Litecoin Chart Analysis: LTC stuck between 21 and 50-DMAs, lacks clear directional bias

- Battle lines well-defined for the LTC/USD traders on the daily chart.

- A potential Doji candlestick charted with neutral RSI.

- Litecoin awaits a strong catalyst to determine the next direction.

Following Friday’s solid rebound from multi-day lows of $123, Litecoin (LTC/USD) lacks a follow-through bias, as the bulls and bears get into a tug-of-war this Saturday.

At the press time, the digital asset trades little changed on the day near the $137 region, unable to find a clear direction while awaiting a fresh impetus to break through the recent trading range.

LTC/USD: Range play likely to extend

LTC/USD: Daily chart

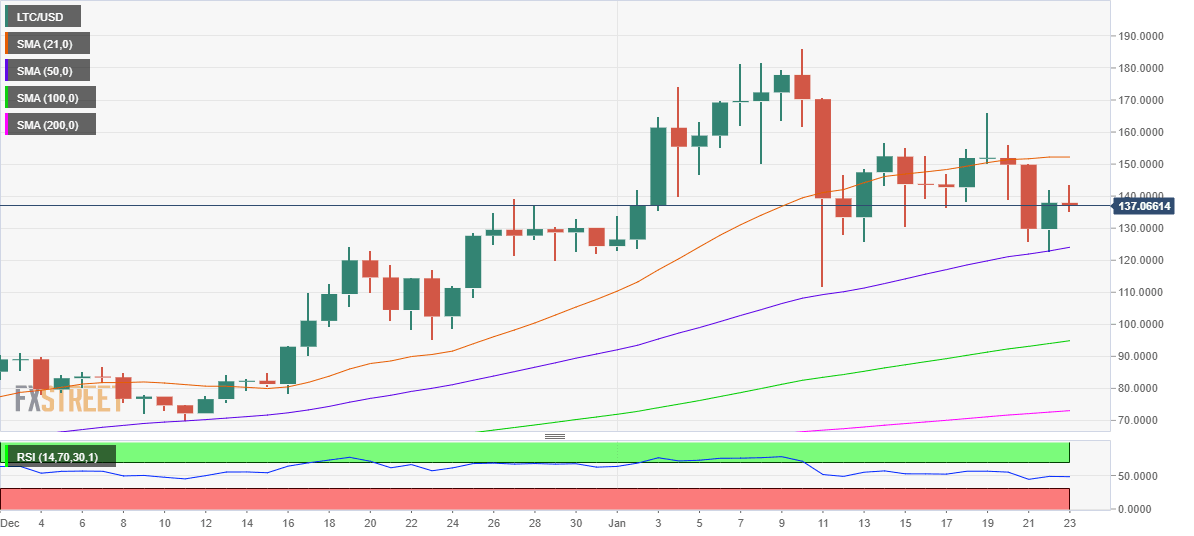

LTC/USD has formed a potential Doji candlestick on the daily timeframe after Friday’s bounce, suggesting that the price in search of a clear direction for its next move.

The price wavers between the 21-day moving average (DMA) and 50-DMA, with the 14-day Relative Strength Index trading flat at the midline. The technical picture, therefore, points to indecision.

Only a convincing break above the 21-DMA barrier at $152 could revive the recovery momentum from eleven-day lows.

Meanwhile, the sellers need acceptance below the 50-DMA at $124 to resume this week’s downward spiral from near $166 levels.

Should the selling pressure intensify, a breach of the $100 level becomes inevitable. The next significant support is aligned at the upward-sloping 100-DMA at $94.87.

LTC/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.