Federal Reserve pauses interest rate hikes for second time in a row, Bitcoin price still tethered to $34,600

- The Federal Open Market Committee (FOMC) meeting took place on November 1, recording no change in interest rates.

- Per the announcement, the Federal Reserve paused rates for the second time in a row, holding steady at 5.25% - 5.50%.

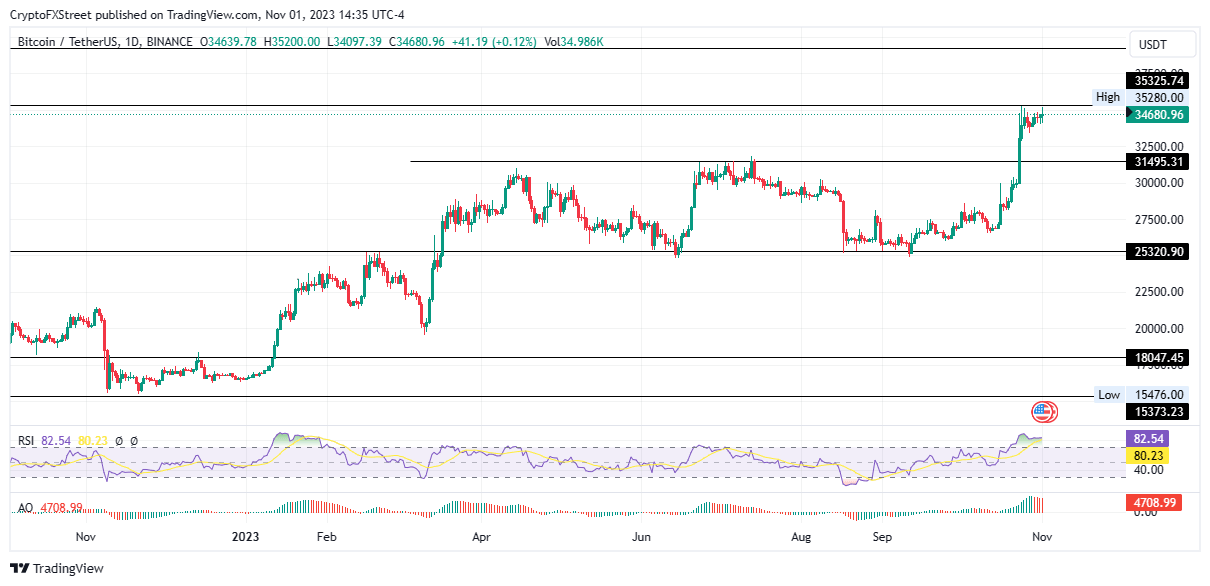

- Bitcoin price remains unphased, still capped under the $35,000 psychological level to trade at $34,600 at the time of writing.

The Federal Reserve (Fed) has decided to pause interest rate hikes for October, the second time in a row, meeting the expectations of many at 5.25% - 5.50%. The development is a paradigm shift, relative to the past year, when the central bank aggressively tightened monetary policy in a bid to fight inflation.

Also Read: US Fed interest rate preview: Two scenarios for Bitcoin and Ethereum prices

Federal Reserve pauses interest rate hikes

Similar to what happened at the September meeting, the Federal Reserve paused interest rate hikes at its November 1 meeting. It comes after a careful endeavor to calm the rather turbulent US economy, with the Fed also trying to keep a recession at bay. The bank began tightening monetary policy by raising rates in mid-2022 at a staggering pace following the worst inflation seen since the 1980s.

In the past few meetings, the tightening campaign has eased. Wednesday's decision was the third pause in 2023. Notably, prior to the June pause, rates had increased for 10 consecutive meetings.

Cognizant that tightening policy exerts downward pressure on economic activity, Powell has also set the tone for what could come next regarding monetary policy, saying:

"Everything we do is in service to our public mission to achieve maximum employment and price stability goals….the committee will always do what it thinks is right."

No decisions have been made about future meetings as the Fed is not confident the threshold is met. With this Powell asserts his commitment to a case-by-case basis ahead of the December meeting. The labor market cooling off and broader market financial conditions will play a role in the committee's decision moving forward.

The Fed is watching banking stress. They have been working with institutions so they have a plan for their unrealized losses. They don’t feel that rate hikes are worsening the picture for banks at present. When asked about bond yields and their effect on monetary policy he stated that higher bond yields need to be persistent to have an effect on monetary policy stance. They cannot be as a result of market expectations of Fed interest rate decisions.

The current rise in yields, if sustained, is going to have a negative impulse on economic activity. However, Powell was not comfortable estimating the equivalent rate hike effect that recent rises in bond yields will have.

Nevertheless, the 2% target inflation continues to hold for the Fed, with the previous pause hinting at a strengthening market and economic growth beyond expectation. Still, the pace of inflation is outpacing the Fed’s target with the 3.4% Core PCE reading in September suggesting a slow improvement.

Bitcoin price still tethered to $34,600

Bitcoin price did not respond significantly to the Fed decision, considering the announcement was expected and already priced in.

BTC/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.