Ethereum whales go into buying spree in anticipation of new all-time highs

- ETH moves above $750 for the first in over two years.

- Whales are accumulating ETH tokens ahead of the further price increase.

Ethereum (ETH) hit a new high of 2020 at $759 during early Asian hours. At the time of writing, the second-largest digital asset is changing hands at $751, having gained over 30% in the past seven days. ETH has been gaining ground since the beginning of December amid positive fundamentals and the growing interest from institutional investors.

ETH whales push the market to new highs

According to the data provided by the behavioral analytical company Santiment, the number of Ethereum addresses holding over 10,000 ETH increased by 39 in just two months, while the number of smaller addresses having from 1-10,000 ETH decreased over the same timeframe.

With $ETH crossing $750 for the first time in 31 months, we've discovered that there are 39 more #Ethereum addresses holding 10,000+ $ETH compared to just 2 months ago. Meanwhile, the amount of addresses holding 1-10,000 $ETH have shrunk over this time. https://t.co/H2bp5UHRaV pic.twitter.com/Tr7wiYsUO7

— Santiment (@santimentfeed) December 31, 2020

The increased number of large accounts usually is a precursor of massive price growth as the sudden spike in buying pressure can translate into millions of dollars.

Meanwhile, the Santiment analysts noted that the decrease of smaller accounts numbers might be related to the DeFi industry developments.

This massive drop from two weeks ago from this group surprised us, too. It could very well have been a #defi-related anomaly, considering just how big the dropoff was.

— Santiment (@santimentfeed) December 31, 2020

ETH bulls target at $800

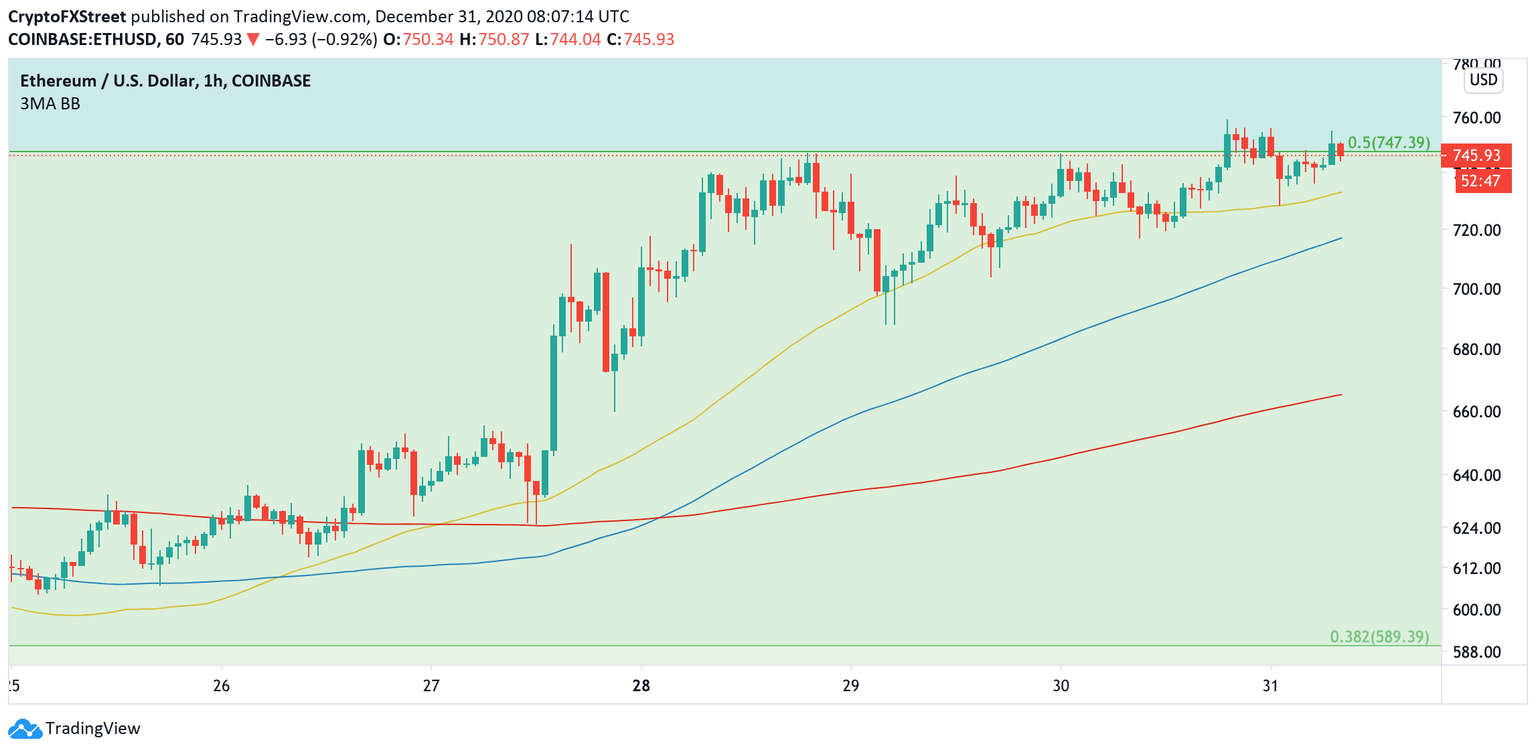

From the technical point of view, a sustainable move above $750 bodes well for ETH bulls. This resistance area is reinforced by a 0.5 Fibo retracement level for the downside move from January 201 high to December 2018 low. It served as a strong barrier for the price since December 28.

On the intraday charts, the local support is created by 1-hour EMA50 at $733. This level shall provide a short-term backstop for the price; however, if it is broken, the sell-off may be extended towards $700. A sustainable move below this level will bring more sellers to the market and bring $665 into focus (1-hour EMA200).

ETH, 1-hour chart

On the upside, if the move above $750 is sustained, the upside momentum will start gaining traction, taking the price to $800.

Author

Tanya Abrosimova

Independent Analyst