Market wrap: Ether breaks out as Bitcoin lags

Ether, the second-largest cryptocurrency by market capitalization, broke out of a month-long consolidation on Wednesday and looks poised to continue higher. Bitcoin, meanwhile, was trading at around $48,600 at press time and is up about 3% over the past 24 hours, compared with an 8% rise in ETH over the same period.

“Ethereum’s blockchain activity is bullish, indicating the second leg of the bull run is close,” Alexandra Clark, a trader at U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk.

“The recent spike in NFT (non-fungible token) activity has prompted a rise in transaction volume and active addresses on the Ethereum network, as well as a deflationary supply,” Clark wrote.

For bitcoin, analysts are watching for a potential increase in trading volume, which has been on the decline over the past month, to confirm support above $46,000 and $48,000.

Latest prices

-

Bitcoin (BTC) $48,243, +2.50%.

-

Ether (ETH) $3,724, +9.45%.

-

S&P 500: +0.0%.

-

Gold: $1,814, -0.0%.

-

10-year Treasury yield closed at 1.302%, -0.003 percentage point.

Ether takes the lead

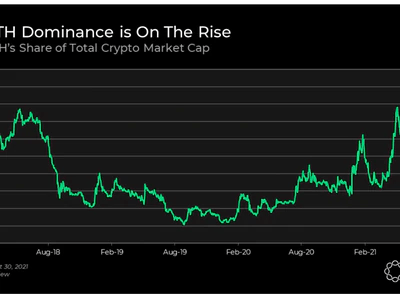

Ether’s share of the total crypto market capitalization has been rising since 2019, and is now just below 20%. The increase in market share could solidify Ethereum’s place in the crypto ecosystem as a top smart contract platform.

Analysts at Delphi Digital wrote in a Tuesday blog post that if support holds near $3,500, ETH could be primed for takeoff. Delphi also noted that September could be a seasonally weak period for cryptocurrencies, but a positive fourth quarter could make up for any short-term pullbacks.

Ether dominance ratio (Delphi Digital)

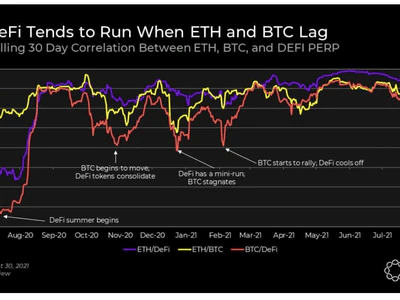

Decentralized finance (DeFi) tokens have also caught a bid as some traders rotate out of ETH in search of higher return potential.

“The 20-month long trend of investors withdrawing ETH from exchanges and pushing them into smart contracts has continued,” Delphi Digital wrote. The chart below shows the recent outperformance of DeFi tokens relative to BTC and ETH.

DeFi vs. BTC and ETH (Delphi Digital)

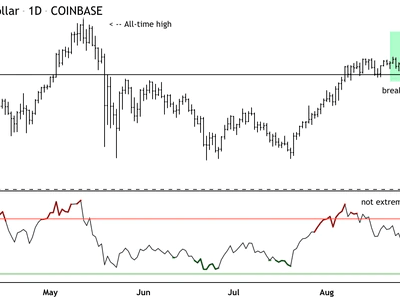

ETH toward all-time high

From a technical perspective, unlike bitcoin, ether has broken out of a month-long consolidation phase and is poised to reach an all-time high near $4,000. Further, upside momentum has improved over the past week given the earlier breakout above $3,000. ETH is entering overbought territory, albeit less extreme compared with the beginning of August.

Ether daily price chart (CoinDesk, TradingView)

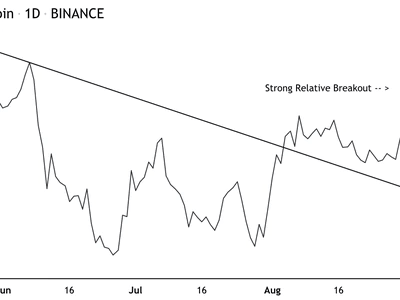

And relative to BTC, ETH is maintaining a strong breakout, which will likely continue this month. The ETH/BTC ratio has support above 0.067 with an initial upside target toward 0.08 resistance.

ETH/BTC daily chart (CoinDesk, TradingView)

Blockchain data also shows greater support for ether relative to bitcoin.

There has been roughly 147,759 ETH burned, priced at almost more than $1.5 billion, since the EIP 1559 activation in early August, according to digital asset manager 21 Shares. Meanwhile, older bitcoin wallets have taken some profits near the $50,000 supply zone.

But not all is lost for bitcoin. Overall, “on-chain activity signified a persistent long-term conviction in bitcoin enduring its momentum and reaching higher prices as whales holding 100-10,000 BTC have added almost 20,000 to their total holdings coupled with MicroStrategy’s latest top-up,” 21 Shares wrote in a Tuesday newsletter, referring to the software company that bought a lot of bitcoin.

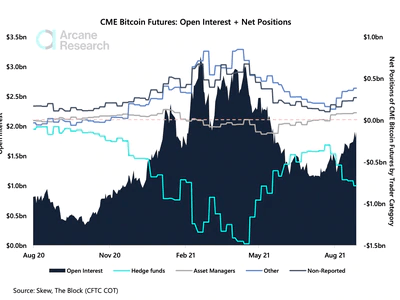

CME bitcoin open interest rises

Open interest in Chicago Mercantile Exchange (CME) bitcoin futures is approaching $2 billion. It saw steady growth throughout August. That could be a sign of greater institutional interest in bitcoin futures, which is sometimes used to hedge spot BTC exposure.

Last week, the legendary investor Bill Miller’s flagship fund, the Miller Opportunity Trust, disclosed in a regulatory filing that it owned $1.5 million shares in Grayscale’s Bitcoin Trust (GBTC).

“These types of investors could be interested in hedging their positions through the CME futures,” Arcane Research wrote in a Tuesday report.

Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.

CME bitcoin futures open interest (Arcane Research)

Altcoin roundup

Chainlink feeds go live on Optimistic Ethereum: Decentralized oracle network Chainlink’s price feeds went live today on Optimistic Ethereum, a layer 2 scaling product, ensuring that new and existing DeFi applications can migrate to layer 2 smoothly. At press time, the price of LINK was up 9% over the past 24 hours. In a press release, Chainlink co-founder Sergey Nazarov said, “With Chainlink oracle networks natively integrated on Optimism, developers can leverage the most decentralized and secure off-chain services for building advanced hybrid smart contracts.”

Polygon’s MATIC token available for trading on Okcoin at 10 p.m. ET: Ethereum scaling platform Polygon’s native MATIC will be available to trade on cryptocurrency platform Okcoin this evening. The listing will be accompanied by an exclusive drop of 10 Polygon-minted NFTs created by The Most Famous Artist (TFMA) Community, available for purchase on the OpenSea exchange.

DEX aggregator 1inch integrates with BitPay: Cryptocurrency payment servicer BitPay announced an integration with DeFi protocol 1inch, a decentralized exchange (DEX) aggregator that offers users more enhanced yield farming rates than any individual exchange. BitPay wallet holders can swap ETH and ERC-20 tokens while sourcing the highest rates with a more seamless user experience. The 1inch DEX aggregator has surpassed $65 billion in overall volume on the Ethereum network.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.