Hedera Price Forecast: HBAR bulls aim for all-time highs

- Hedera’s price extends its gains on Friday after rallying over 38% so far this week.

- HBAR Foundation announces that Vaultik and the World Gemological Institute have partnered to tokenize $3 billion RWAs on the Hedera network.

- On-chain data also paints a bullish picture as HBAR’s Open Interest and TVL reach record levels.

Hedera’s (HBAR) price extends its gains, trading at $0.384 on Friday after rallying more than 38% this week. HBAR Foundation announces that Vaultik and the World Gemological Institute have partnered to tokenize $3 billion worth of diamonds, gemstones, watches, and jewelry as Real World Assets (RWAs) on the Hedera network. On-chain data also paints a bullish picture as HBAR’s Open Interest and Total Value Locked reach record levels, suggesting a rally continuation targeting all-time highs.

Hedera announces partnership with Vaultik and World Gemological Institute to tokenize $3 billion in diamonds and gemstones

HBAR Foundation announced on Wednesday that it has partnered with Vaultik (the cutting-edge luxury fintech platform) and the World Gemological Institute (United Kingdom’s largest and most trusted gemstone certification lab) to tokenize $3 billion worth of diamonds, gemstones, watches, and jewelry as Real World Assets (RWAs) on the Hedera network.

“Through this partnership, Vaultik and WGI are addressing some of the most pressing challenges in the luxury market, including fraud and lack of transparency, by creating immutable digital certificates,” says HBAR Foundation in its X post.

Partnerships like these are seen as strong foundations for Hedera’s future growth in the crypto space. Investors are optimistic and confident about the Hedera ecosystem, thus boosting the performance of its native token, HBAR.

We're excited to announce that @Vaultik and the World Gemological Institute (WGI) have partnered to tokenize $3 billion worth of diamonds, gemstones, watches, and jewellery as RWAs on the @Hedera network pic.twitter.com/jSxIe7Kc9W

— HBAR Foundation (@HBAR_foundation) January 15, 2025

HBAR’s strong on-chain metrics

HBAR’s on-chain metrics further support its bullish outlook. According to Coinglass’s data, the futures’ Open Interest (OI) in HBAR at exchanges rose from $290.77 million on Tuesday to $550.88 million on Friday, the highest level since its launch. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Hedera price.

HBAR Open Interest chart. Source: Coinglass

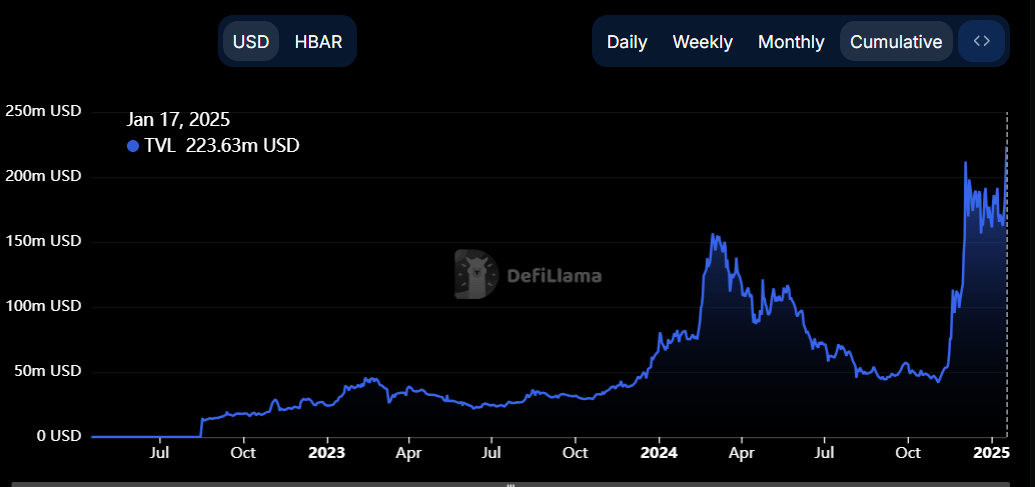

Additionally, crypto intelligence tracker DefiLlama data shows that HBAR’s Total Value Locked (TVL) increased from $162.39 million on Monday to $223.63 million on Friday, also the highest since its launch.

This increase in TVL indicates growing activity and interest within the Hedera ecosystem. It suggests that more users deposit or utilize assets within HBAR-based protocols, adding credence to the bullish outlook.

HBAR TVL chart. Source: DefiLlama

HBAR’s technical outlook remains strong

Hedera price found support around its weekly support level of $0.258 on Monday and rallied more than 30% in the next three days. At the time of writing on Friday, HBAR continues to trade higher by 6% in the day at $0.384.

If HBAR continues its upward momentum, it could extend the rally to retest its all-time high (ATH) at $0.576, seen in November 2022.

The weekly chart’s Relative Strength Index (RSI) stands at 77, trading above its overbought level of 70. Traders should be cautious because the chances of a price pullback are increasing. Still, the RSI is still pointing upwards, so there is the possibility that the rally continues and the indicator remains above the overbought level.

HBAR/USDT weekly chart

(This story was corrected on January 17 at 09:25 GMT to state the correct name of Hedera, not Hedara.)

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.