Ethereum tokens flood exchanges suggesting imminent correction on the horizon

- Ethereum price has hit a new three-year high at $1,162 after a massive 63% move.

- The digital asset could be facing a short-term correction after such a significant rally.

Ethereum has reached a total market capitalization of $121 billion which is the highest ever due to the increase in circulating supply. The smart-contracts giant has also seen a significant rise in market dominance from 10% in December 2020 to a high of 14.3%.

Ethereum price might be poised for a pullback soon

Considering the magnitude of the bull move to $1,162, it wouldn’t be surprising to see Ethereum price take a hit before resuming the uptrend. The exchange inflow of ETH has seen a significant spike on January 3 which suggests investors are looking to take some profit in the short-term.

ETH exchange inflow chart

This metric coincides with the number of Ethereum coins inside exchanges which has increased since January 1 from 22.6% to 22.89%, again adding credence to the idea of a potential short-term pullback.

ETH coin supply on exchanges chart

However, it’s important to note that although the supply of Ethereum inside exchanges has increased in the past three days, it’s still in a downtrend since November which overall means that most investors are still not interested in selling.

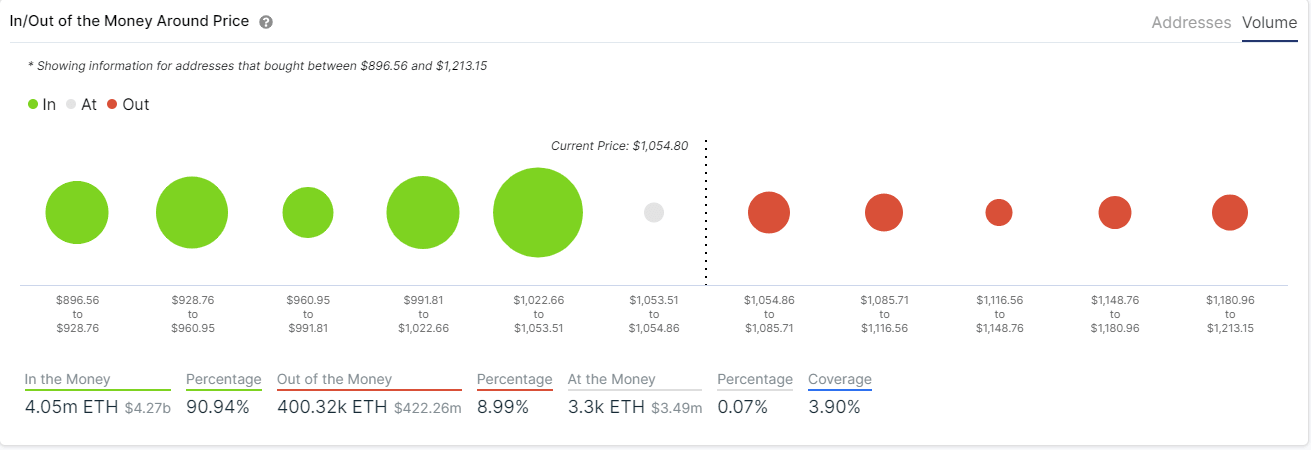

ETH IOMAP chart

Furthermore, the Eth2 deposit contract holds more than 2.25 million ETH currently which represents around $2.4 billion at current prices. The In/Out of the Money Around Price (IOMAP) chart shows very little resistance to the upside as bulls target $1,200. There is a robust support area between $1,022 and $1,053 which should serve as a strong pillar for the bulls.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B18.39.37%2C%252005%2520Jan%2C%25202021%5D-637454654615831551.png&w=1536&q=95)

%2520%5B18.40.29%2C%252005%2520Jan%2C%25202021%5D-637454654647240198.png&w=1536&q=95)