NEO Price Analysis: NEO/USD struggles to settle above $7.00 as the upside momentum fades away

- NEO/USD retreated from the intraday high amid growing bearish sentiments.

- Vital support is created by a combination of intraday technical indicators.

NEO, now the 2nd largest digital asset with the current market value of $492 million, is hovering around psychological $7.00. The coin has gained over 2% on a day-to-day basis, however, the upside momentum has faded away during early Asian hours. NEO tokens worth nearly $500 million changed hands in recent 24 hours, which is in line with the long-term average figures.

NEO unlocks tokens

Neo Foundation released 1,660,865 NEO tokens worth over $11 million from the cold wallet. The team explained that the money is needed to finance further development and network operation. The tokens were transferred from the frozen wallet to the current account on March 24. The plan to finance community expansion and everyday operations. According to the estimates, the annual expenses should not exceed 15 million tokens.

According to rules established in the Neo White Paper, the NEO tokens maintained by the Neo Foundation are mainly used to continuously support Neo's technological development, ecosystem growth, community expansion and the normal operations of the foundation and related organizations, the press-release says.

Apart from that, the NEO Foundation finished the financial review for the fiscal year 2019 and promised to disclose the results to the community.

NEO/USD: Technical picture

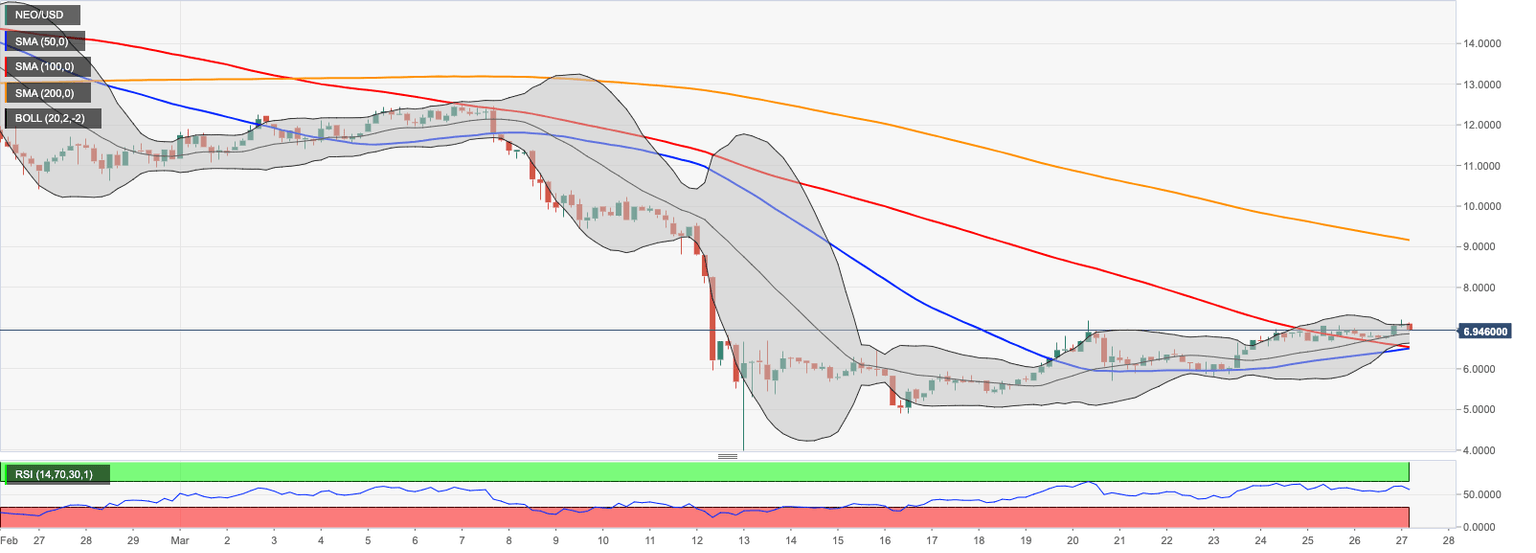

On the intraday charts, NEO's recovery is limited by the upper line of 4-hour Bollinger Band currently at $7.10. Once it is out of the way, the upside is likely to gain traction with the next focus on the intraday high of $7.20 reinforced by the upper line of 1-hour Bollinger Band. The next upside target is created by $8.00 and $9.10 (SMA200 4-hour).

On the downside, strong support is seen at $6.50. It is created by a combination of SMA50 and SMA100 on a 4-hour chart and also the lower line of 4-hour Bollinger Band. A sustainable move below this handle will trigger more sell-off with the next bearish target $5.00 and $4.00 (March 13 low registered at $3.99).

NEO/USD 4-hour chart

Author

Tanya Abrosimova

Independent Analyst