LINK holders’ patience could pay off as Chainlink price likely to initiate recovery

- Chainlink price, despite the decline, has sustained above $6, right above the crucial support line at $5.9.

- LINK investors have exhibited patience throughout the recent crash, which kept them from witnessing significant losses.

- The MVRV ratio suggests that LINK is in the opportunity zone, which is synonymous with recoveries, last visited by the altcoin in March.

Chainlink price action was no different than most of the other cryptocurrencies in the past two weeks. As the market crashed, LINK plunged too, but the altcoin was saved from witnessing a severe drawdown thanks to its investors, whose behavior might play a crucial role in initiating recovery going forward.

Chainlink price aims at a bounce-back

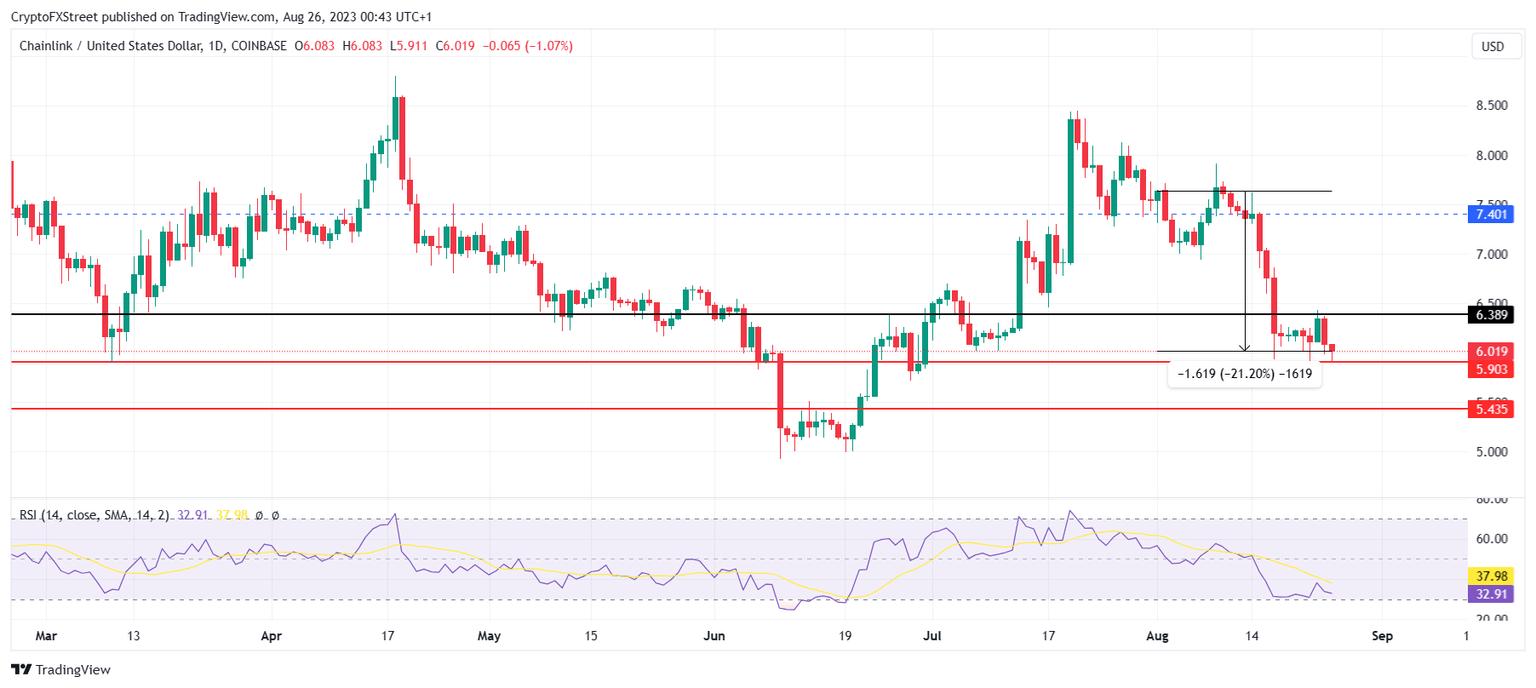

Chainlink price has had a rather rough August, similar to the entire crypto market, as the cryptocurrency fell by 21.2% month to date. Trading at $6, LINK is keeping above a key support level marked at $5.9. The Relative Strength Index (RSI) denotes that while the altcoin is facing bearish pressure, it still has not reached the oversold zone.

LINK/USD 1-day chart

A decline to $5.9 would lead to the same as the indicator dips below 30.0, which could lead to a recovery in the price action. The likeliness of the same is evinced by the Market Value to Realized Value (MVRV) ratio, which is currently sitting in the “opportunity zone”. The indicator, which measures the profit/loss witnessed by investors on a 30-day average, last visited this area back in March.

The opportunity zone is marked beyond -13%, and historically, at this point, investors tend to hold off any selling and instead switch to accumulation. This drives the demand higher and leads to a recovery in price. With the indicator around it at the time of writing, further decline would potentially trigger a similar momentum for Chainlink price.

Chainlink MVRV ratio

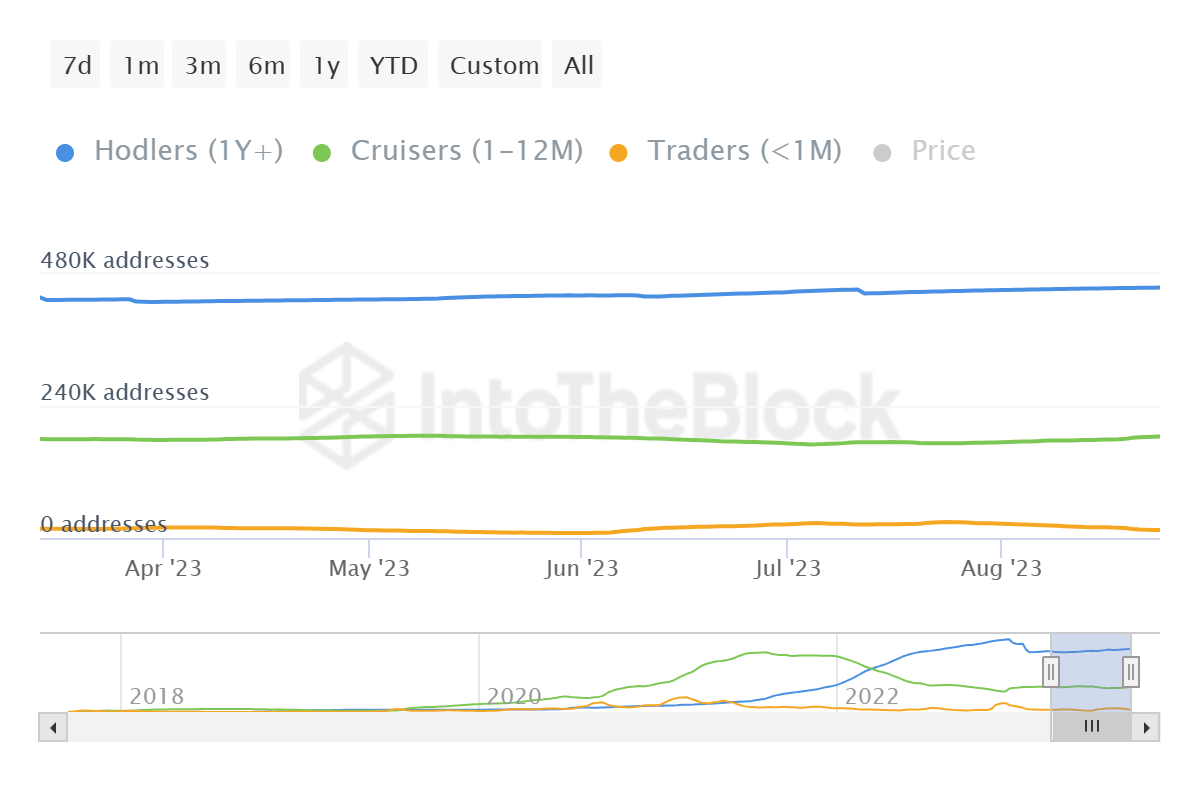

Regardless, LINK holders’ patience has been one of the biggest contributors to keeping the altcoin above $5.9. As noted in the distribution of addresses by time, over the past four weeks, there has been a rise in mid-term holders (Cruisers) and a decline in short-term holders (Traders).

Chainlink address distribution

This shows that most of the investors have been holding on for more than a month, proving the fact that LINK holders refrained from selling and exiting during the recent crash. Maintaining sentiment will help Chainlink price recover quickly as the chances of selling at a loss are much lower at the moment.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.09.19%2C%252026%2520Aug%2C%25202023%5D-638286129678839218.png&w=1536&q=95)