LayerZero ZRO token tumbles 24% in 24 hours, hit by airdrop-related controversy

- LayerZero’s ZRO token airdrop went live on Thursday, with a claiming mechanism called Proof of Donation.

- The team requires 10 cents in USDC, USDT or Ether per ZRO token with the aim to weed out manipulative Sybil entities.

- ZRO wiped out 24% of its value in the past 24 hours.

- Crypto traders slammed LayerZero for the donation requirement post using a “Sybil detection” mechanism prior to the airdrop.

LayerZero’s newly-launched token ZRO has noted a double-digit price decline one day after its launch. The drop can be attributed to a new mechanism deployed for claiming airdropped tokens, which requires eligible addresses to pay $0.10 in USD Coin (USDC), USD Tether (USDT) or Ether to claim the token.

While The LayerZero team said this is effective in weeding out manipulative bots and Sybil entities, this has enraged crypto traders, who broadly seem to agree that ZRO token’s distribution “is not an airdrop.”

LayerZero’s ZRO token airdrop brings controversy

Claims for LayerZero’s token ZRO started on Thursday on one condition. Eligible users need to donate 10 cents in a stablecoin (USDC/USDT) to the Protocol Guild, a collective of Ethereum developers, for each ZRO token they claim.

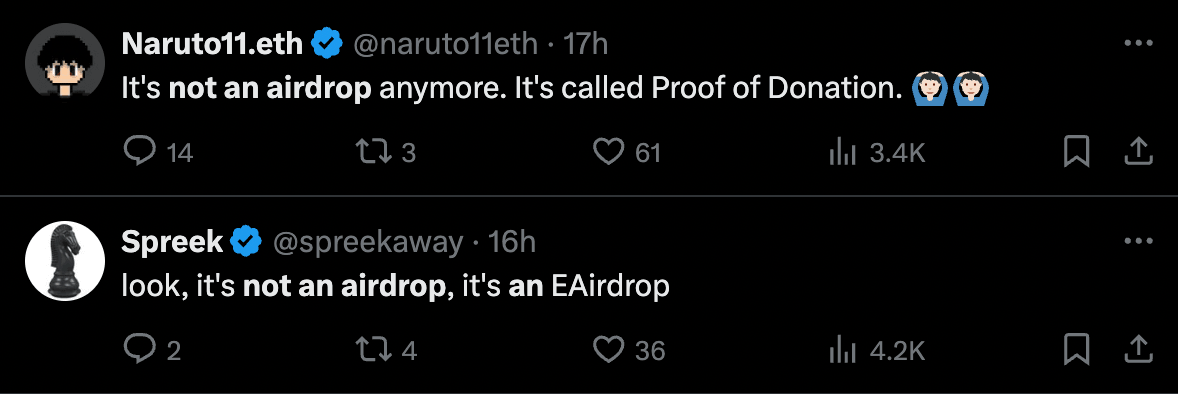

LayerZero said the Proof of Donation requirement intends to avoid Sybil entities, manipulative bots that farm airdrops. However, the community of crypto investors in X did not take kindly to the new initiative and slammed the firm for claiming that the token distribution via this mechanism is an airdrop.

“Because the token is in exchange for a donation it's technically not an airdrop, and the team didn't call it an airdrop anywhere in their comms…” a trader behind the X handle @dcfgod said.

Polymarket odds for layerzero airdrop crashed to 50% despite the token being out already

— DCF GOD (@dcfgod) June 20, 2024

Because the token is in exchange for a donation it's technically not an airdrop, and the team didn't call it an airdrop anywhere in their comms

in fact they explicitly say "this is not an… pic.twitter.com/ufkPNVj1VM

Not an airdrop comments on ZRO token distribution

LayerZero explained that the innovative method for distributing tokens is aligned with the protocol and its commitment to the future of crypto in the long-term. The foundation said it will match up to $10 million in donations to the Protocol Guild and support Layer 1 developers on Ether.

The fee is being likened to a “tax” and the controversy has resulted in a steep correction in ZRO token price, which is down 23.9% in the past 24 hours, per CoinGecko data.

ZRO suffers steep correction

ZRO price is down to $3.38 at the time of writing. The token is down nearly 30% from its all-time high of $4.79, from less than a day ago. The token’s market capitalization was around $845 million on Friday at the time of writing.

ZRO/USD price chart at GeckoTerminal

It remains to be seen whether ZRO can shrug off the correction and make a comeback to its all-time high of $4.79.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.