Fed Chair Powell says interest rates may not rise too much; Bitcoin price whiplashes around $27,000

- Bitcoin price initially reacted positively to Federal Reserve chair Jerome Powell's speech, rising to $27,140, before coming back down to $26,800.

- Powell stated that inflation is far above Fed's objective, but the central bank remains committed to returning to the 2% target.

- Concerns surrounding the US government defaulting on its debt are high, but interest rates are expected to refrain from rising by 25 bps.

The Federal Reserve chair Jerome Powell during his speech at the "Perspectives on Monetary Policy" panel before the Thomas Laubach Research Conference on May 19, shared his opinion on what is expected from the Fed going forward.

Opening with inflation, Powell noted that the current inflation is far above the objective set by the Federal Reserve of 2%. He stated that inflation poses significant hardship, particularly to those at the margins of society, and the central bank remains "strongly committed" to returning to this goal from the present 4.93%.

Adding to the same, Powell said,

"Price stability is the foundation of a strong economy; responsibility of central bank to maintain it."

Powell, during the speech, also noted that the interest rate may not need to rise as high. The Fed chair stated that tighter financial conditions mean "our policy rate may not need to rise as much as it would have otherwise to achieve our goals."

Concerns surrounding the next meeting are high as the market is expecting the Federal Reserve to refrain from hiking interest rates.

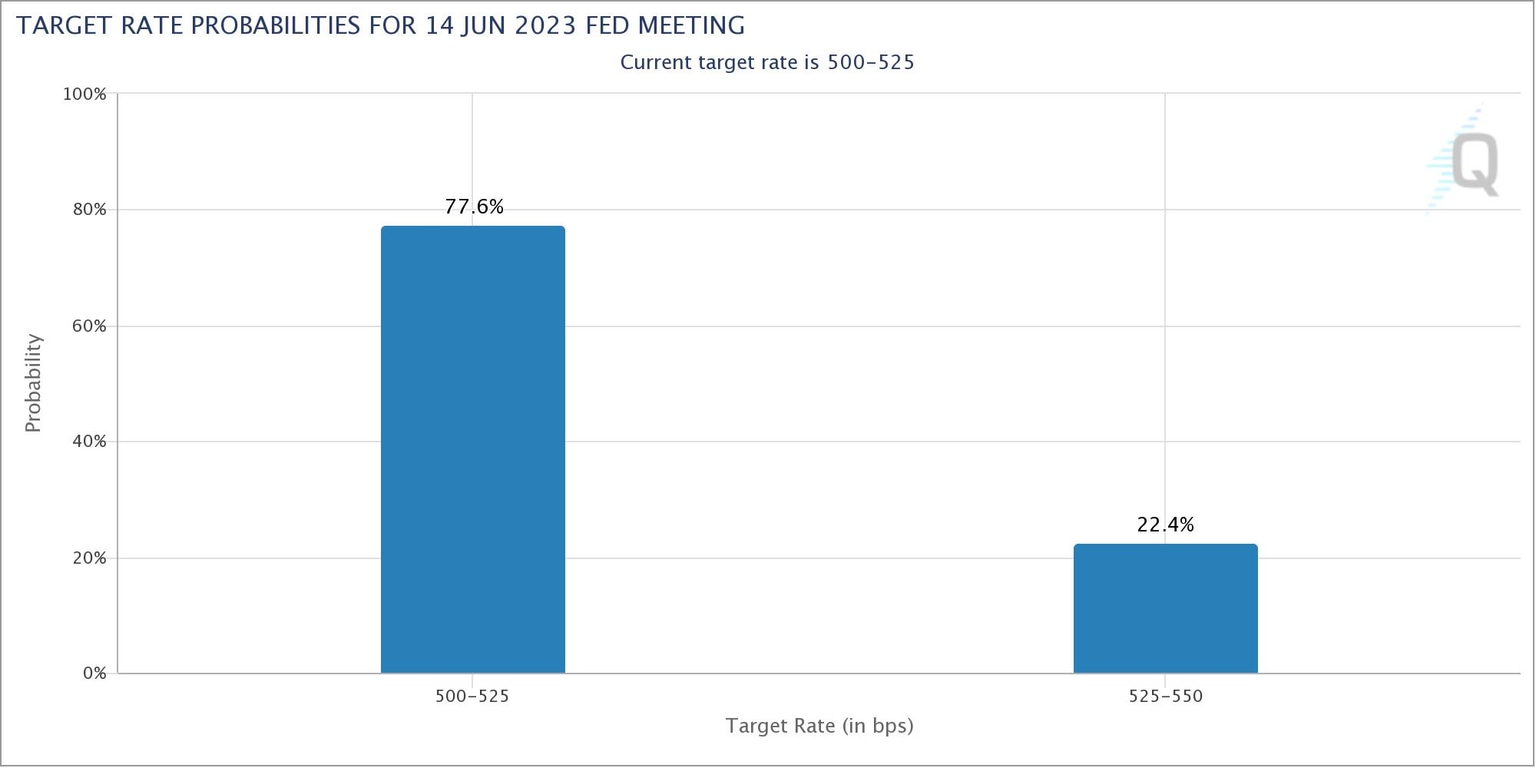

According to the FedWatch tool, the probability of the Fed sticking with the current Fed Funds target of 5% - 5.25% is 77.6%, though down from last week's 84.5%. The probability of a 25 basis points (bps) hike is still at a low of 22.4%.

Interest rate hike probability

The biggest threat to stable interest rates is the debt ceiling. While US President Joe Biden stated last week that he is sure the country will avoid an unprecedented and potentially catastrophic debt default, fear remains static.

This is because the US government's debt defaults could send interest rates skyrocketing, severely impacting the country's economy.

This rise in interest rate could also impact the crypto market negatively since borrowing becoming more expensive could lead to a decline in investments in riskier assets.

Bitcoin price shows mixed reactions

The immediate reaction of the biggest cryptocurrency in the world to Federal Reserve Chair Jerome Powell's speech was mostly bullish as Bitcoin price shot up to over $27,200. However, at the time of writing, BTC is maintaining its presence above the 100-day Exponential Moving Average (EMA), trading at $26,873.

BTC/USD 1-day chart

Following a 2% decline on May 18, Bitcoin price slid below $27,000, which has been acting as a crucial technical and psychological support level since mid-March. Keeping above this level is important for BTC in order to rise back above $28,000 and flip the 50-day EMA line into a support level.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.