IOTA Market Update: IOT/USD aims for $0.40 as Chrysalis update gears up to go live next week

- IOTA plans to launch the first phase of its Chrysalis update next week.

- The updated network is expected to process 1000 TPS.

- The upgrade will include many scalability improvements.

IOTA is all set to launch the first phase of its Chrysalis project, the beginning of a series of upgrades leading up to IOTA 1.5. The new upgrade includes several improvements to the network. The IOTA Foundation noted that Chrysalis will bring “significant performance, usability, and reliability upgrades,” including the capacity to process 1,000 transactions per second (TPS). It will also be able to confirm transactions in ten seconds.

The first phase of the upgrade will include multiple changes to achieve scalability improvements. This includes autopeering and Improved tip selection (URTS), which will speed up the process by which transactions are connected.

The second phase will encompass many other features such as Bitcoin-like UTXO model, atomic transactions, reusable addresses and binary transactions. IOTA is expecting these changes to improve the network’s usability rather than scalability.

While the first phase of Chrysalis will start next week, the second phase is scheduled to be completed by October 2020. Chrysalis will also make IOTA “enterprise-ready” to attract larger corporations and governments to the platform.

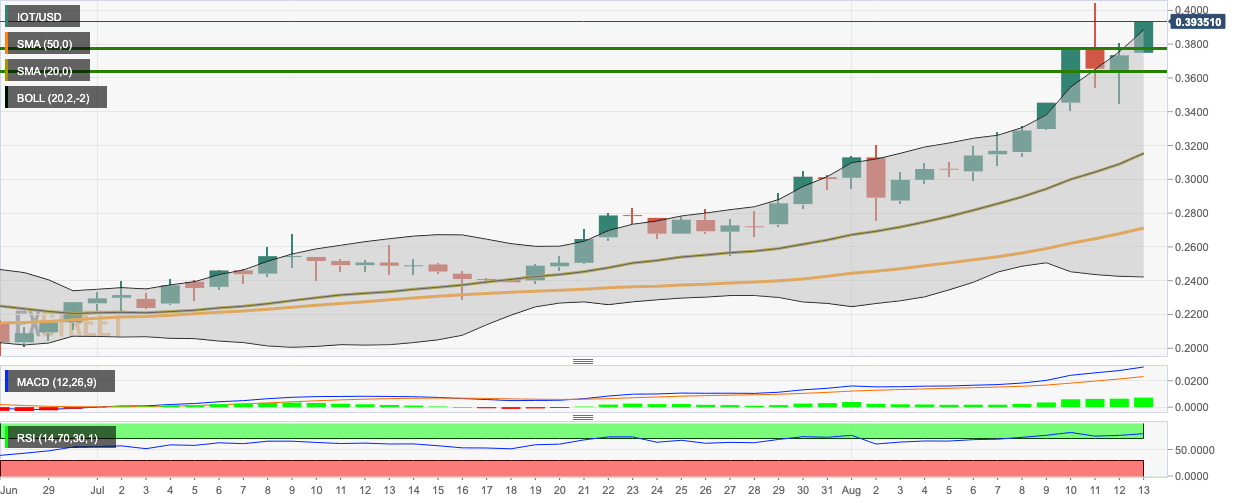

IOT/USD daily chart

IOT/USD bulls have stayed in control for two days straight. The price has gone up from $0.37487 to $0.3935 as buyers aim for the $0.40-line. The price is back trending above the 20-day Bollinger Band, while the RSI continues to hover inside the overbought zone. These two indicators show that IOT/USD is presently overvalued and may face bearish correction soon.

IOT/USD has four healthy support levels at $0.378, $0.363, $0.316 (SMA 20) and $0.272 (SMA 50). The MACD shows increasing bullish momentum.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.