Litecoin Price Analysis: 122,000 new investors buying LTC amid Ripple’s latest victory

- Litecoin price steadied above $110 on Tuesday, as a US court decision to drop SEC charges against Ripple.

- A US Court’s decision to drop all charges against Ripple reignited speculations of a potential ETF approval for altcoins like LTC, SOL and DOGE.

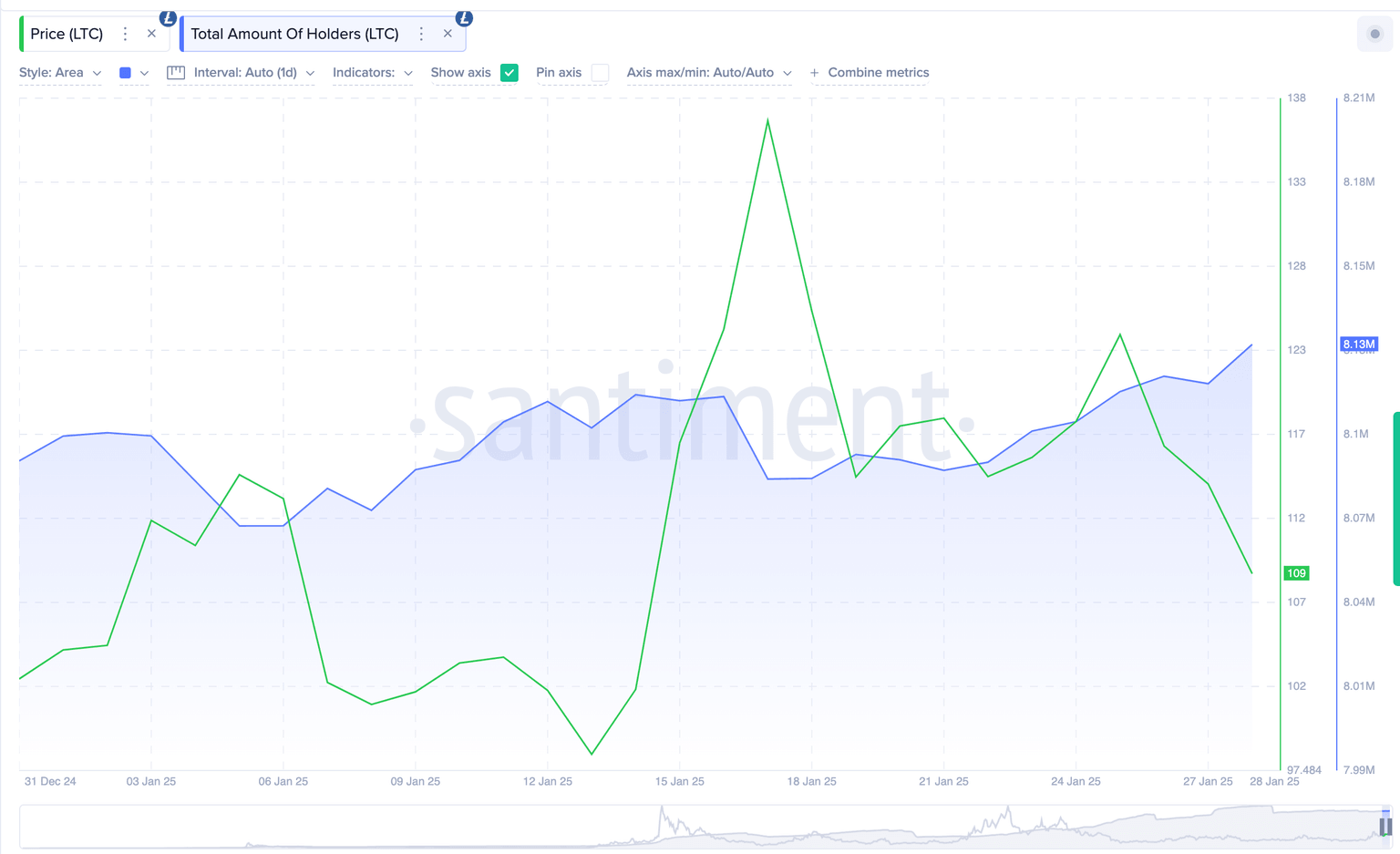

- Total LTC holder wallets increased by 122,000 over the last 10-days, despite a 22% price decline during that period.

Litecoin price consolidated above the $110 mark on Tuesday buoyed by positive swings in US regulatory pendulum towards altcoins ETF. On-chain data shows LTC continues to attract new buyers, despite recent volatile market movements.

Litecoin price stabilizes above $110 as Ripple victory lifts market sentiment

The recent decision by a US court to drop all charges against Ripple has had a ripple effect on the cryptocurrency market, particularly benefiting Litecoin (LTC).

Litecoin Price Action | LTCUSDT

The move has sparked renewed hope for the approval of Exchange-Traded Funds (ETFs) for altcoins, including LTC, SOL, and DOGE.

This legal victory for Ripple has been interpreted as a positive sign for the broader crypto industry, suggesting a more favorable regulatory environment.

As a result, LTC has managed to stabilize above $110, despite a 22% price decline over the last 10 days.

The resilience of LTC's price, coupled with the increase in total holder wallets by 122,000, indicates a growing confidence among investors.

This surge in new investors is likely speculative, driven by anticipation of an LTC ETF approval, which could significantly boost the cryptocurrency's market presence.

122,000 New Investors spotted buying Litecoin Amid ETF Speculations

The Litecoin ecosystem has witnessed a significant influx of new investors, with the total number of LTC holder wallets increasing by 122,000 in just 10 days.

This growth in investor base occurred even amidst a 22% drop in LTC's price, suggesting a strong underlying demand and confidence in the cryptocurrency's future prospects.

The increase in wallets is a clear indicator of new capital entering the LTC market, potentially in anticipation of a rumored ETF approval.

Litecoin Total Number of Holders, Litecoin (LTC) \

Such an approval would not only provide more investment avenues for retail and institutional investors but also lend additional legitimacy to LTC as a viable asset class.

The current market sentiment, fueled by Ripple's legal victory and the potential for ETFs, is driving this speculative demand, which could be a precursor to LTC's price recovery and growth in the coming months.

Litecoin Price Forecast: ETF speculations could spark $150 breakout

Litecoin price forecast is currently leaning bullish, with ETF speculations potentially sparking a breakout towards $150.

On the daily LTCUSDT chart, the recent price action has formed a symmetrical triangle pattern, often considered a continuation pattern that could lead to a breakout in the direction of the prior trend. The Moving Averages are converging, with the shorter-term MAs crossing above the longer-term ones, suggesting a bullish crossover.

Litecoin Price Forecast | LTCUSDT

Additionally, the MACD is trending upwards, indicating increasing bullish momentum. If the price breaks above the triangle's resistance level, it could confirm the bullish scenario and lead to a significant price increase.

Conversely, the bearish scenario is also plausible. The price has been consolidating within the triangle, and if it fails to break above the resistance, it could reverse and test the support levels.

The recent high volume sell-off, indicated by the large red candle, suggests that there is significant selling pressure at higher price levels.

If the bears regain control and push the price below the triangle's support, it could lead to a deeper correction.

However, the overall market sentiment and the increasing interest in Litecoin due to ETF speculations make the bullish scenario more likely

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.