US Consumer Price Index Preview: US Dollar vulnerable to violent crash, every 0.1% in Core CPI matters

- The first US Consumer Price Index report for 2023 is set to show a minor pickup in underlying price pressures.

- Robust labor market figures and a bounce in used vehicle costs have been worrying markets.

- A minor miss would trigger a massive retreat for the US Dollar and calm Fed-fearing markets.

Clunkers are causing calamity – at least for stock markets, which have clung to Manheim's report about the costs of used vehicles to fear robust inflation figures. The United States Consumer Price Index (CPI) report has been the No. 1 market mover in 2022. The new year is no different.

Here is where we stand ahead of the US CPI release for January, scheduled for Tuesday, February 14th at 13.30 GMT, and how I expect markets to respond.

Consumer Price Index Background

The Federal Reserve (Fed) is focused on bringing inflation down, and within the components of price rises, it has been zeroing in on costs related to wages. Everything else is coming down. Headline inflation has dropped dramatically thanks to the drop in fuel prices, while supply-chain issues no longer buoy the costs of goods.

The Fed's higher interest rates are working by bringing down housing costs via elevated mortgage costs – and further declines are on the horizon. That leaves "non-shelter core services costs" – or wage-related inflation in layman's terms.

While the latest Nonfarm Payrolls (NFP) report showed an ongoing decline in the pace of annual earnings, the 4.4% level exceeded expectations. Moreover, the leap of 517,000 jobs shocked markets. Will inflation also follow?

As in previous releases, the focus is on Core CPI MoM. Economists expect a rise of 0.4% MoM in January, 0.1% above the original read of 0.3% for December, or equal to the revised version of the Consumer Price Index data.

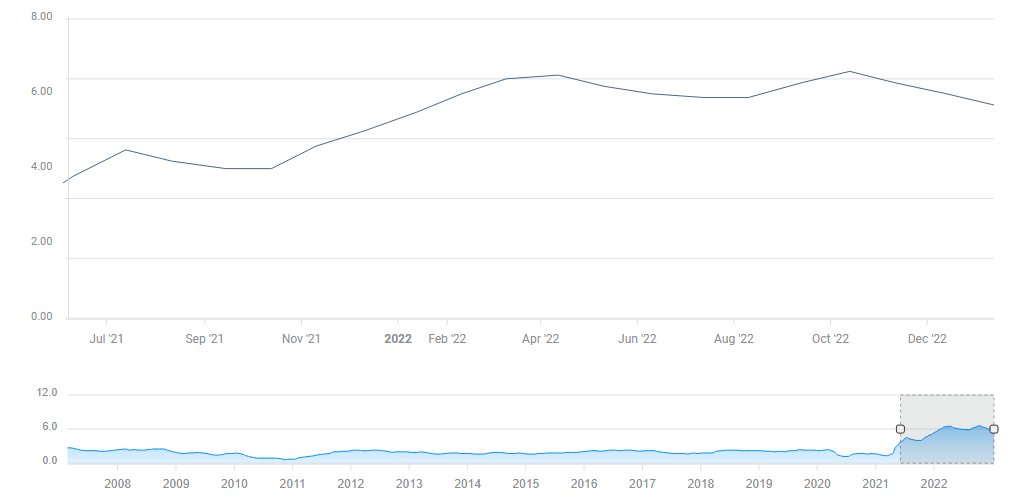

Core CPI is coming down:

Source: FXStreet

Why markets expect a higher outcome, and why another US Dollar surge is unlikely

As mentioned at the outset, market expectations may be higher due to the reported rise in prices of used cars. Cars are goods, not services, but their costs have a significant impact on overall Core CPI.

Another driver of higher prices comes from the leap in jobs reported in the NFP report – yet this argument is somewhat weakened by the moderation in wage growth.

The big-known unknown is annual revisions to the basket of goods and services the CPI comprises. Once a year, authorities update the weights of costs according to what consumers do.

If the price of lettuce jumped early in 2022 and shoppers ditched it for spinach, the latter will have more impact on overall inflation calculations than the former. The same goes for services, such as going less to the barber shop if beards go out of fashion.

According to some economists, these changes may trigger a bounce in January's Consumer Price Index report. They may or may not be correct, but the mere talk of stronger has already been pushing the US Dollar higher and stocks lower.

It also means that without a positive surprise, recent moves may come undone. I expect the Greenback to fall on an increase of 0.4% in CPI. It may also suffer an adverse "buy the rumor, sell the fact" response in response to a 0.5% read.

It would take an unequivocally strong 0.6% figure to send the US Dollar up. A downbeat 0.3% figure or below would send it .

Final thoughts

The Federal Reserve's hawkish tone in recent days has also triggered a risk-averse mood, and expectations for a calmer tone for officials could also add to a potential reversal in markets.

I would like to emphasize that the US Consumer Price Index report is the No. 1 market mover, triggering massive volatility. Will it be the kind of volatility that traders fall in love with on Valentine's Day? It could also trigger a heart-breaking whipsaw. Trade with care and low leverage.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.