Here’s what needs to happen for Fantom price to hit $1

- Fantom price shows signs of exhaustion, which is in line with the broader market conditions.

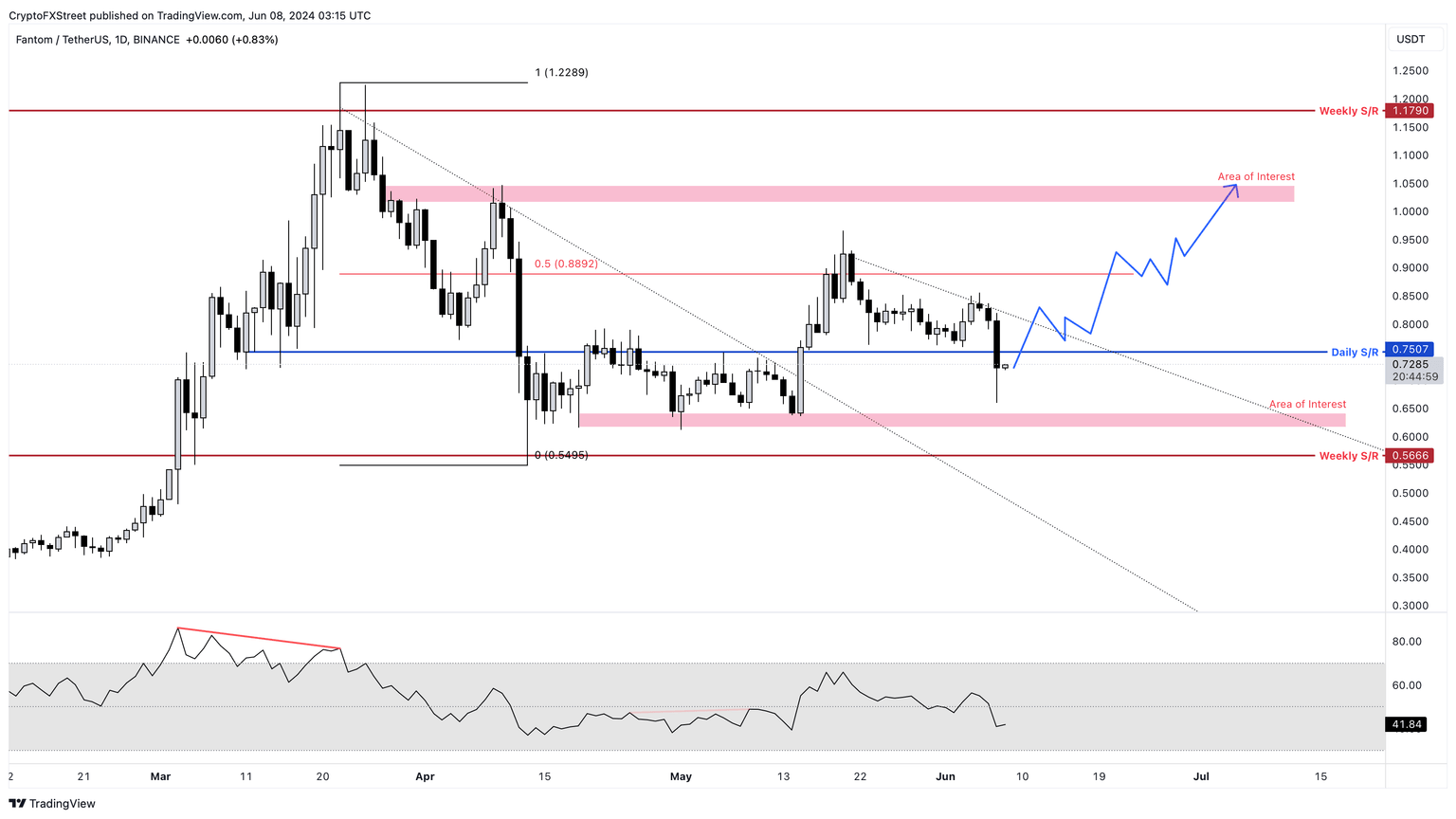

- Investors can expect FTM to revisit $1 if it can reclaim $0.75.

- A breakdown of the $0.61 support level will invalidate the bullish thesis.

Fantom (FTM) price shows signs of recovery after Friday’s sudden crash. If FTM bulls manage to overcome key hurdles, it could trigger a double-digit bounce.

Also read: GMX whales are not hiding anymore, here’s what swing traders can do next

Fantom price eyes recovery

Fantom price sell-off on Friday caused it to slip below the $0.75 daily support level and set up a swing low at $0.65. The 18% crash eventually recovered, leading to a daily candlestick close of $0.77. As long as Bitcoin (BTC) finds a stable support level and plugs the selling pressure, FTM holders can be optimistic.

Assuming there isn’t a BTC-led move to the downside, investors need to wait for Fantom price to reclaim the $0.75 barrier. A successful stabilization above this level could see FTM contest the 0.889 hurdle, which is the midpoint of the 55% crash witnessed between March 22 and April 13.

If the recovery above $0.75 is coupled with the Relative Strength Index’s (RSI) move above the 50 mean level, it would suggest a bullish momentum comeback. Such a development would further promote a move toward the area of interest, extending from $1.01 to $1.04. This uptrend would constitute a 40% gain from $0.72.

Also read: XRP sinks as Ripple moves 200 million tokens, inviting community suspicion

FTM/USDT 1-day chart

Santiment’s Supply Distribution by the balance of addresses shows the 1 million to 10 million cohorts added nearly 8 million in FTM to their wallets in less than a week. These wallets were booked profits around the local top formed on March 22 before Fantom price crashed 55%, showing they were ahead of the markets. Considering that these investors have begun accumulating again could suggest that FTM could be ready for another move to the upside.

FTM Supply Distribution

On the other hand, if Fantom price continues to slide lower, it will encounter the $0.64 to $0.61 area of interest. A decisive daily candlestick close below $0.61 will create a lower low and invalidate the bullish thesis. Such a development could further trigger an 8% crash to the next key support level of $0.56.

Read more: Dogecoin whales could end DOGE’s muted volatility

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B08.34.17%2C%252008%2520Jun%2C%25202024%5D-638534150672821975.png&w=1536&q=95)