Iota market overview: IOT/USD spikes up on the back of Intel endorsement

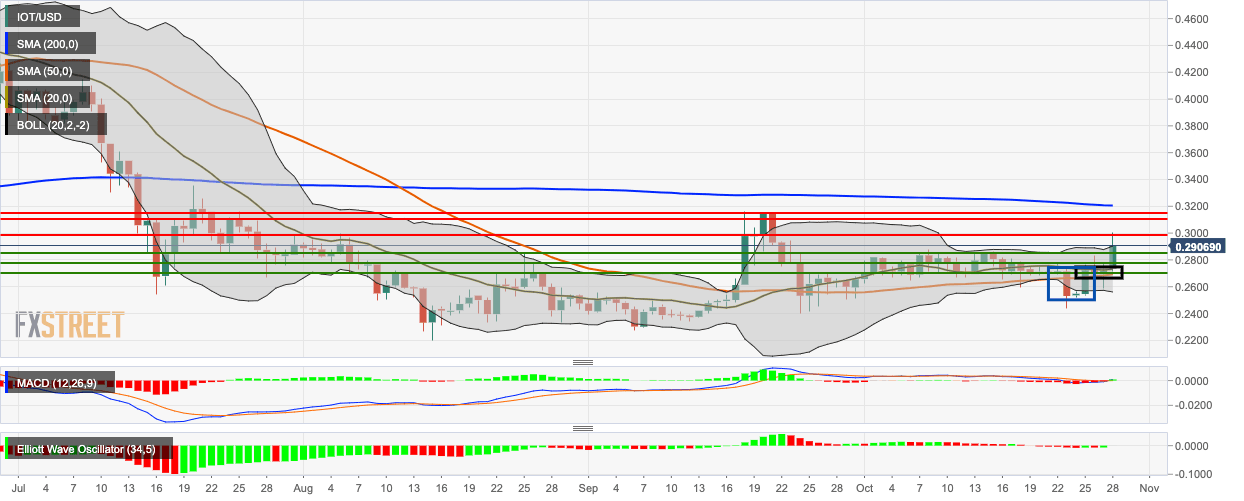

- IOT/USD went through a period of consolidation after charting a morning star pattern.

- This Monday’s session has peeked above the 20-day Bollinger band.

IOT/USD had a hugely bullish Monday on the back of Intel’s endorsement. In one of its patents for IoT, Intel gave a shoutout to Iota and Tangle. The price spiked up from $0.273 to $0.29. Looking at the daily chart, we can see that IOT/USD was going that before Monday, the price was going through a period of consolidation after charting the morning star pattern (blue box). The hourly IOT/USD chart shows us that the price had dropped to $0.271, where it found support and went up to $0.296. After reaching that level, IOT/USD trended horizontally for a bit before dropping to $0.29.

IOT/USD daily chart

Tuesday’s price action took the price above the 20-day Bollinger band and must overcome resistance at $0.30 to continue upwards momentum. The 20-day and 50-day Simple Moving Average (SMA 20 and SMA 50) curves act as immediate market support. The Moving Average Convergence/Divergence (MACD) indicates a reversal of market momentum from bearish to bullish. The Elliott Oscillator has had two green sessions out of the last three.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.