Bitcoin increased to nearly $45,000 and major altcoins rose as well after the world's 11th-largest economy announced it would regulate instead of ban cryptocurrencies.

Good morning. Here’s what’s happening:

Market moves: Bitcoin steadied above $44,000, and the broader crypto market ended in higher.

Technician's take: BTC buyers have defended intraday support levels, although upside appears limited.

Prices

Bitcoin (BTC): $44,475 +0.6%

Ether (ETH): $3,241 +3.4%

Top Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Ethereum Classic | ETC | +8.5% | Smart Contract Platform |

| XRP | XRP | +6.3% | Currency |

| Polygon | MATIC | +5.2% | Smart Contract Platform |

Top Losers

There are no losers in CoinDesk 20 today.

Markets

S&P 500: 4,587 +1.4%

DJIA: 35,768 +0.8%

Nasdaq: 14,490 +2%

Gold: $1,833 +1.3%

Market moves

Bitcoin (BTC) traded steadily above $44,000, following news that the Russian government decided to regulate cryptocurrencies instead of ban them.

At the time of publication, the oldest cryptocurrency is changing hands above $44,475, up less than a percentage point over the past 24 hours, according to CoinDesk data. Meanwhile, ether, the second-biggest cryptocurrency by market capitalization, was trading at above $3,241, a 3.4% increase over the same time period.

One analyst said bitcoin’s gains came after the Russian government released a document on its official website late Tuesday setting principles for crypto regulation.

“What makes this decision all the more important is that the central bank also is on board,” Edward Moya, senior market analyst at OANDA the Americas, wrote in his newsletter. “Russia appears poised to recognize cryptocurrencies as a form of currency. Anytime a major [b]itcoin country embraces cryptos, that is great news for the cryptoverse.”

As CoinDesk reported, the Russian government’s plan received support from its central bank, which had earlier called for a ban on crypto mining and trading. The development also came not long after India took a step toward crypto legalization with a tax on digital asset transfers.

Following bitcoin, most cryptocurrencies tracked by CoinDesk also ended in the green on Wednesday.

Moya added that as bitcoin’s price has steadied, many retail traders have started feeling more comfortable investing in alternative cryptocurrencies (altcoins).

Moya said the market will need “a major catalyst” or fresh new capital to send the No. 1 cryptocurrency by market capitalization above $50,000.

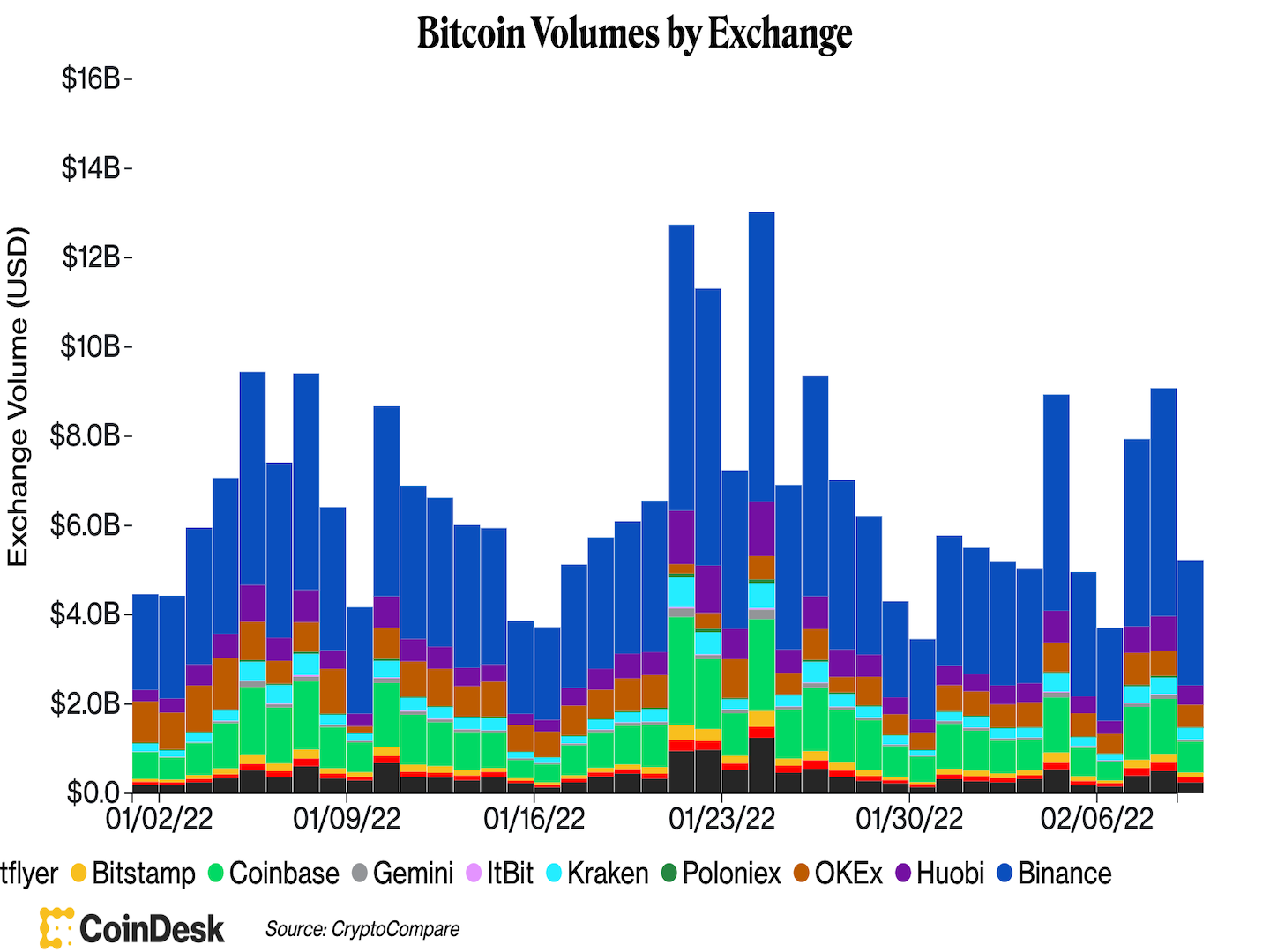

Data complied by CoinDesk shows that bitcoin's trading volume across centralized exchanges on Wednesday was down from a day ago.

(CoinDesk/CryptoCompare)

Technician's take

Bitcoin daily price chart shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is recovering from a slight pullback on Wednesday as buyers maintain intraday support levels. The cryptocurrency was trading around $44,500 at press time and could face resistance at $46,800.

BTC is up 3% over the past 24 hours and, on average, spot trading volume is starting to rise, albeit still below January highs, according to CoinDesk data.

For now, technical indicators are improving and do not signal extreme overbought conditions. That could keep buyers active into the Asian trading day so long as immediate support at $42,000 holds.

The downward-sloping 50-day moving average, currently at $42,689, is gradually turning upward, which could indicate a bullish shift. Still, upside appears limited given negative momentum on longer-term charts.

Important events

8 a.m. HKT/SGT (12 a.m. UTC): Australia consumer inflation expectations (Feb.)

China M2 money supply (Jan. YoY)

China new loans (Jan.)

5 p.m. HKT/SGT (9 a.m. UTC): European Commission releases its economic growth forecasts

9:30 p.m. HKT/SGT (1:30 UTC): U.S. consumer price index (Jan. MoM/YoY)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?