No Bitcoin nor Crypto buyers in Sight

Cryptocurrencies continue its bearish path, and all attempts by buyers to pull the price up are finished with a flurry of sales. Ethereum (-2.3%) is the most harmed of the top cryptos, whereas, Atom (+5.5$) is the most optimistic. In the Ethereum token sector, Link is losing 7.41%, while SNX moves +4.86%. Also strong are EKT (+7.7%), and Theta (+8,7%).

Fig 1 - 24H Crypto Sector Heat Map

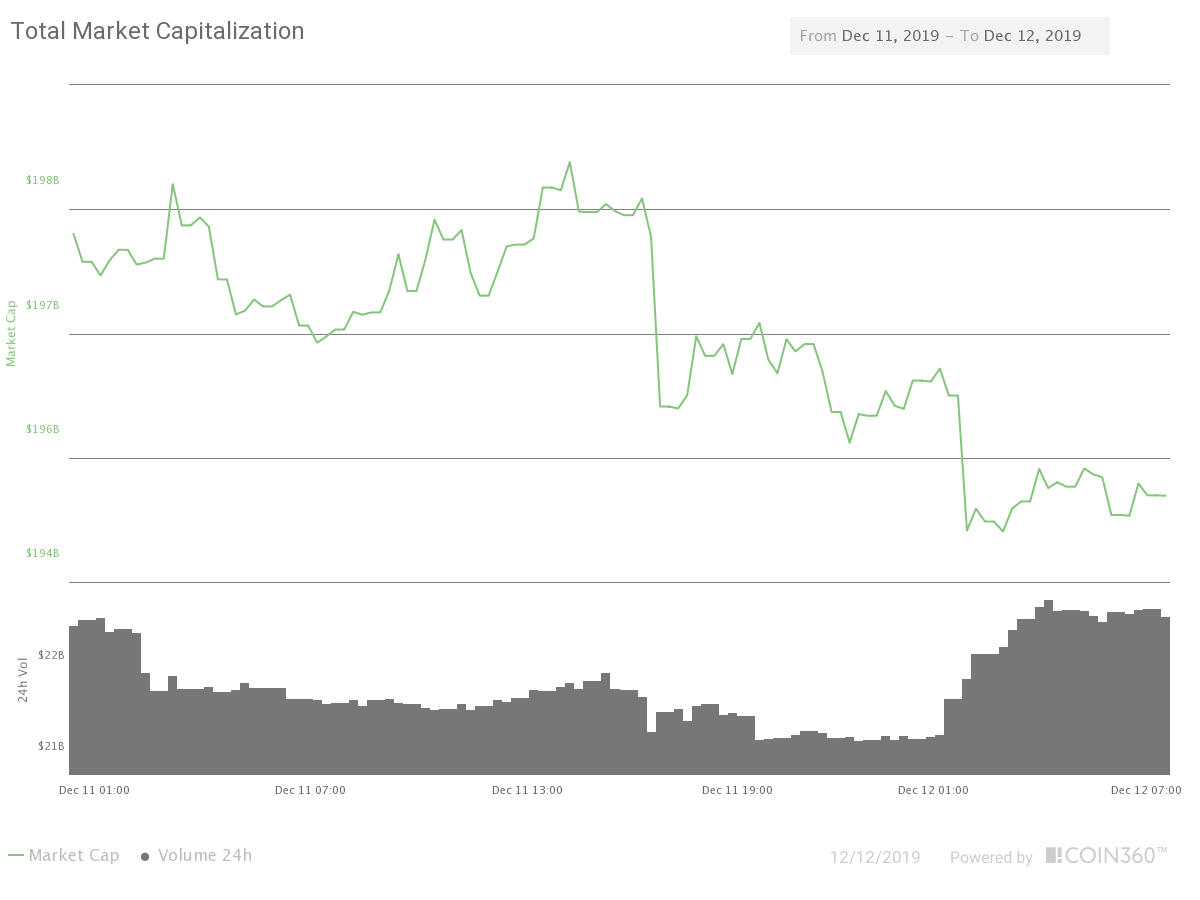

The Market capitalization continues descending. Currently, it sits at $195.254 billion (-1-07%), while the traded volume has moved to $23.7 billion (+0,4%) in the last 24 hours. Finally, Bitcoin dominance is stable at 66.5%.

Fig 2 - 24H Market Cap and Traded Volume

Hot news

Napoleon Asset Management launched France's first bitcoin fund regulated by the Autorité des Marchés Financiers. This fund is the first fund compose entirely by crypto assets.

Swiss Crypto bank SEBA expands to nine countries, including Singapore and Hong Kong. SEBA was created in April 2018 with a baking license by the Swiss Financial Market Supervisory Authority. The bank makes available to its customers a SEBAwallet app, e-banking, and a credit card. Customers can manage five cryptocurrencies: Bitcoin, Ethereum, Stellar, Litecoin, and Ether Classic.

German-based Solaris Bank announced it would launch a digital asset custody service through the creation of a subsidiary branch. Solaris Bank is fully regulated in Germany.

US SEC has charged Shopin founder, Eran Eyal, for fraud. SEC officials stated in a press release that Eyal fraudulently raised more than $42 million in an ICO offering, and according to the SEC, this action constituted an unregistered offering.

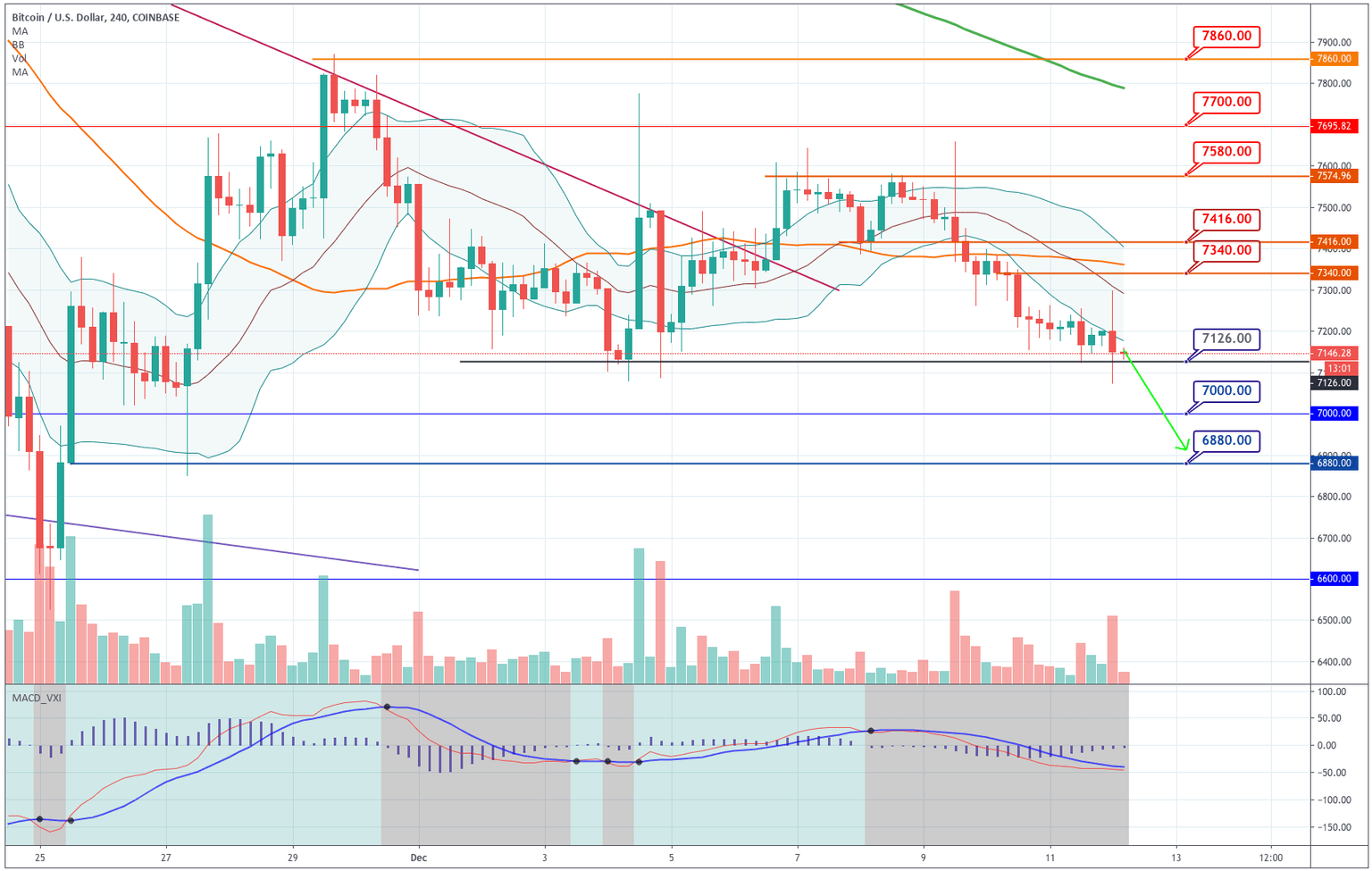

Technical Analysis - Bitcoin

Chart 1 Bitcoin 4H Chart

Bitcoin continues moving weakly. The latest attempt to pull the price up created another selling candle. The price is currently touching a support area at about $7.150, but there is no conviction by buyers to move the price further. If we look at the last candlestick, the large lower wick means that below $7.150 there are buyers interested, but we need to see the price move to the upper side of the Bollinger bands to consider the selling is over. Currently, the price moves below the -1SD line, so our primary scenario is for more drops to $7,000, $6,800, and, even, $6,600.

The Bitcoin_Longs chart shows the accumulation continues.

Chart 2 - Bitcoin_Longs 4H Chart

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,126 |

7,200 |

7,266 |

|

700 |

7,340 | |

|

6,800 |

7,416 |

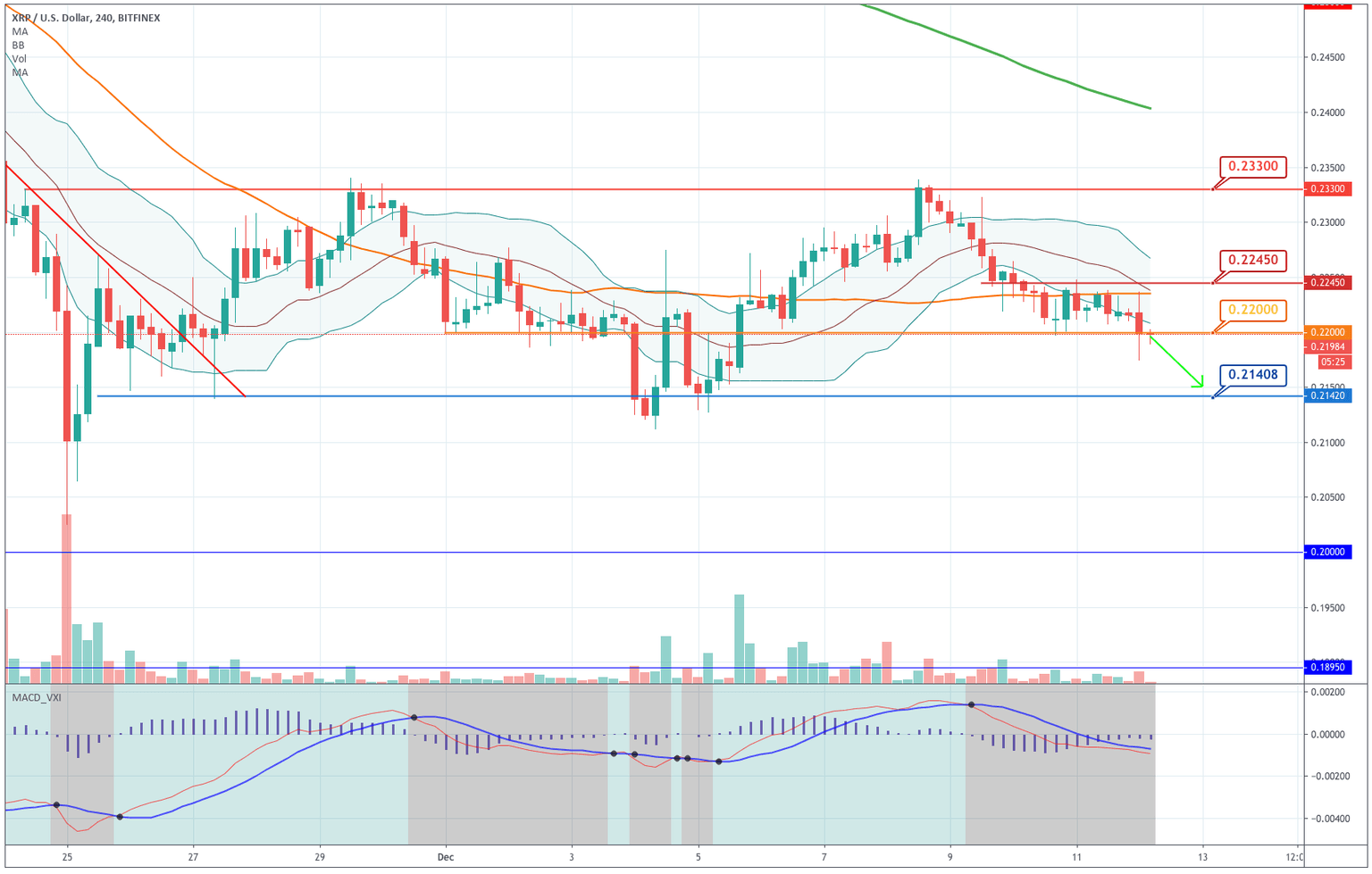

Ripple

Chart 3 - Ripple 4H chart

Ripple continues moving down, and below its -1SD line THe price is fighting to recover its $0.22 level, but the last candlestick shows sellers come whenever a rally appears, driving prices down. This type of market action shows the market is in a fear state product of the bearish mood.

XRP's price seems to head to text the next bottom of Dec 4 and Dec 5.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2200 |

0.2224 |

0.2245 |

|

0.2160 |

0.2270 | |

|

0.2140 |

0.2300 |

Ethereum

Chart 4 - Ethereum

Ethereum's V 2.0 Istanbul hard fork seems not to convince the buyers as the price continued descending in the last days. The price broke the $144 support yesterday and, even, tested the $140 level. The price, like the rest of assets, analyzed today, moves below its -1SD line, in an increasing bearish momentum. The price seems headed to test again its $140 support and beyond.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

141.00 |

144.00 |

146.00 |

|

139.50 |

148.00 | |

|

137.00 |

150.00 |

Litecoin

Chart 5 - Litecoin 4H Chart

Litecoin moves similarly to Ethereum. Its price following the -1SD line. Currently, it's close to testing its $43.2 support line, but there is no strength in the market, so it seems headed to visit the $42.7 low today.

|

SUPPORT |

PIVOT POINT |

|

45.20 |

44.00 |

|

42.70 | |

|

42.00 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and