Ethereum’s next hard fork could make lost private keys a thing of the past

Ethereum users may no longer need to worry about losing their seed phrases ever again after the Pectra hard fork — thanks to a new “social recovery” feature part of the planned Ethereum Improvement Proposal (EIP) 3074 upgrade.

EIP-3074 was confirmed as a new addition to the Pectra hard fork by Ethereum core developer Tim Beiko in an April 11 X post.

The upgrade will see a “supercharging” of ordinary Ethereum wallets (externally owned accounts) with several new smart contracts capabilities, including the ability to recover assets, Ethereum Foundation researcher “Domothy” explained in a March 25 blog post.

However, to leverage the social recovery tool, users must first have transferred ownership of their assets to an invoker contract via a digital signature, which will perform future transactions and function calls on the user’s behalf.

While ownership is delegated, the message in the digital signature will enable the user to retrieve their assets if they lose or forget their seed phrase.

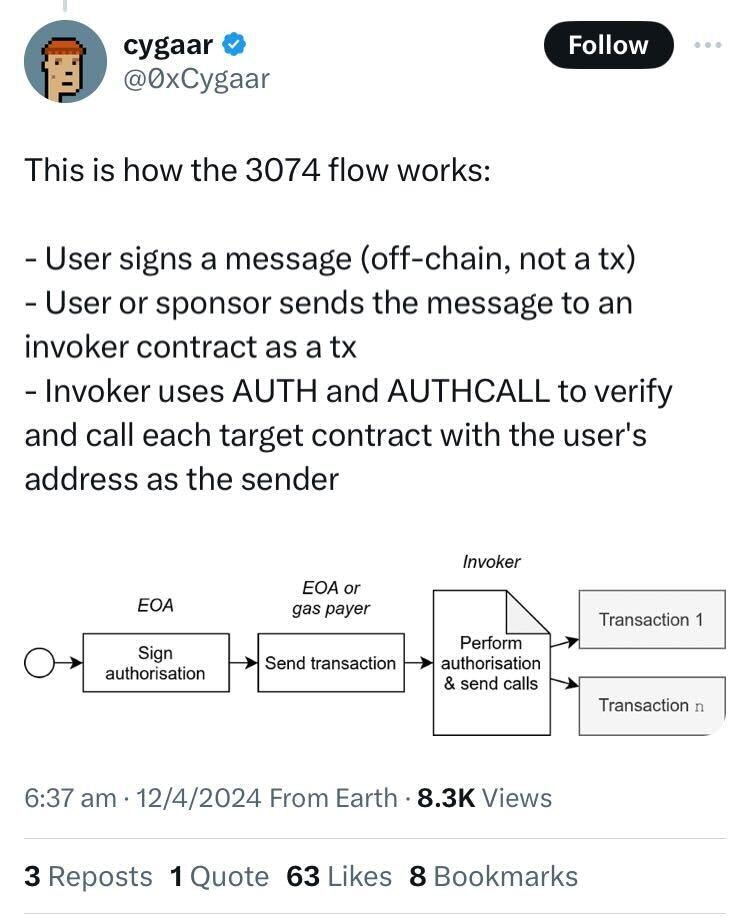

The feature will be made possible by the implementation of the “AUTH” and “AUTHCALL” opcodes, cryptocurrency commentator Cygaar explained in an April 11 X post.

AUTH will take a user’s signature and intended action and verify it was signed properly. AUTHCALL will then call the target contract to carry out the transaction but will assign the user as the caller instead of the invoker contract.

Source: Cygaar

Domothy, however, shared concerns that funds could be drained if users delegate their assets to a malicious invoker contract, though he also expects a few formally verified and fully audited invoker contracts to become available after the Pectra upgrade.

It has been estimated that billions of dollars worth of cryptocurrency have been lost over the years due to users forgetting or losing their private keys.

Meanwhile, another key advantage of EIP-3074 is that users won’t need any Ether (ETH $3,533) in their wallet to send transactions, as the entity behind the invoker contract can pay for that upfront.

“This could be huge for gaining mass retail adoption,” Cygaar noted.

It will also enable multiple actions to be taken in one transaction.

Right now in order to swap tokens on Uniswap, you have to first approve Uniswap to use your tokens, and then run the actual swap. Not great.

“[But] with 3074, these two actions can be batched into a single tx,” Cygaar added.

The Pectra hard fork is reportedly expected to occur in late 2024 or early 2025.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.