FTT plunges as FTX reaches $228 million cash settlement with Bybit

- Bybit and its associated companies will pay FTX $228 million in cash after reaching a settlement.

- The funds will aid FTX in its $16.5 billion creditors repayment.

- FTT has declined by nearly 5% since the filing surfaced online.

In a filing uploaded on Monday, the defunct exchange FTX reached a $228 million cash settlement with the Bybit crypto exchange to support its cash repayment to creditors. The settlement entails that FTX will recover $175 million in assets held in Bybit and an agreement that the latter's trading arm, Miranda, will purchase 105.4 million FTX debtor's BIT tokens for $52.7 million.

BIT tokens will allow "debtors to recover significant value for their illiquid and difficult-to-monetize holdings of a volatile asset," the filing stated.

FTT token dives 5% after Bybit-FTX settlement

The settlement comes after Judge John T. Dorsey of the U.S. Bankruptcy Court of the District of Delaware approved FTX's plans to repay creditors $16.5 billion in cash as opposed to creditors' plea to get paid their total crypto assets balance before the exchange crashed.

However, Judge Dorsey ruled on October 7 that FTX should repay creditors 118% of their asset value as of the November 2022 filing, according to a court filing. This is far less than the potential gains creditors would have seen in the past two years on their assets since repayment filing two years ago.

It's yet to be seen how the $16.5 billion creditors' repayment will impact digital asset prices, with some crypto community members suggesting that the cash will flow back into the crypto market.

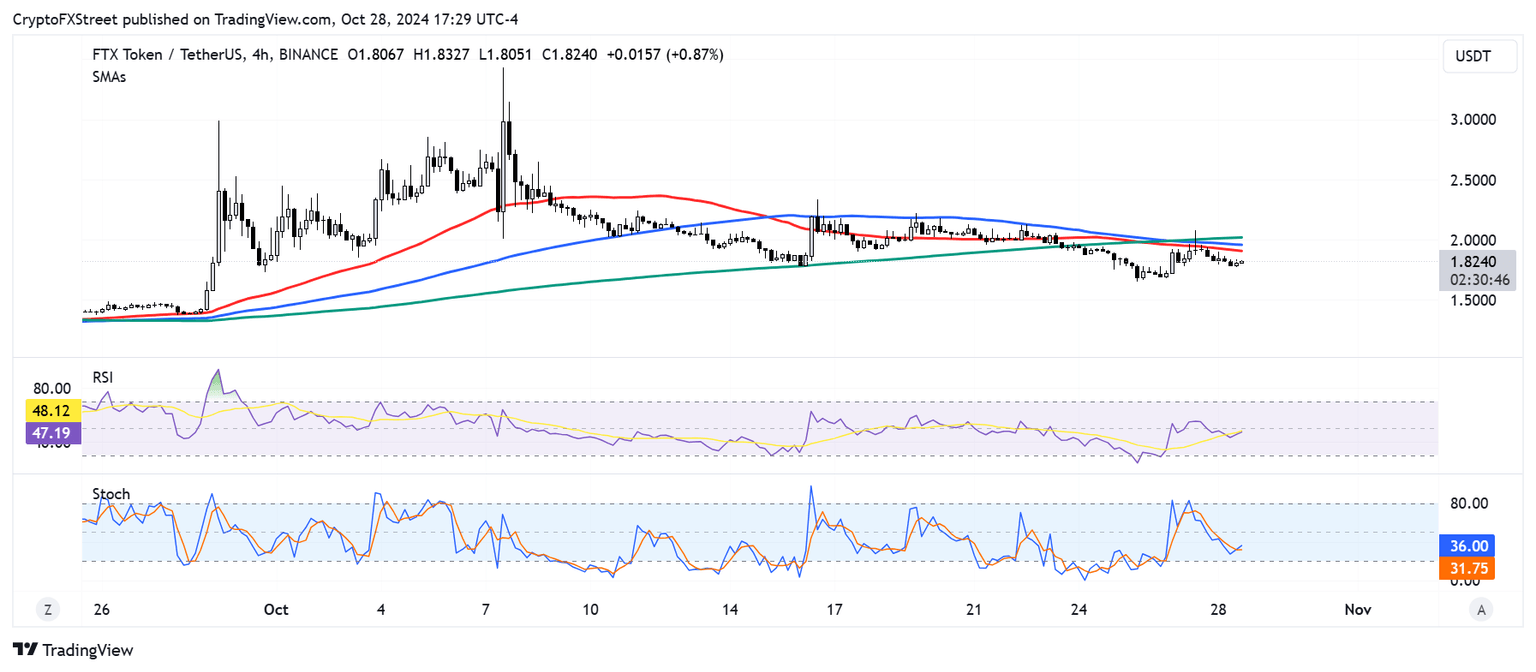

Following news of the cash settlement with Bybit, FTX's FTT token plunged by nearly 5% in the past 24 hours. FTT has been on a decline since October 8 after seeing a spike when the court initially approved its plans to repay creditors.

FTT/USDT 4-hour chart

The token saw a rejection near the convergence of its 200-day, 100-day and 50-day Simple Moving Averages (SMA) over the weekend. FTT could continue its horizontal move until another key event unfolds in FTX's plans to repay creditors.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi