Here's why crypto markets will not feel the love on Valentine's day

- Crypto markets anticipate inflation numbers to come in hotter than expected on February 14.

- The seasonal adjustments and change in weights of elements in the CPI basket are likely to induce unusually high volatility.

- Combined with the spike in the jobs report seen on February 3, the 2023 bull rally is likely going to end.

Last week was relatively calm but favored the bears nonetheless. Things are going to change for Valentine’s week as investors mark their calendars with a red heart which coincides with the United States Consumer Price Index (CPI) announcement. Sadly, that will likely not be the only red we see this week, as markets, both traditional and crypto, are expecting a continuation of the downtrend.

The February US CPI announcement is critical due to a few reasons:

- Seasonal adjustment

- Reweighting elements of the CPI basket

- Strong jobs report

- SEC’s bold move in tightening the noose around US-based crypto companies

Also read: Will US CPI release whipsaw Bitcoin price to $16,500?

The known aspects of CPI

The seasonal adjustment refers to the process of removing the predictable seasonal fluctuations in exchange rates and other financial data to help make the underlying trend clearer. The US Bureau of Labor Statistics (BLS) uses seasonal adjustment to achieve a more accurate portrait of inflation levels in the United States. The adjusted data can be used to identify key trends and patterns that would be difficult to see in the raw data.

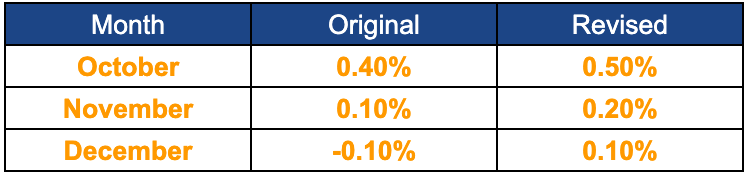

The adjusted CPI data showed the following changes.

While these adjustments happen every year, it has garnered a lot of attention due to the macroeconomic and geopolitical conditions we are experiencing. Over the course of months, inflation is likely to continue to grind lower. So investors should pay attention to the long-term effects of this adjustment and not the chaos it creates in the short term.

There is a high chance that this adjustment will print higher CPI numbers and catch many market participants off guard. Although this outcome is obvious, the short-term panic it generates could cause the stocks and cryptos to slide lower.

Coupled with the unusually high Nonfarm Payrolls number seen last week does one thing – it strengthens the downward bias.

The big unknown with inflation numbers

Another significant change is the update to the CPI basket. The new changes indicate that the CPI index for 2023 will now consider consumer spending information collected and obtained in 2021 and processed in 2022.

While we know that the CPI basket faces periodic changes, the effects of these changes are unknown.

Concluding thoughts and market reaction

US CPI is considered the most significant high-impact event in the current state of the markets. It usually triggers a massive spike in volatility. Therefore, these changes – both known and unknown – could get exaggerated and hence trigger unusually large moves in markets or could lead to a giant whipsaw.

All in all, the markets are likely to be caught off guard with a probability skewed in favor of bears due to the higher CPI print expectations and the uptick in the jobs report seen on February 3.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.