- MATIC price falling by 12% in the last seven days sent the altcoin into the oversold zone on the daily chart.

- The altcoin also slipped into the opportunity zone for the second time in two months, suggesting it is most likely set to witness HODLing from investors.

- The crypto market sentiment is still neutral despite the decline, which stands to be a crucial trigger for recovery.

MATIC price continued its downtrend this week after losing the $1 mark, bringing the cryptocurrency to a four-month low. However, an important signal noted over the last 24 hours suggests that the altcoin may not be too far away from beginning a recovery.

MATIC price to drive up on the charts

MATIC price failed to follow Bitcoin and Ethereum’s lead as the Layer-2 blockchain token added another 12.7% decline this week to the already ongoing drawdown. Trading at $0.88, the altcoin is currently at a four-month low.

As the altcoin’s trading value declined over the last few weeks, MATIC price has reached a point where its potential for a bounce exceeds the probability of a further decline. The cryptocurrency’s Relative Strength Index (RSI) fell into the oversold zone below the 30.0 mark on the daily chart. The last time the indicator was at this point was back in June 2022, marking 11 months since the altcoin’s bearishness reached this zone.

MATIC/USD 1-day chart

Historically, this zone has been synonymous with recovery, which is visible on the charts as well. The last time the altcoin slipped into oversold territory, MATIC price ended up rallying by 75% in the span of four days. Although a similar rise is not expected in the current market conditions, some recovery is on the horizon.

This is also reflected in the investors’ behavior, who are more likely to hold on to their assets instead of selling at a loss. The Market Value to Realized Value (MVRV) ratio measures whether the token holders are underwater or in profit.

In the case of MATIC, a dip below -10% suggests that most of the investors are facing profits and that rather than realize their losses, they might refrain from selling. This zone is also known as the opportunity zone, where recovery is bound to take place, as observed in past instances.

MATIC MVRV ratio

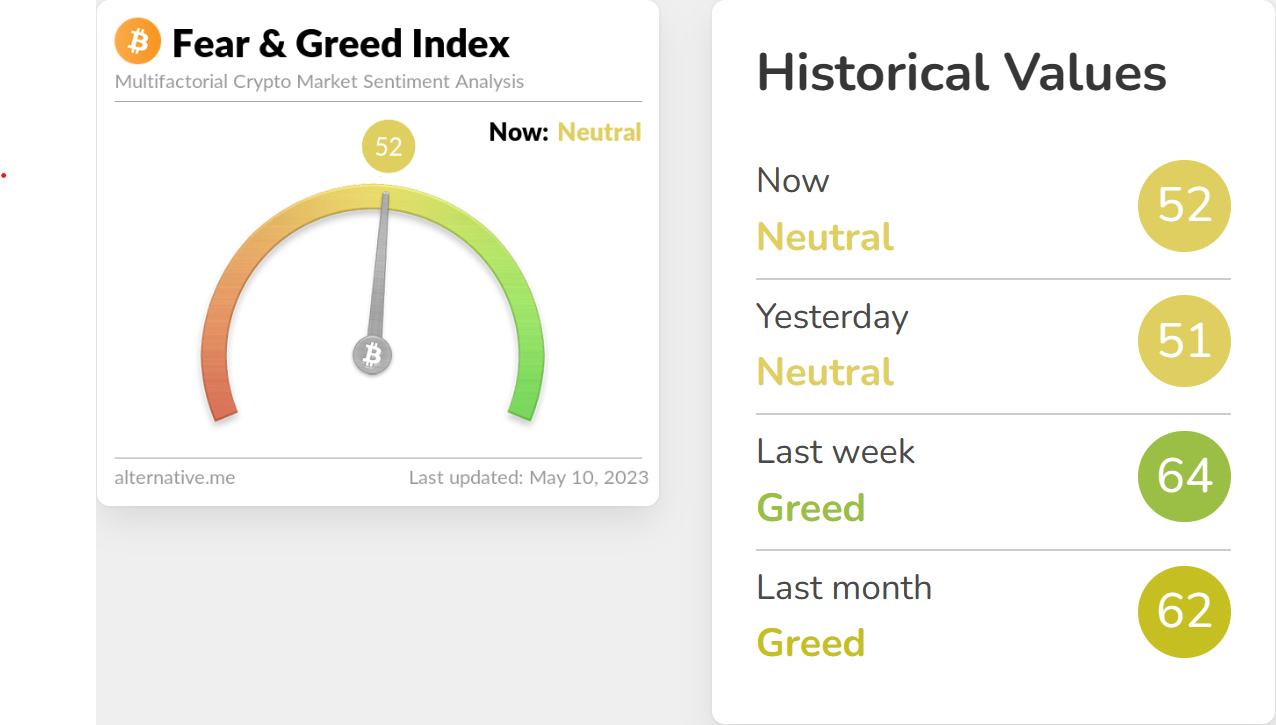

Furthermore, investor sentiment, another crucial trend-identifying factor, is moving away from greed thanks to the recent red candlesticks. However, the crypto fear and greed index shows that the overall sentiment is not negative yet.

Crypto Fear and Greed Index

As long as investors lean into HODLing, the sentiment will remain neutral, which will be crucial for MATIC recovery going forward.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

OpenAI parts ways with cofounder and chief scientist Ilya Sutskever

OpenAI cofounder Ilya Sutskever is exiting the firm for reasons not disclosed yet. Jakub Pachocki replaces Sutskever, taking the baton after running many of OpenAI’s most important projects, Altman says. Reportedly, Sutskever played a key role in the November ouster of CEO Sam Altman.

Sonne Finance suspends all Optimism markets after over $20 million exploit

With PeckShield attributing the attack to a time-locked contract, Sonne Finance has suspended all Optimism markets, adding that the Base market is safe. Noteworthy, Sonne Finance is the first platform to launch a lending protocol on Optimism.

Bitcoin Price Outlook: Will GameStop stock resurgence have downstream effect on BTC and alts?

Bitcoin continues to glide along an ascending trendline on the four-hour time frame. Meanwhile, the GameStop saga that has resurfaced after three years distracts the market, with speculation that it could inspire risk appetite among traders and investors.

Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

Ethereum is indicating signs of a bearish move on Tuesday as it is largely trading horizontally. Its co-founder Vitalik Buterin has also proposed a new type of gas fee structure, while the chances of the SEC approving a spot ETH ETF decrease.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.

%20[21.07.46,%2010%20May,%202023]-638193316925149220.png)