Hyperliquid reaches a new high of $29 following record levels of open interest and total value locked

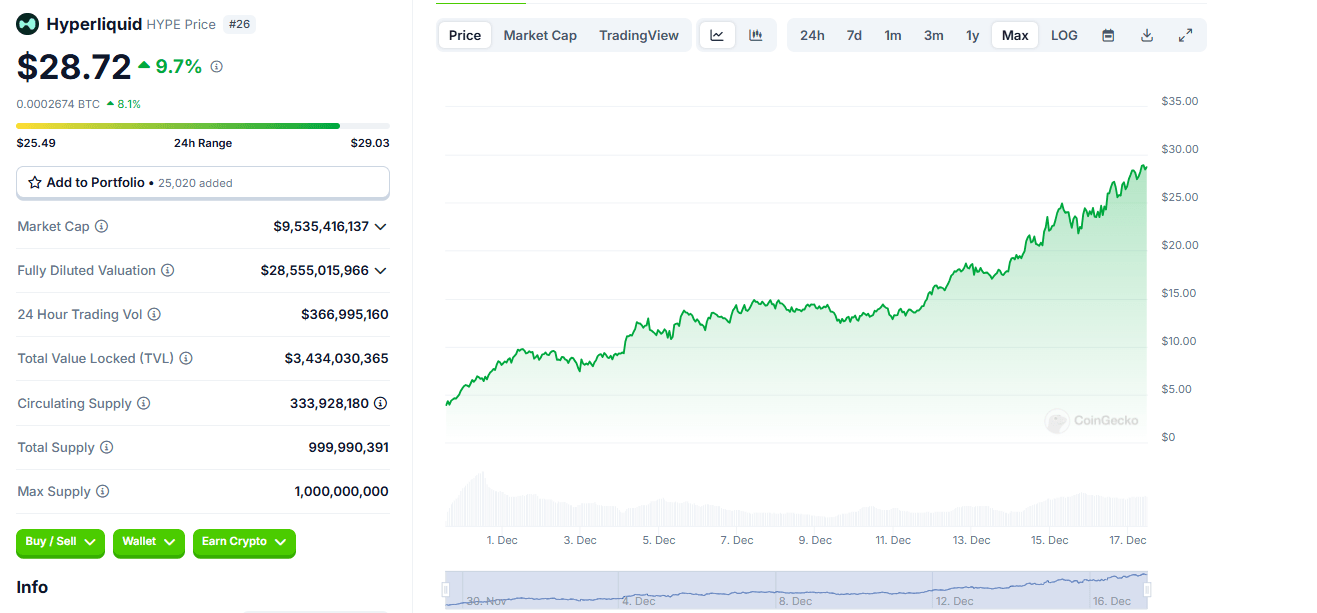

- Hyperliquid’s price reaches a new high of $29 on Tuesday after its launch on November 29.

- The rally is fueled by the record level seen on HYPE’s open interest and TVL.

- Lookonchain data shows whales are buying HYPE tokens and increasing the buying pressure.

Hyperliquid (HYPE), the decentralized perpetual trading platform and Layer 1 blockchain, reaches a new all-time high (ATH) of $29.03 on Tuesday after its recent launch on November 29. On-chain metrics supported the recent rally, as HYPE’s Open Interest (OI) and Total Value Locked (TVL) reached record levels of $4.3 billion and $3.04 billion, respectively.

Moreover, Lookonchain data shows that whales are accumulating HYPE tokens and increasing the buying pressure, hinting at further rallies ahead.

Hyperliquid reaches a new all-time high

Hyperliquid is a decentralized platform that allows users to trade perpetual derivatives by aggregating liquidity from various sources. It also allows users to trade crypto with leverage.

The genesis event of HYPE occurred on November 29, when it airdropped 31% of its native token supply to its users at a face value of $4.8 billion. Many analysts predicted that HYPE would be a failed event because of its large airdrop. However, the HYPE ecosystem appears to have reached a community of real users committed to it for the long term. This led to the recent rally, reaching a new all-time high of $29.03 on Tuesday. This surge has led HYPE market capitalization to reach $9.6 billion, surpassing another decentralized platform, Uniswap (UNI), according to CoinGecko.

Hyperliquid chart. Source: CoinGecko

Hyperliquid on-chain metrics supported this price rise and suggest a bullish outlook. Data from crypto intelligence tracker DefiLlama data shows HYPE TVL increased from $190.96 million on November 29 to $3.04 billion on Tuesday, the highest level since its launch, and stands at eighth in the list of TVL position above Sui (SUI), Avalanche (AVAX) and Aptos (APT).

This increase in TVL indicates growing activity and interest within the HYPE ecosystem. It suggests that more users deposit or utilize assets within HYPE-based protocols, adding credence to the bullish outlook.

HYPE TVL chart. Source: DefiLlama

TVL tokens position chart. Source: DefiLlama

Moreover, HYPE Open Interest (OI) reached a new ATH above $4.3 billion on Monday, indicating additional money entering the market and new buying, hinting at a potential rally ahead.

Hyperliquid reached a new all-time high in open interest of >$4.3B. pic.twitter.com/8YUwBEEWEU

— Hyperliquid (@HyperliquidX) December 16, 2024

Additionally, Lookonchain data shows that whales are accumulating HYPE tokens and increasing the buying pressure. The data shows that a whale has deposited $9.89 million USDC stablecoin to buy HYPE tokens on Monday. Since December 7, this whale has spent $17.08 million USDC to buy 1.02 million HYPE tokens worth $29.44 million. On Tuesday, two more whales added $4.8 million and $3.57 million worth of HYPE tokens.

A whale deposited another 9.89M $USDC to #Hyperliquid to buy $HYPE.

— Lookonchain (@lookonchain) December 17, 2024

Since Dec 7, this whale has spent 17.08M $USDC to buy 1.02M $HYPE($29.44M), with an unrealized profit of $12.4M.https://t.co/vOBPQJM2im pic.twitter.com/4a41II5dze

Many whales are depositing funds into #Hyperliquid to buy $HYPE and $PURR!

— Lookonchain (@lookonchain) December 17, 2024

0x0013...5D22 deposited 9.66M $USDC into #Hyperliquid, then bought 166,913 $HYPE($4.8M) and 6.48M $PURR($4.14M).

0xCA97...651E deposited 4.26M $USDC into #Hyperliquid, then bought 125,252 $HYPE($3.57M)… pic.twitter.com/u4pSbOitNA

Despite this recent price surge, rise in TVL and open interest, as well as whales accumulating HYPE tokens, traders and investors should exercise caution. The project is still in its early stages and warrants close monitoring, given that early crypto projects can sometimes be pump-and-dump schemes.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.