First Mover Asia: Bitcoin falls below $49k as trading volume weakens, altcoins see red

Bitcoin’s drop-off coincides with a strengthening U.S. dollar; ether declines.

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin fell as U.S. stocks sagged and the U.S. dollar strengthened.

Technician’s take: Buying activity remains weak, which reduces the chance of a significant price rise into January.

Prices

Bitcoin (BTC): $48,123 -4.7%

Ether (ETH): $4,183 -5.3%

Markets

S&P 500: $4,667 -0.7%

Dow Jones Industrial Average: $35,754 -0.0001%

Nasdaq: $15,517 -1.7%

Gold: $1,775 -0.4%

Market moves

Bitcoin fell toward $48,000 on Thursday, sliding nearly 5% after hovering over $50,000 for much of the previous two days.

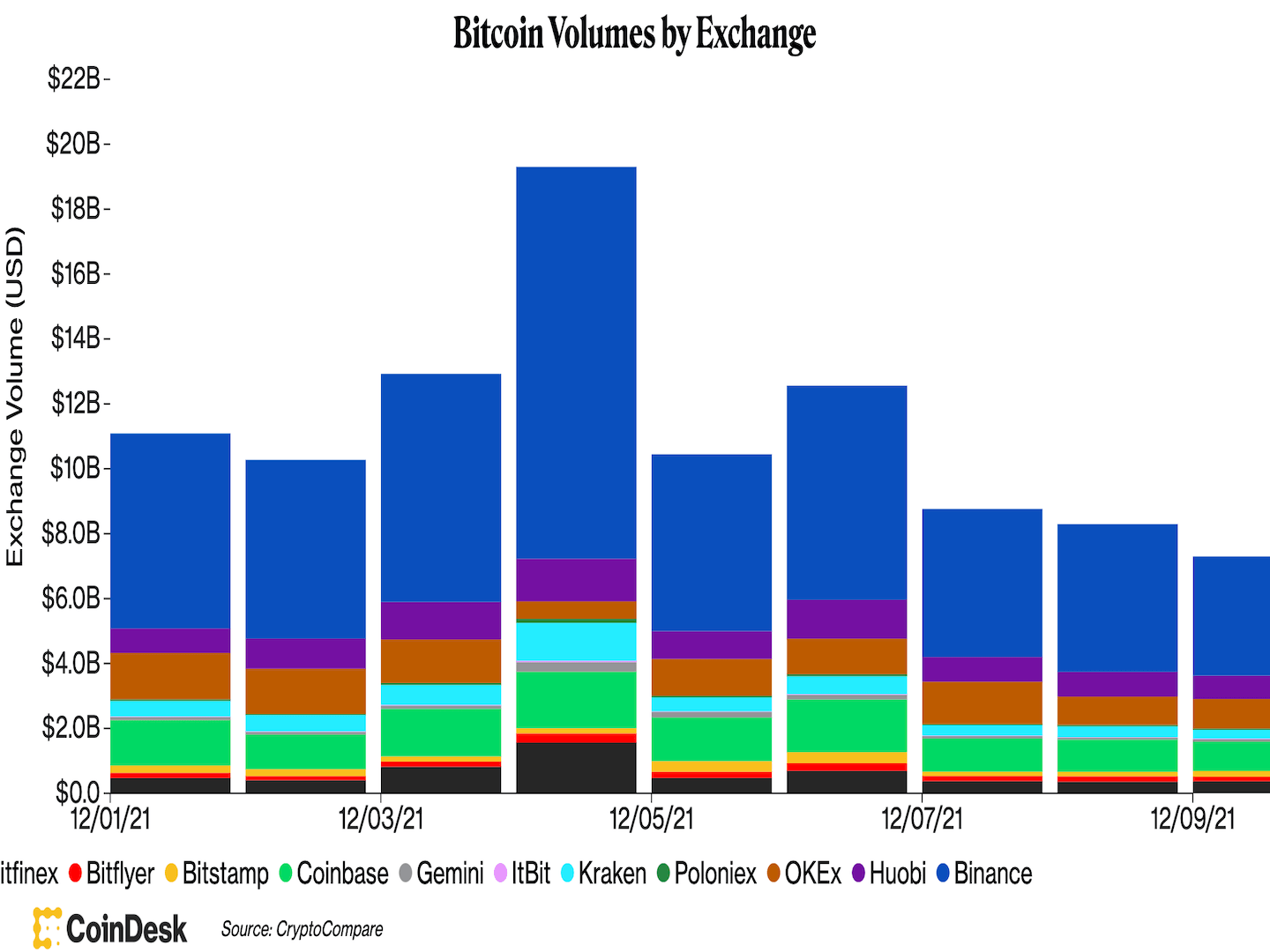

Trading volume of the No.1 cryptocurrency by market capitalization across major centralized exchanges, however, continued to drop.

Credit: CoinDesk/CryptoCompare

The majority of the crypto market was also in red: Ether was down by more than 5% to around $4,000. The bearish market performance occurred as U.S. stocks fell and the dollar index (DXY), which tracks the greenback’s value against major fiat currencies, rose by 0.28%.

As CoinDesk reported, a strengthened U.S. dollar brings downside pressure on bitcoin’s prices.

“The long-term bull case remains for bitcoin, but everything in the short-term seems bearish,” Edward Moya, senior market analyst at Oanda, said in an email. “Bitcoin will need to overcome growing expectations for a stronger dollar, an extended altcoin season and short-term bearishness for risk assets as Omicron derails reopening momentum.”

Technician’s take

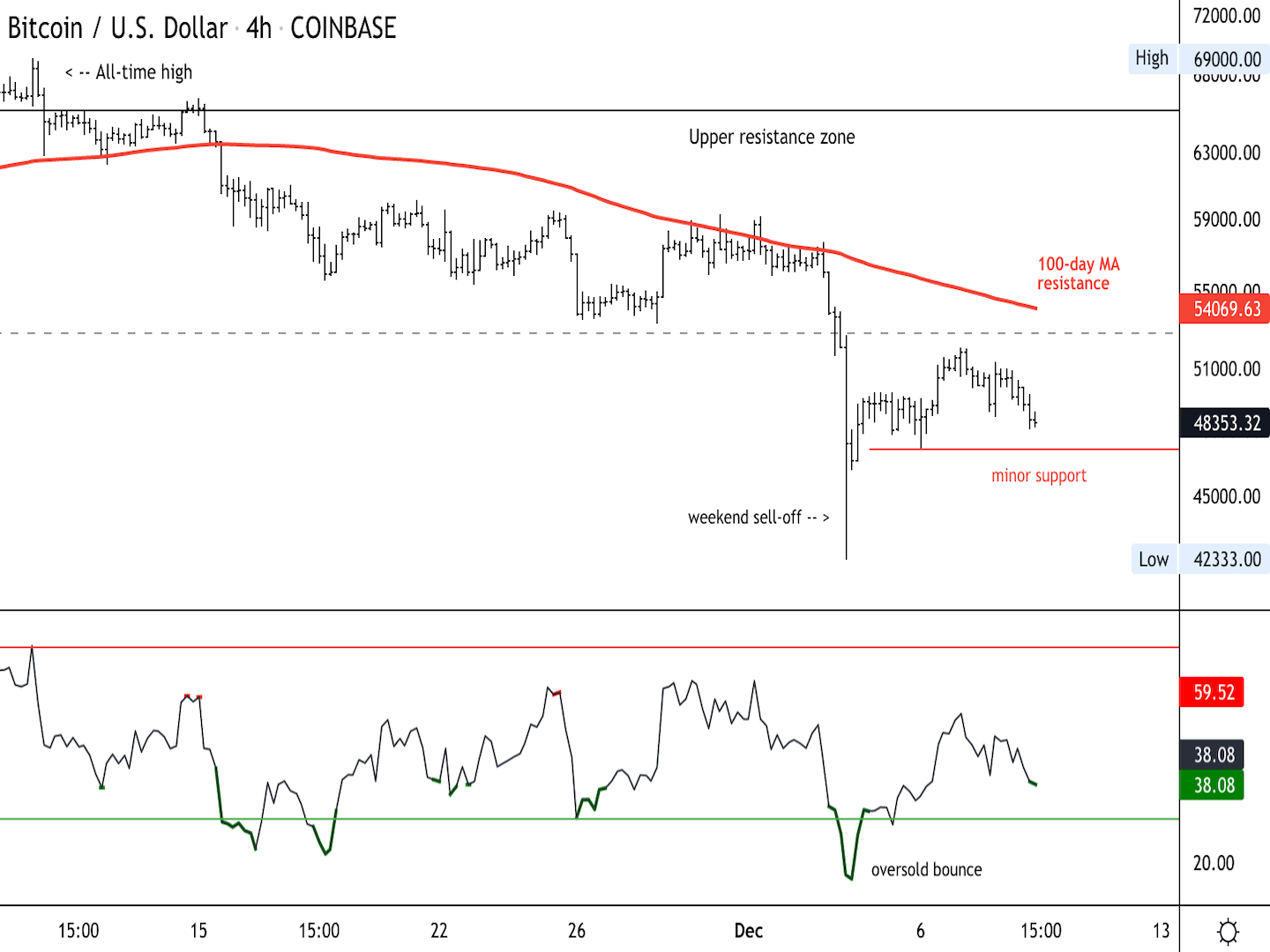

Bitcoin's four-hour price chart shows support/resistance levels with RSI in second panel (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continued to struggle below the $50,000 resistance level.

The short-term downtrend over the past month remains in effect, which could limit further upside beyond $50,000-$60,000.

The cryptocurrency is down about 4% over the past 24 hours, although support around the 200-day moving average (currently at $46,500) could stabilize the current pullback.

BTC buying activity remains weak despite several oversold signals on the charts. That reduces the chance of a significant price increase heading into January, especially given the loss of upside momentum on the weekly and monthly charts.

Important events

3 p.m. HKT/SGT (7 a.m. UTC): U.K. trade balance (Oct.)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. industrial production (Oct. YoY/MoM)

3 p.m. HKT/SGT (7 a.m. UTC): Germany consumer price index (Nov. YoY/MoM)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. consumer price index (Nov. YoY/MoM)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.