Mitchnick said, “We think about the digital asset space across three pillars: crypto, stablecoins and tokenization. Many of our clients are interested in investing in Bitcoin and Ether, but they’re also interested in some of these technology applications, particularly tokenization.”

ONDO could rally 25%

ONDO’s price extends gains by 9% on Tuesday, trading at $0.7478 at the time of writing. The governance token of Ondo Finance could extend gains by nearly 25% and rally towards its target of $0.9245, the upper boundary of a Fair Value Gap (FVG) in the ONDO/USDT daily chart.

ONDO faces resistance at two imbalance zones, between $0.75956 to $0.79013 and $0.80962 to $0.86272, as seen in the daily chart below.

The Relative Strength Index (RSI) momentum indicator shows ONDO is now out of the “oversold” zone and reads 31.92, suggesting a buy signal.

ONDO/USDT daily chart

On the other hand, ONDO could find support in the Fair Value Gap between $0.5289 and $0.6422. A daily candlestick close below $0.74 could invalidate the bullish thesis for ONDO.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.