Kraken Chief Security Officer stresses on importance of crypto self custody, traders express concern

- Kraken Chief Security Officer Nick Percoco shared his thoughts on crypto self custody in a recent tweet.

- Percoco said never keep all of your assets on an exchange or web platform.

- Kraken Security lead’s tweet raised concerns among crypto traders, the exchange ranks among the top 10 platforms.

Data from Cryptogics, a data platform tracks the traffic to cryptocurrency exchanges and ranks the platforms based on it. Kraken ranks among the top 10 platforms. The platform tracked 6 million visits to the exchange platform in July 2024.

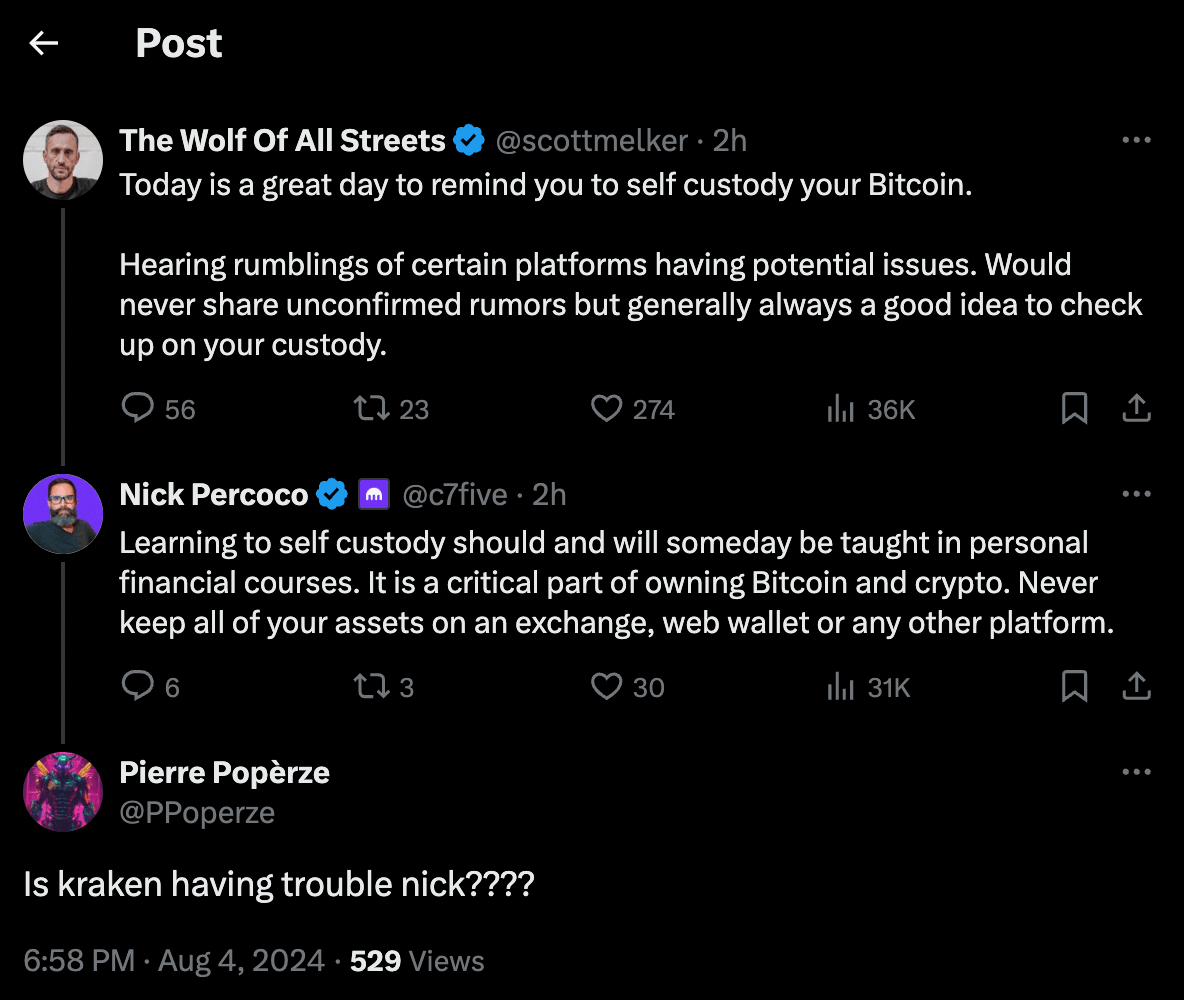

A recent tweet by the exchange’s Chief Security Officer Nicholas Percoco, behind the X handle @c7five resulted in uncertainty and concerns among traders. The CSO stressed on the importance of “self custody” in a response to analyst and trader Scott Melker’s tweet regarding “certain platforms having potential issues.”

Crypto analyst warns traders of potential issues in certain platforms

Scott Melker, a Bitcoin and crypto influencer, and host of “The Wolf Of All Streets Podcast,” noted that he has heard of “certain platforms” having potential issues, in a recent tweet on X. Melker reminded his followers of the importance of self custody and stressed that he would never share unconfirmed rumors.

Today is a great day to remind you to self custody your Bitcoin.

— The Wolf Of All Streets (@scottmelker) August 4, 2024

Hearing rumblings of certain platforms having potential issues. Would never share unconfirmed rumors but generally always a good idea to check up on your custody.

Kraken CSO responded to Melker’s tweet and the Security Officer’s comments raised concerns among traders. Trader behind X handle @PPoperze asked the executive “Is Kraken having trouble?” in his response.

Several crypto market participants have interpreted the executive’s tweet in a manner that adds to the uncertainty at a time of correction among top cryptocurrencies.

Response to Kraken CSO’s comments

Kraken ranks among the top 10 exchanges per Cryptogics data, therefore uncertainty and concerns in the market regarding the CSO’s tweet could have an impact on the sentiment of traders.

The crypto fear and greed index reads 34, up from 26 on Friday. This signals fear. The metric went from fear to greed and back within a two week timeframe, and represents the sentiments of crypto traders from different platforms.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.