FLOKI holders to receive Simon’s Cat (CAT) airdrop on Binance, rallies nearly 7%

- FLOKI announces Binance support for Simon’s Cat (CAT) airdrop for the meme coin’s holders on the exchange.

- The exchange will take a snapshot on August 29 at 23:59:59 UTC and conduct an airdrop based on that, per an official announcement.

- FLOKI rallies nearly 7% on the day, trades at $0.00012729.

FLOKI is the sixth largest meme coin by market capitalization, and the meme token rallied in double-digits on Tuesday. Binance announced the Simon’s Cat (CAT) token airdrop for FLOKI holders on its exchange platform, and traders are racing to buy FLOKI ahead of August 29.

FLOKI holders bag CAT airdrop on Binance

Binance, one of the largest cryptocurrency exchanges by volume, announced its support for the Simon’s Cat token airdrop to FLOKI holders. The exchange will take a snapshot on August 29, 2024 at 23:59:59 UTC per an official announcement. The exchange will disclose final details like tokens dropped to FLOKI holders and additional criteria at the time of the snapshot.

Binance Will Support the Simon’s Cat ( $CAT ) Airdrop to $FLOKI Holders

— FLOKI (@RealFlokiInu) August 20, 2024

Binance, the world’s largest cryptocurrency exchange, will support the Simon’s Cat / $CAT airdrop to $FLOKI holders on its platform.

You can read the full details of the announcement here:… pic.twitter.com/23tqY1br92

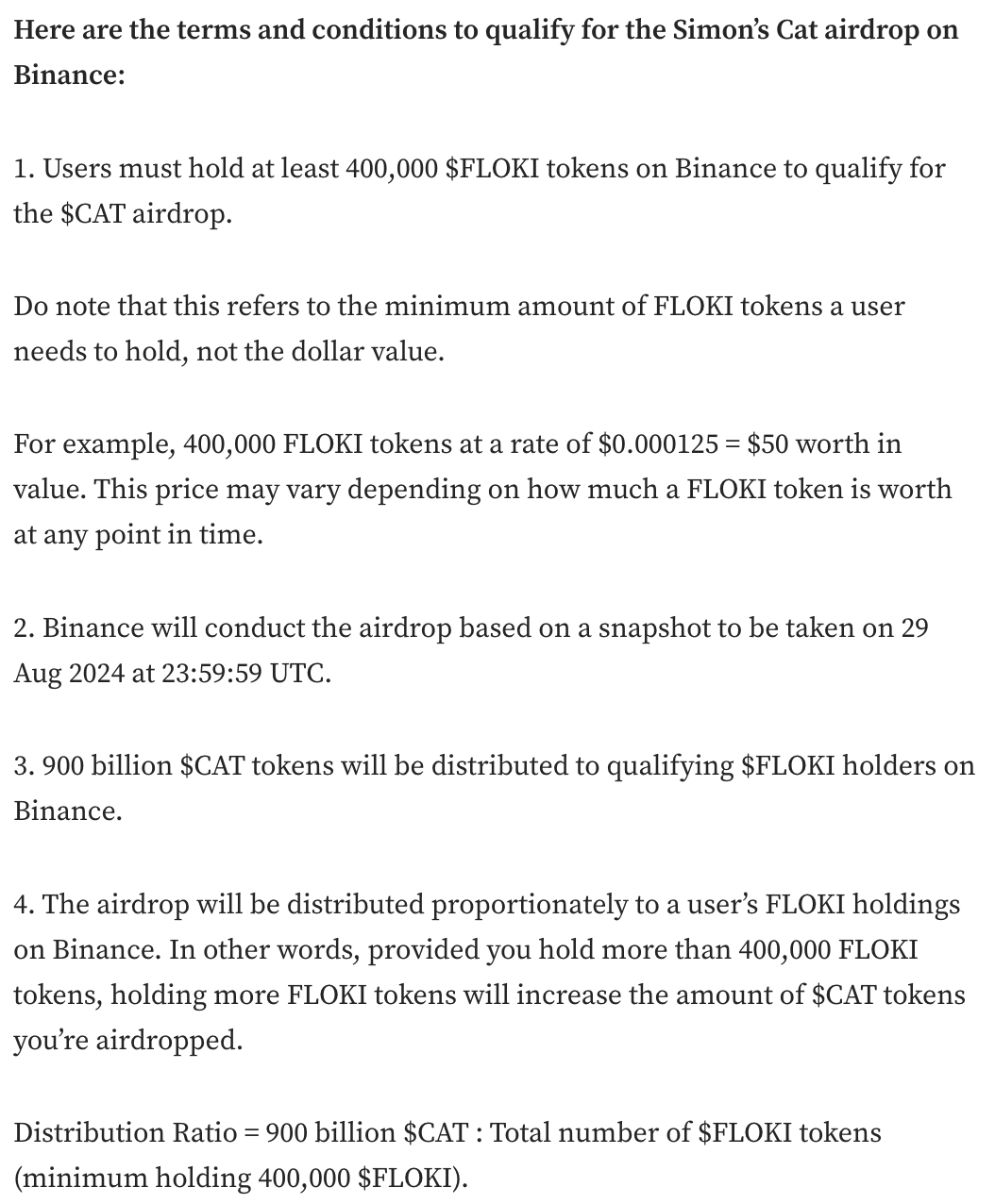

In a blog post, FLOKI team shared requirements, such as holding at least 400,000 FLOKI on Binance, irrespective of the US Dollar value. All FLOKI holders that qualify will receive a part of the 900 billion CAT token airdrop. It will be distributed proportionately to user’s in the ratio of 1 CAT for 1 FLOKI token.

FLOKI airdrop criteria

FLOKI rallies 7%

FLOKI trades at $0.00012373 at the time of writing. The sixth largest meme coin could extend gains by another 13.3% and rally to the upper boundary of the Fair Value Gap (FVG) between $0.00014039 and $0.00013453.

The Relative Strength Index (RSI) reads 43.49 and is climbing toward neutral at 50.

FLOKI/USDT daily chart

FLOKI could find support at the August 5 low of $0.00009585 in the event of a correction in the meme coin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.