JPMorgan vs Bitcoin

JPMorgan has issued yet another piece as it tries to dissuade people from entering into the Cryptocurrency market. This makes it’s fourth attempt at that, and yet again it has failed to do anything but prop up the instrument.

This time around, the major investment bank’s report was aimed at all those Bitcoin and Cryptocurrency fans who buy the coin because other major corporations or funds may follow in Tesla’s footsteps, i.e. buying millions (or possibly billions) of the Cryptocurrency because “while Bitcoin got another boost with Tesla’s announcement this week, the 8% allocation of its cash reserves to Bitcoin is unlikely to be followed by more mainstream corporates.”

Allow me to say that I completely disagree with this notion.

One month ago, Zerohedge predicted exactly that not only would Tesla buy Bitcoin following the brilliant example set by Microstrategy, but that many more companies would follow in Elon Musk's footsteps.

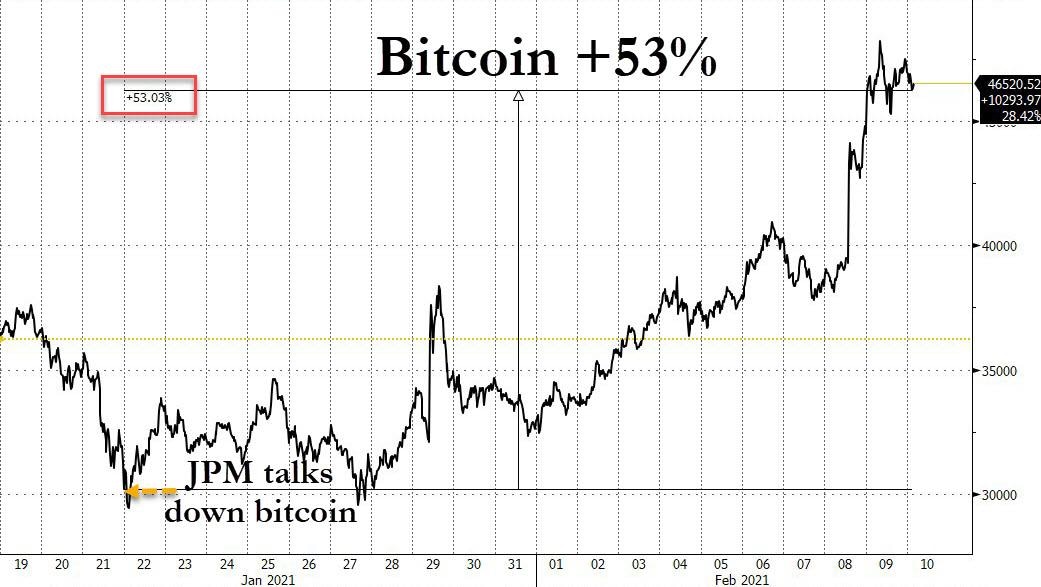

Just over two weeks ago, JPM had also issued an article trying to spark a major selloff in Bitcoin. This was when Bitcoin rose above the $40,000 for the first time, and JPMorgan once again tried to convince its clients that it would not go any higher. In a nutshell, the company warned that because Bitcoin now correlates with risk assets, it does not provide “diversification” to investors who seek a safe haven from conventional risk exposure.

Indeed, if one wanted to be truly diversified and safe, one would just buy gold. But that's not why anyone is buying Bitcoin, least of all corporate CFOs and Treasurers, who have made their case for the crypto very clearly: in a world in which just under 1% of US GDP enters the market in the form of newly created central bank liquidity, Bitcoin is becoming an asset that while not safe from high beta correlation to other risk assets, is certainly a hedge to not just infinite monetary dilution but to outright fiat and monetary collapse.

What’s ironic about this is that JPM itself admitted this: “Relative to any other asset class or portfolio hedge, Cryptocurrencies would uniquely protect portfolios against a simultaneous loss of faith in a country’s currency and its payments system, because they are produced and they circulate outside conventional and regulated channels.”

Well Duh!

And in the biggest headscrather, JPM itself admitted what Elon Musk just did, namely that “as insurance (or a lottery ticket) against dystopia, some exposure to these assets could be always justified irrespective of liquidity and volatility concerns.”

But the clearest and simplest reason why JPM was dead wrong is that since JPM's latest hit piece was written on Jan 21, Bitcoin is up a whopping 50% and anyone who shorted it on JPM's latest "advice" has suffered terminal losses.

You see that article was written by Nick Panigirtzoglou, the greek quant analyst, whose argument said: “with Bitcoin failing to breach $40K, CTAs, trend followers and momentum-chasing algos and quants would no longer pursue it.”

Needless to say that argument was also absolutely dead wrong because while momentum-chasing quants may or may not have been long, Bitcoin did find enough marginal buyers to push it up from the $30,000 level to just shy of $50,000. But you see Panigirtzoglou was the first to come out with the (quite credible) forecast that Bitcoin would hit $140,000 as it becomes the millennials' “digital gold” and keeps rising until the value of gold and Bitcoin reach rough parity.

According to JPM, even small allocations of 1% to Bitcoin “would cause a big increase in the volatility of the overall portfolio. For example, if a corporate treasurer allocates 1% of her 1% vol portfolio to Bitcoin, the overall portfolio volatility will rise from 1% to 8%. This is because of the large 80% annualized vol of Bitcoin.”

On its surface this argument is reasonable, unfortunately it’s also wrong. No corporate treasurer is buying (or not buying) Bitcoin because of its potential volatility. The reason why they would be buying Bitcoin is also the main reason why corporate officers do anything “to boost their stock price.”

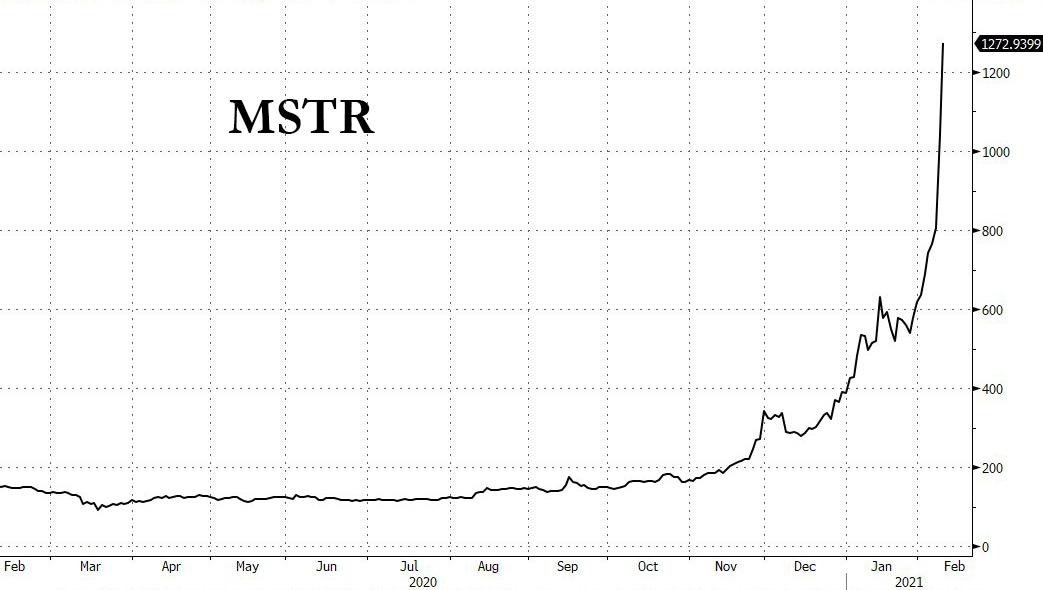

And as the case of MicroStrategy (MSTR), which was the first company to convert most of its cash into Bitcoin demonstrates so vividly, there is a lot of stock price upside once companies load up on Bitcoin.

It wouldn’t come as much as a surprise if Musk announced another $1.5 billion Bitcoin purchase, and then another, as he hopes to make TSLA a company that becomes a publicly-traded proxy for Bitcoin. And that's why countless other companies will follow suit, perhaps even Apple, which RBC predicted yesterday could buy as much as $5BN in Bitcoin as part of launching an “apple exchange” where Bitcoin is one of the permitted currencies.

In short, buying Bitcoin is a win-win for all companies involved.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.