Litecoin Price Prediction: LTC targets $220 amid growing buying pressure

- Litecoin price is bounded inside a symmetrical triangle pattern.

- New LTC whales have joined the network increasing buying pressure.

- The digital asset is on the verge of a potential 17% breakout towards $220.

Litecoin has been trading inside a tightening range in the past week and whales have continued to accumulate significant sums of LTC. The digital asset is primed for a breakout towards $200.

Litecoin price is on the verge of a 17% move to the upside

Litecoin price is contained inside a symmetrical triangle pattern on the 12-hour chart. Bulls need to defend the key support trendline at $181 to see a rebound towards the upper boundary of the pattern.

LTC/USD 12-hour chart

A breakout above $191 will quickly drive Litecoin price towards $223. A breakout seems more likely due to the significant increase of whales. One new large holder with 1,000,000 to 10,000,000 LTC has joined the network in the past two days.

LTC Holders Distribution chart

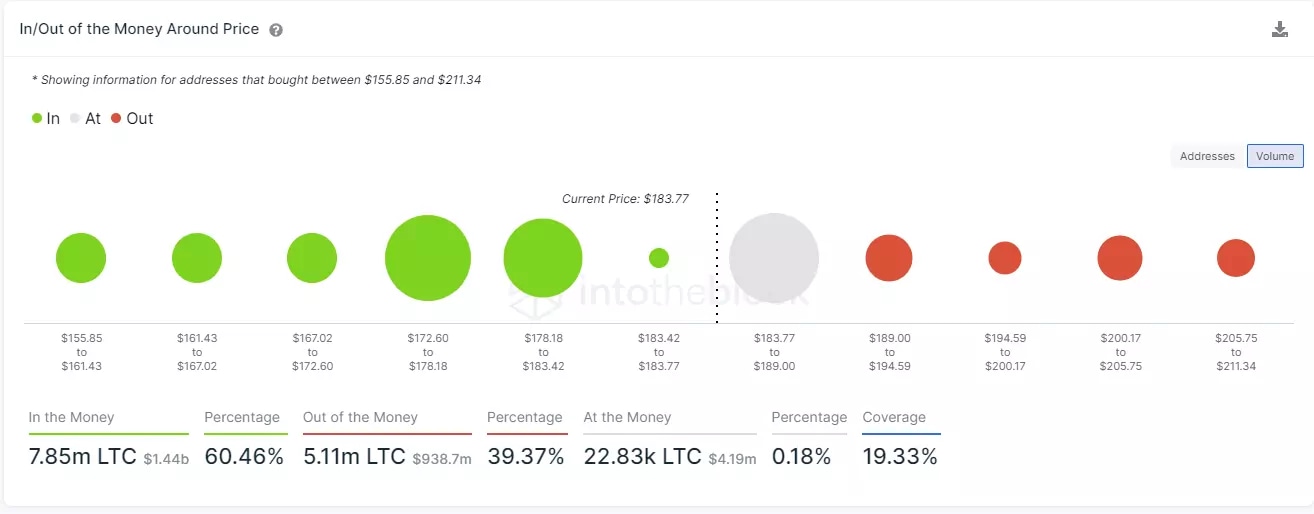

Similarly, the number of whales holding between 100,000 and 1,000,000 LTC has also increased from 112 on February 15 to 116 currently. The In/Out of the Money Around Price (IOMAP) chart shows only one crucial resistance area.

LTC IOMAP chart

The range between $183 and $189 will be the most important level to crack for the bulls, but there is a lot of support on the way down until $172. Nonetheless, a breakdown below the lower boundary of the symmetrical triangle at $180 will push Litecoin down by 17% to $150.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.18.26%2C%252008%2520Mar%2C%25202021%5D-637508066421638066.png&w=1536&q=95)