Ethereum Price Analysis: ETH bulls ignore overbought RSI to attack $1,100

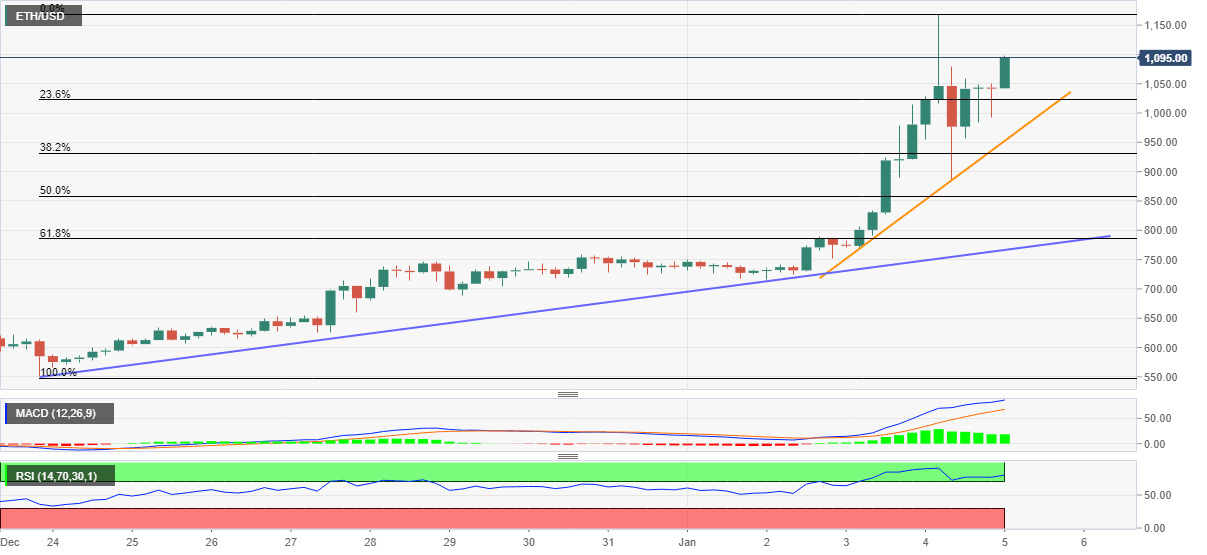

- ETH/USD keeps bounce off 886.00 while eyeing February 2018 top, teased the previous day.

- Overbought RSI conditions probe upside momentum, sellers await break of two-day-old support line for entry.

ETH/USD stays bid around $1,090 during early Tuesday’s trading. The crypto major refreshed the highest since February 2018 before stepping back to 886.00 amid overbought RSI conditions.

While the oscillator remains in the region suggesting ETH/USD pullback, the quote ignores the downside signals while following bullish MACD clues.

That said, the $1,100 round-figure is in a hand’s reach to the ETH/USD buyers during the latest upswing. However, the previous day’s high around $1,169 and the $1,200 can challenge the pair’s further upside.

In a case where Ethereum buyers refrain from bending the knee around $1,200, February 2018 peak near $1,225 and the record top, marked in January 2018, surrounding $1,420, will be in the spotlight.

Alternatively, even counter-trend traders will wait for a downside break of an immediate support line, at $952 now, for fresh entries. Following that 50% and 61.8% Fibonacci retracement of December 23 to January 04 upside, respectively near $858 and $785 will challenge the ETH/USD bears.

It should be noted that an upward sloping trend line from December 23, close to $766, adds to the downside filters.

Overall, ETH/USD is up for challenging the multi-month top but momentum indicators test the bulls.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.