- MakerDAO has added Decentraland’s native token MANA as a new collateral type.

- Customers can now use MANA for the generation of the stablecoin DAI.

- MANA is Decentraland’s primary token.

The MakerDAO ecosystem has added MANA (the native token of the Decentraland marketplace) as a new collateral type after an executive vote among MKR token holders. According to an official blog post, customers can now use MANA to generate the stablecoin DAI.

MANA is Decentraland’s primary medium of exchange and is used to pay for things within the virtual world. In the last few months, MKR token holders have voted to add the stablecoin USDC and wBTC as collateral types. wBTC is an Ethereum-based token that is 1-to-1 backed by Bitcoin.

According to an earlier FXStreet report, MakerDAO became the first DeFi protocol to reach $1 billion in total locked value (TLV). The rise in interest in DeFi applications has driven the growth of the sector.

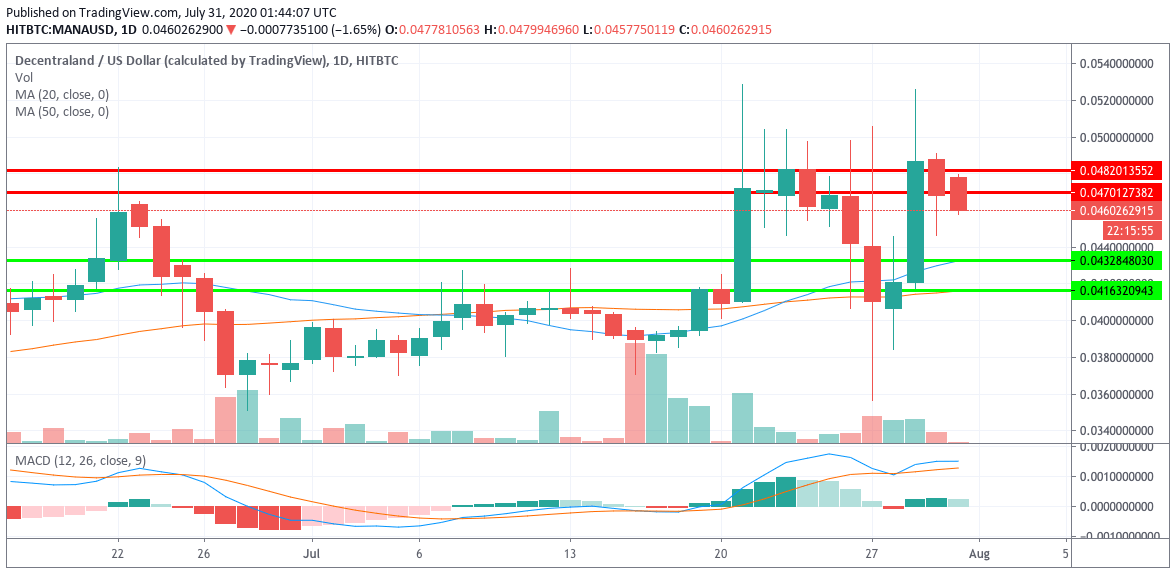

MANA/USD daily chart

MANA/USD shot up from $0.04208 to $0.0487 this Wednesday. Since then, the bears have corrected the price to $0.046 over the next two days. MANA/USD has two strong resistance levels at $0.0482 and $0.047. On the downside, healthy support lies at $0.0432 (SMA 20) and $0.0416 (SMA 50).

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.