Lido DAO price aims for 88% rally as it retests 21-month-old resistance barrier

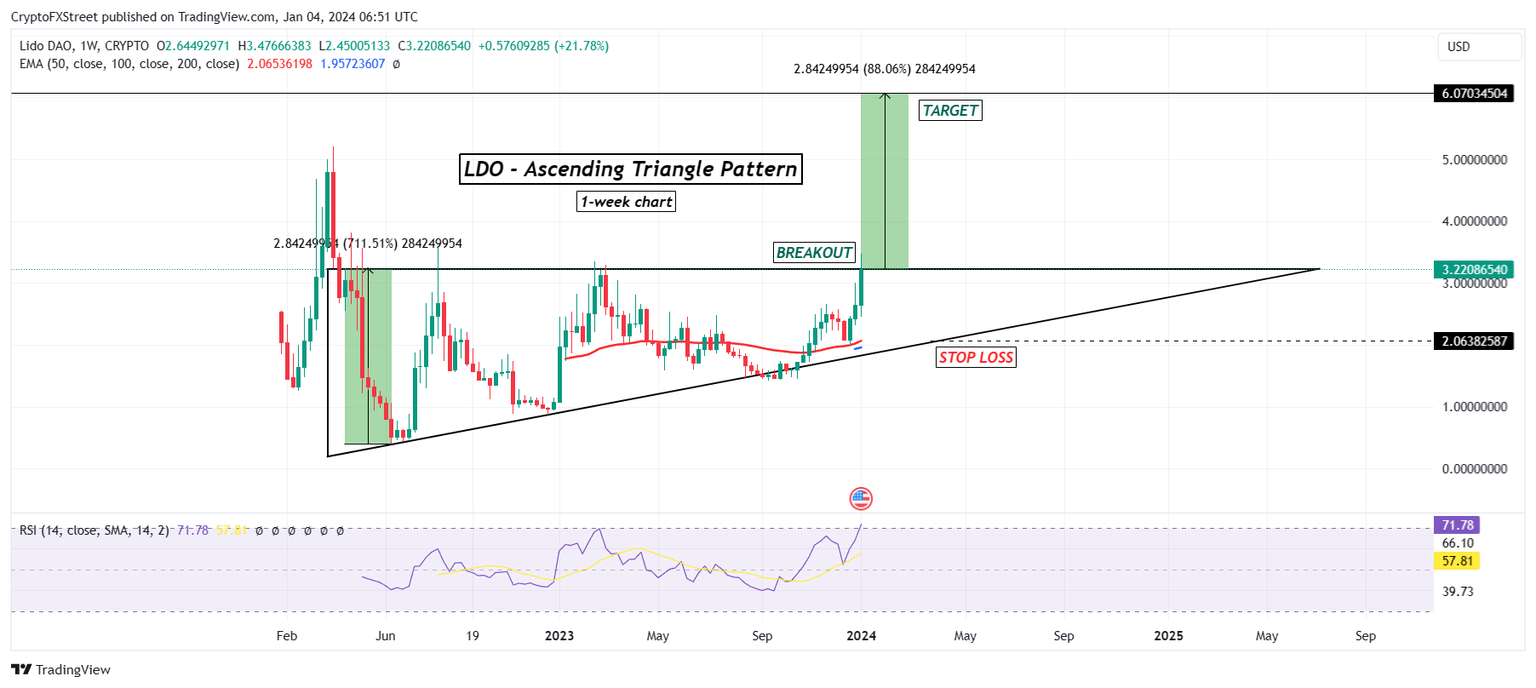

- Lido DAO price is testing the $3.2281 resistance line, which has not been breached since April 2022.

- The ascending triangle pattern on the weekly chart is close to being breached, which would be a bullish sign.

- The target, according to the pattern, is set at $6.0703, a 88% increase from the present price.

Lido DAO (LDO) price is exhibiting a long-term bullish outlook that could prove to be profitable for investors who purchased their assets in the past 21 months. Close to breaking through a key technical pattern, LDO is also nearing an 88% rally, which, if successful, would enable the altcoin to mark a new all-time high.

Lido DAO price could be up for a rally

Lido DAO price is testing a key barrier at $3.2281. This line has been holding the altcoin down for the past 21 months, as the last time it was breached was back in April 2022. Since then, despite the crashes, the altcoin has remained in an uptrend.

This price action has formed an ascending triangle pattern, and at the moment, the altcoin is nearing a breakout, provided it can breach and flip the 21-month-old barrier into a support floor. If it manages to, the pattern will be successful, and LDO will be on the path to achieving its target price of $6.070.

Since the target price lies 88% above the breakout zone, Lido DAO price would end up marking a new all-time high. The potential of this happening is also based on the bullishness generated by the potential spot Bitcoin ETF approval, which is scheduled to take place in the next couple of days before January 10.

LDO/USD 1-week chart

However, if this hype fails to bring enough gains to the altcoin and the breach of the resistance line fails, LDO could face a correction, given that the Relative Strength Index (RSI) is also sitting in the overbought zone at the moment.

If these corrections extend, it would be wise for investors to place a stop loss at $2.06, well below the $3.00 entry point.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.