Litecoin price is failing recovery as Whales pull back to December 2020 lows

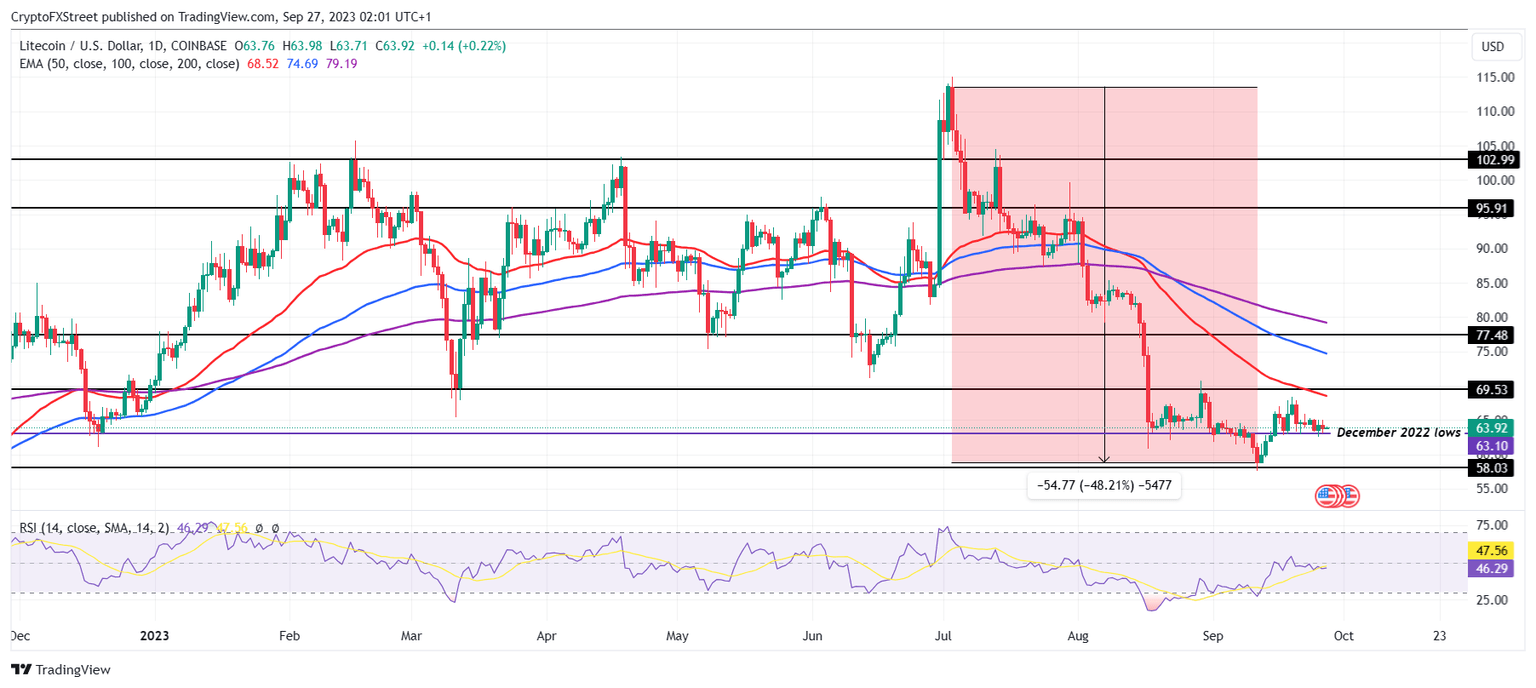

- Litecoin price has been unable to flip the 50-day EMA into a support floor since August began.

- The LTC whales, which command nearly 12% of the entire circulating supply, currently have been subdued.

- The average transaction volume of the LTC whales has been declining, hitting $1.2 billion at the time of writing.

Litecoin price was showing some signs of recovery about two weeks ago, but it failed to sustain the bullish momentum, resulting in minor corrections. While broader market cues are to be blamed for this, a lot of the credit goes to the whales, too, whose disappointing performance has impacted the altcoin.

Litecoin price fails crucial retest

Litecoin price was closing in on breaching not only the barrier at $69 but also flip the 50-day Exponential Moving Average (EMA). A successful retest of these levels would have established them as a support floor, which is important in reclaiming the 100- and 200-day EMAs as well as pushing the altcoin towards $80.

Failing the breach, LTC fell back to test the support at $63, with the Relative Strength Index (RSI) also hovering in the bearish zone below the neutral line at 50.0. Generally, a test of the neutral line as support is considered a confirmation of a bullish signal, which is reflected in the price bouncing back.

LTC/USD 1-day chart

This would be possible if the altcoin finds bullish support and flips the aforementioned resistance level into a support line to invalidate the bearish thesis, or else a further decline is not off the cards either.

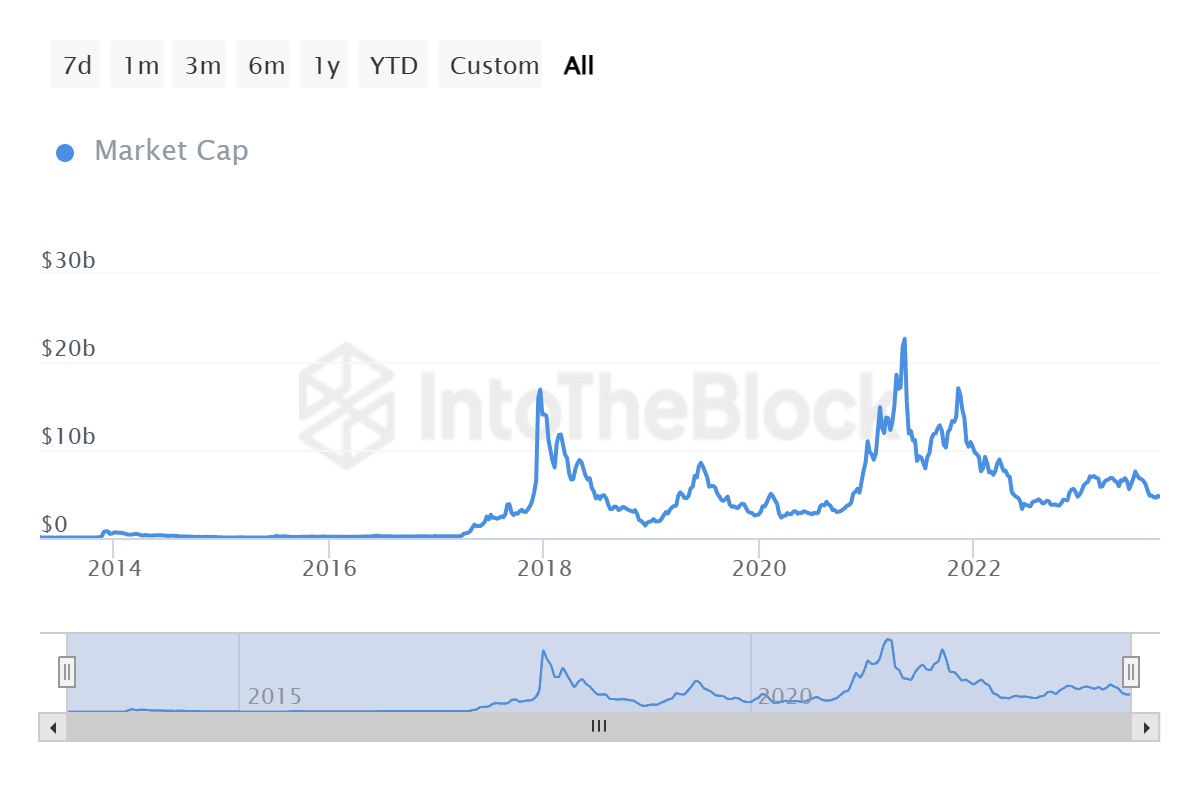

Litecoin whales need to resurface

Litecoin, being one of the oldest cryptocurrencies in the world, certainly has a higher user and holder base of investors. However, it also still has a significant chunk of the circulating supply in the hands of the whale addresses. These are the addresses that hold more than $100,000 worth of tokens in their wallets.

At the moment, whales have been conducting transactions amounting to just $1.22 billion, which is the lowest recorded figure since December 2020. This dip certainly is concerning since even the daily average is well above $11 billion at its lowest.

Litecoin whale activity

The reason why their lack of activity is more concerning is because these addresses hold close to 9 million LTC tokens worth $567 million at the market price. Representing nearly 12% of the entire circulating supply of Litecoin, whale activity could reignite the price rise again, bringing LTC close to $80.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.