Japan records $6 million in underreported crypto taxes amid Cardano price rally

- A large number of Japanese cryptocurrency investors have failed to pay taxes this year.

- Traders have profited off the incredible rally seen in Cardano price this year, but many have dodged taxes.

- Authorities in Japan stated that there were $6 million in underreported taxes.

Japan is starting to strengthen taxation proceedings in cryptocurrencies as individuals have reportedly failed to pay taxes for cryptocurrencies, especially those who profited from trading Cardano (ADA).

Japan cracks down on Cardano traders

Tax authorities in Japan are increasing scrutiny over tax processing on digital assets after the country found that a total of 1.4 billion yen was missing following a large-scale tax audit.

According to the report by Japanese outlet Nikkei, individuals have increasingly used cryptocurrency investment as a “tax-saving measure” due to the new asset class being a legal gray area.

An individual responsible for the investigation noted that cities including Saitama, Tochigi, Gunma, Nigata and Nagano profited off of trading ADA, the native cryptocurrency of the Cardano blockchain. The authorities stated that there were $6 million in underreported taxes.

Investors who were buying and selling ADA did not declare their profits or failed to pay taxes with the means of deception.

Cardano, known as the "Ethereum killer," also gets the name “Japanese Ethereum” in the country, as over 90% of the participants in the initial coin offering (ICO) of ADA were from Japan.

So far, taxation bureaus in the country have conducted six digital asset audits, with the Kanto region in Japan having monitored ADA trades for a number of years.

A tax accountant in Japan revealed that many individuals were able to profit off of the ADA price surge in 2021, as Cardano rallied over 1,100% this year.

Cardano price to retest $2 before next leg up

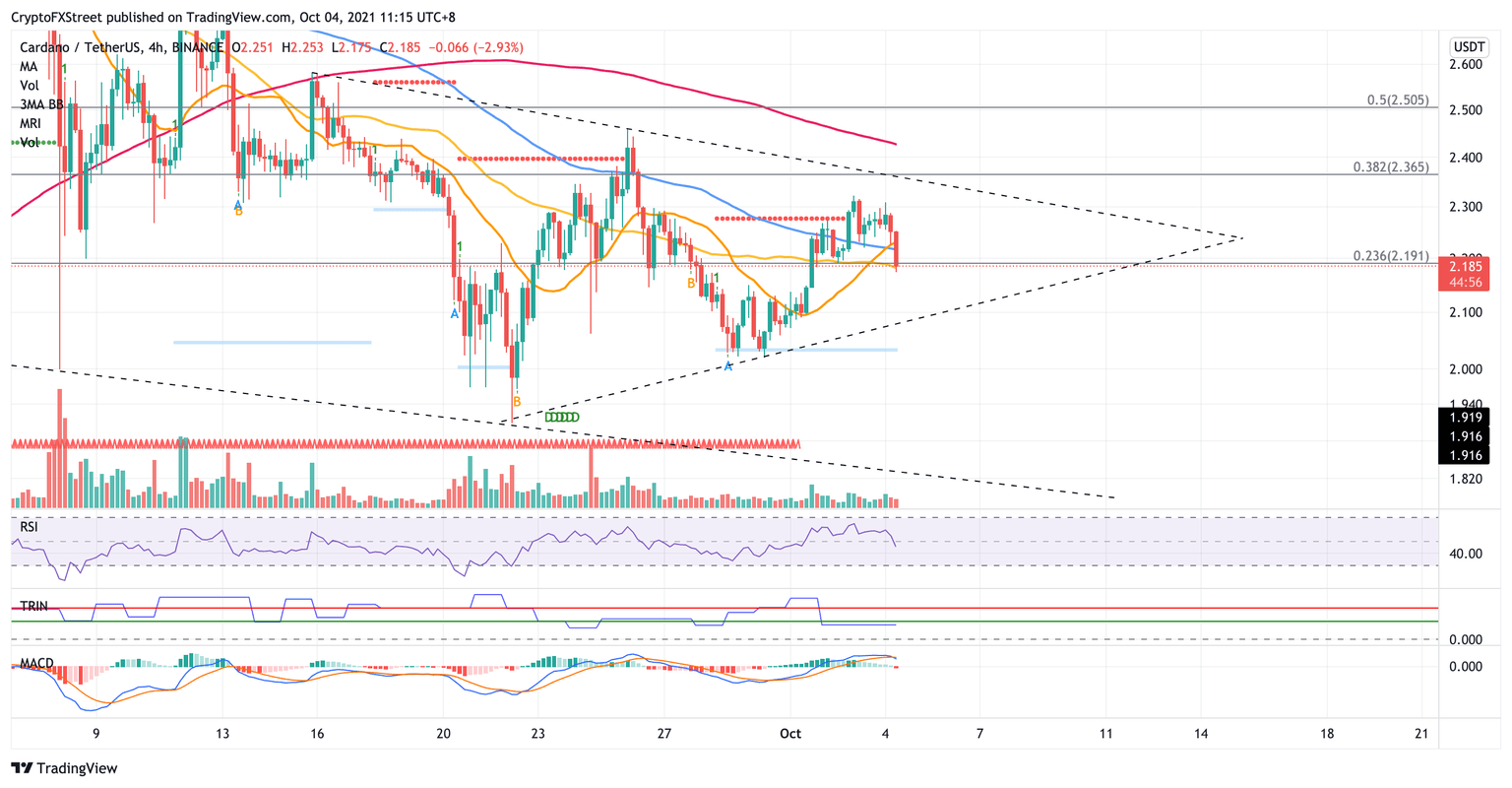

Cardano price has formed a symmetrical triangle pattern on the 4-hour chart, as the Ethereum-killer continues to consolidate.

Cardano price appears to be nearing the 23.6% Fibonacci retracement level at $2.19, where the 50 four-hour Simple Moving Average (SMA) sits. This support level emerges as the last line of resort for ADA before the bears take over, which could see the altcoin drop toward the lower boundary of the triangle at $2.08.

However, the downside trend line of the prevailing chart pattern would act as significant support for ADA. If the bulls step in at this point, Cardano price would likely continue to bounce within the technical pattern before hinting at future directional cues.

ADA/USDT 4-hour chart

Should a spike in buying pressure materialize, Cardano price would discover resistance at the October 3 high at $2.32 before eventually tagging the upper boundary of the triangle pattern at $2.34. Further obstacles may emerge at the 38.2% and 50% Fibonacci retracement levels, at $2.36 and $2.50, respectively.

Like this article? Help us with some feedback by answering this survey:

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.