Safemoon price has weighted pressure screaming, “Sell! Sell! Sell!”

- Safemoon price volume indicator displays weighted bearish presence.

- Safemoon price has breached an ascending trend channel.

- The invalidation for the downtrend thesis will be a breach above $0.0010500.

Safemoon price has one of the more profitable trade setups for traders here analysts FXStreet. The Volume Profile hints to let go of any open positions as prices could begin to head south.

Safemoon price shows bearish signals

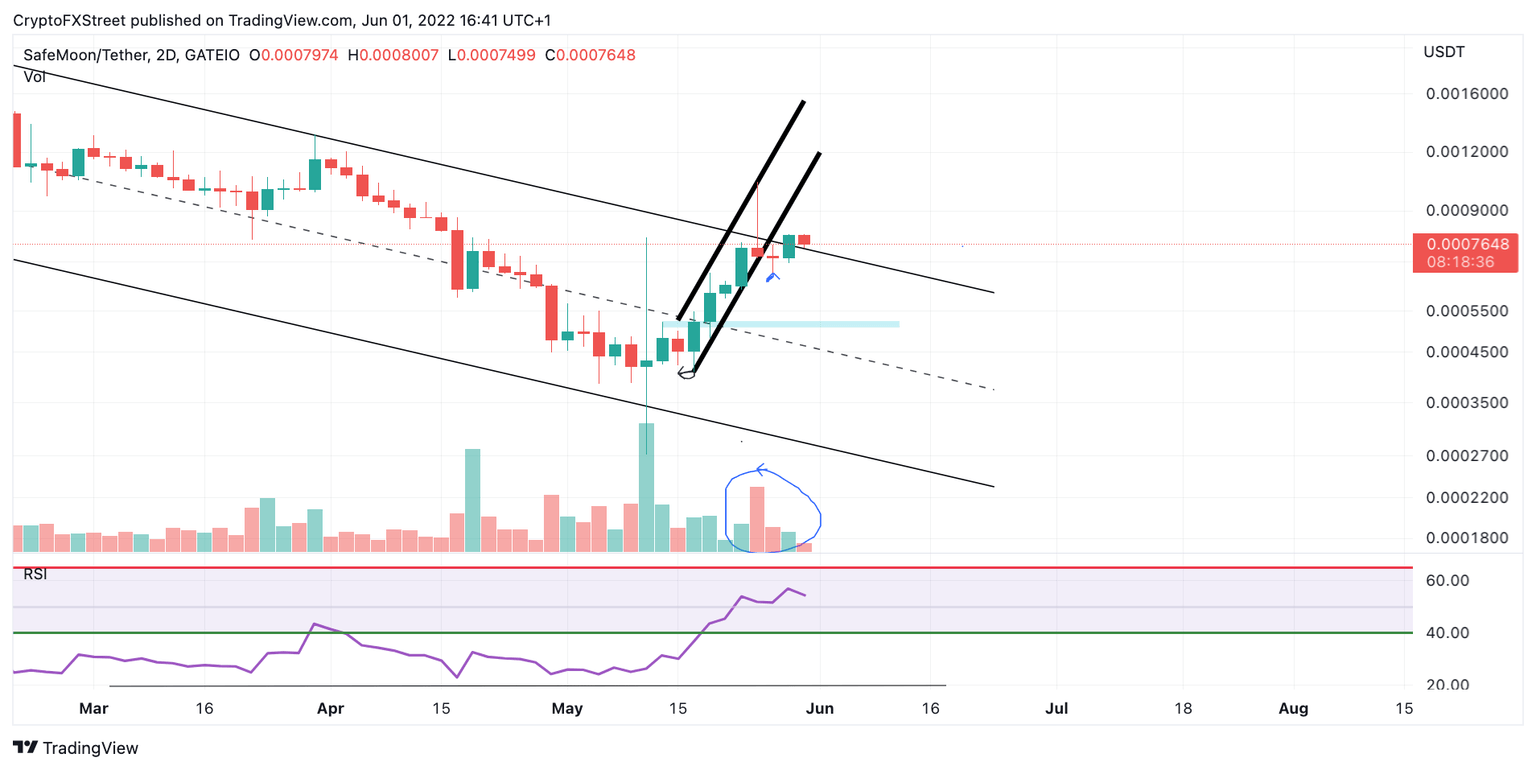

Safemoon price shows reason for traders who partook in the 80% rally in May to close their positions. Safemoon bulls have been in profit now for well over two weeks. Last week, the price displayed the first bearish signal, which was a breach of the ascending trend channel. Now the bears appear to be building their short entries, which could be early evidence of a strong decline in the near future.

Safemoon price is now trading at $0.00076. There has been a pause in the uptrend, which also breached the ascending trend channel. The volume indicator displays a significant bearish presence amidst the current consolidation. Traders in profit from last week’s outlook should see this as the strongest signal to trail stops or actualize their open positions entirely.

Safemoon/USDT 2-Day Chart

Safemoon price still has the potential to continue north. The invalidation for the downtrend thesis will be a breach above $0.0010500. If the bulls can breach this level, a rally to $0.0013500 could occur, resulting in an 80% increase from the current Safemoon price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.