Maker Price Analysis: MKR whales could be getting ready to dump again at $470

- MKR is currently trading at $492 after a notable spike and rejection from $556.

- The daily downtrend is still intact, and a recent inflow of tokens to exchanges is worrying investors.

Maker has been one of the most affected coins after the last crypto crash, losing around 50% of its value in practically one month. MKR is currently ranked 37th with a market capitalization of $500 million.

MKR/USD daily chart

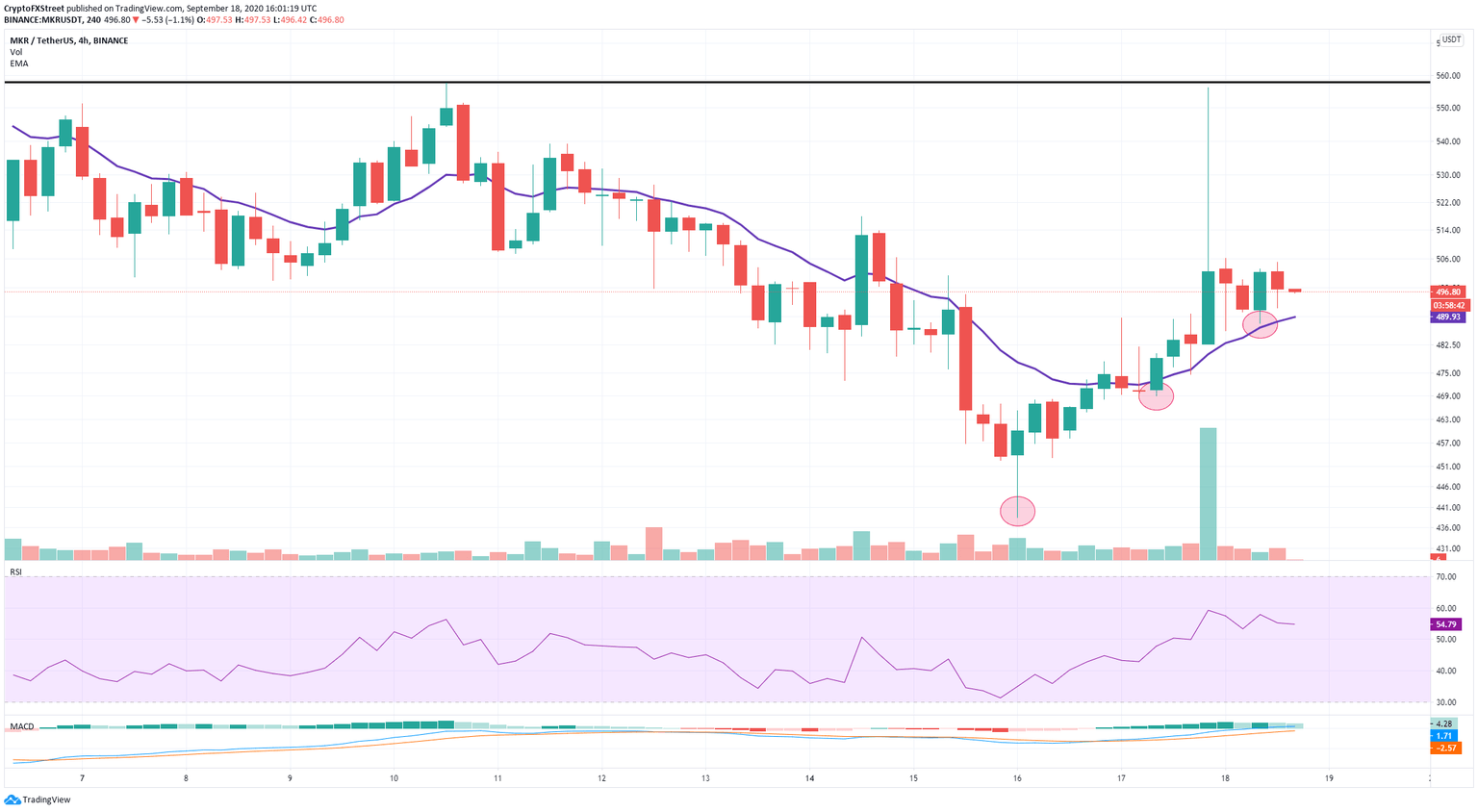

There is a massive downtrend formed by MKR on the daily chart. Bulls tried to breakout on September 17 after a notable spike towards $556 from a low of $468; however, the price got quickly rejected dropping to $500 within minutes. MKR has formed a resistance level at around $560, and it’s also facing the 12-EMA at $510 as resistance.

MKR Holders Distribution

Source: Santiment

The most notable development for MKR is a spike in exchange inflow registered on Glassnode. This doesn’t necessarily mean a sell-off is closeby; however, a significant decline in whales further strengthens the theory that MKR faces a lot of selling pressure. Whales holding at least 10,000 coins dropped from 16 to 10. Similarly, whales with at least 1,000 coins dropped from 82 to 76.

MKR/USD 4-hour chart

Not everything is lost for MKR bulls as the 4-hour chart is slowly changing in favor of them. The price has established several higher lows and the MACD flipped bullish hours ago.

MKR IOMAP Chart

Source: IntoTheBlock

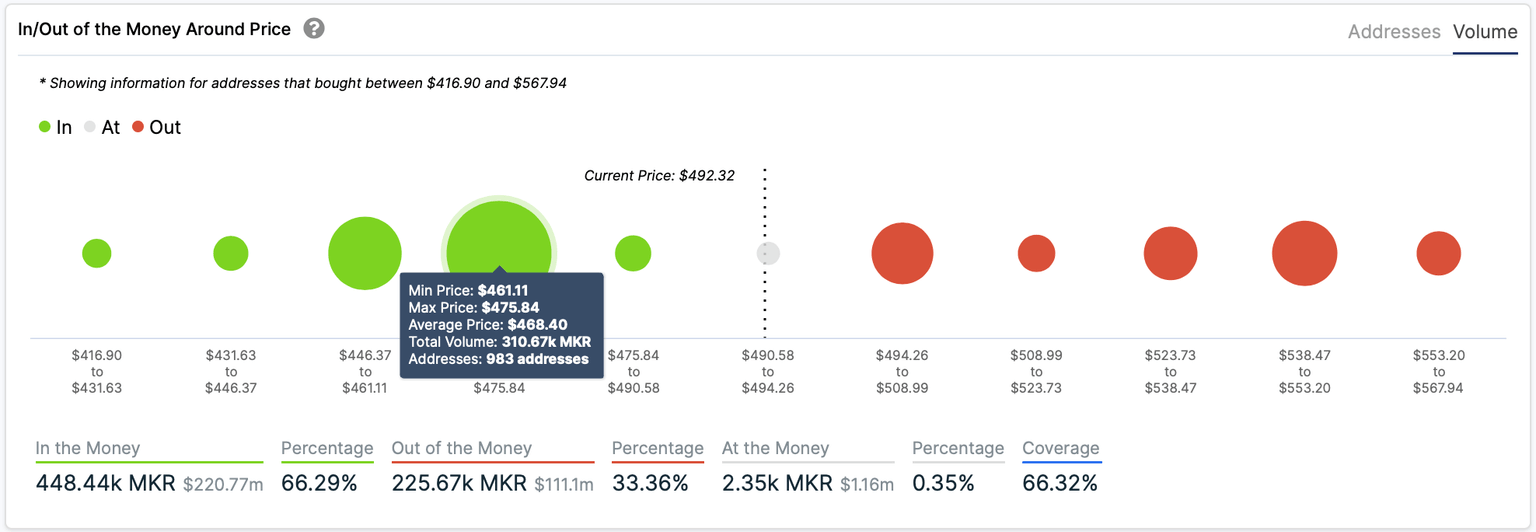

According to the IOMAP chart, MKR has a ton of support at $468, which means that a bearish breakout of this level would be notable. On the flip side, if the bulls can defend this price and bounce back up, resistance levels are significantly smaller than support.

Investors need to look out for the $468 support and $510 resistance levels. Any breakout below or above this range will be crucial for the short-term future of MKR.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637360417904429523.png&w=1536&q=95)