Ethereum price to wreck short positions with a 20% jump

- Ethereum price action is close to completing one of the strongest bullish breakout signals since October 2021.

- New expansion phase for ETH is likely to be confirmed today.

- Downside risks remain a concern, but the size and scope of any drop have been reduced by wide margins.

Ethereum price action continues to be bullish with strong buying pressure pushing ETH close to yesterday’s high. More importantly, however, is Ethereum’s proximity to completing an extremely bullish breakout signal in the Ichimoku Kinko Hyo system.

Ethereum price set to test $3,300 and then $4,500

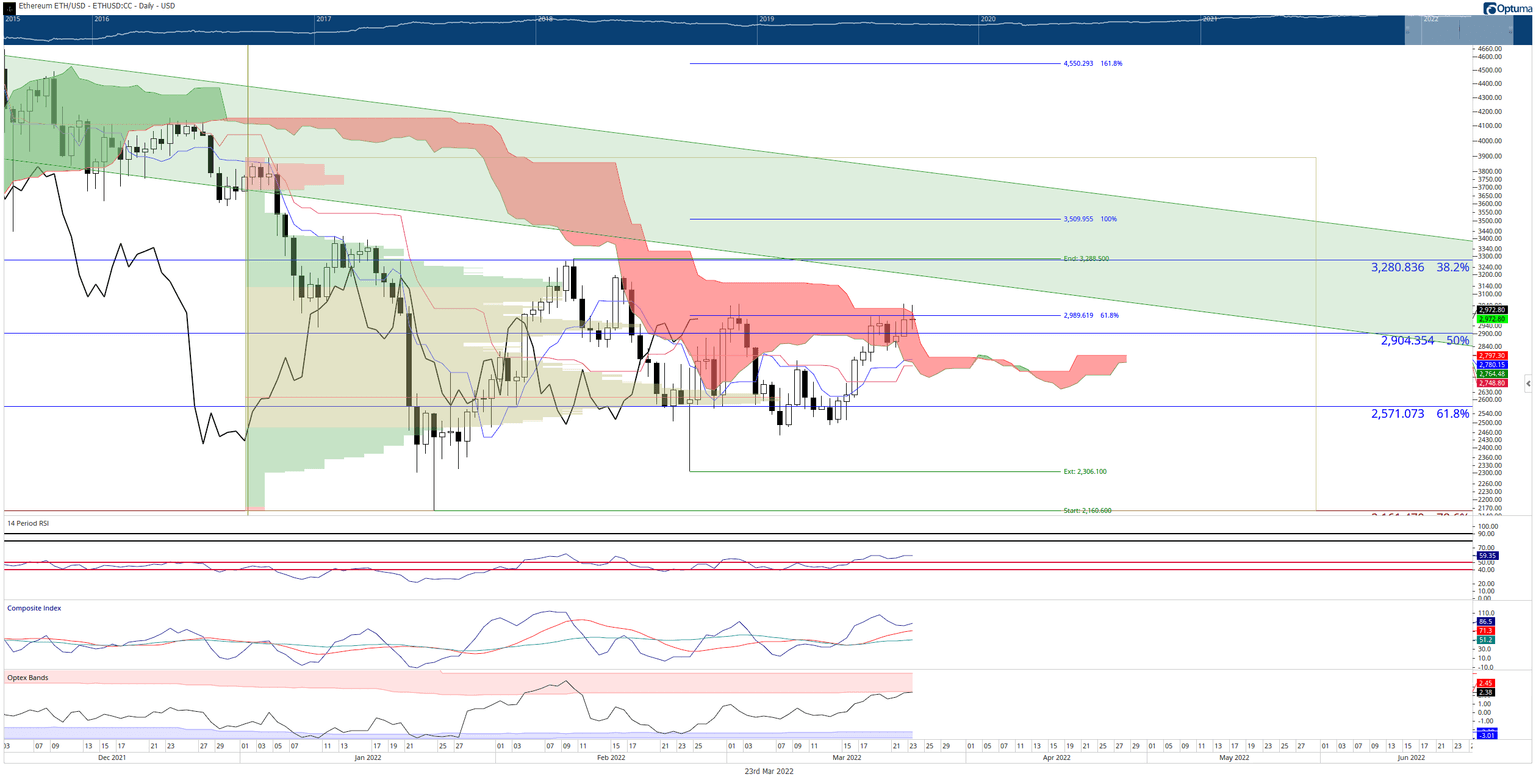

Ethereum price action, during the intraday session, has completed all criteria for an Ideal Bullish Ichimoku Breakout. However, the daily close is what’s most important and required. To confirm an Ideal Bullish Ichimoku breakout, ETH needs to close at or above $2,985.

If bulls can close Ethereum price above the daily Ichimoku Cloud, it will be the first confirmed Ideal Bullish Ichimoku Breakout since October 13, 2021. The entry back in October 2021 resulted in Ethereum moving nearly 35% higher to a new all-time high of $4,864 from the breakout close of $3,607.

ETH/USD Daily Ichimoku Kinko Hyo Chart

The first resistance zone that Ethereum price will contend with, pending a close above the Ichimoku Cloud, will be the 38.2% Fibonacci retracement at $3,300. Following that level is the weekly Kijun-Sen and 100% Fibonacci expansion, both at $3,500. If bulls can breach $3,500, then it is mostly clear and open until the 161.8% Fibonacci expansion at $4,550.

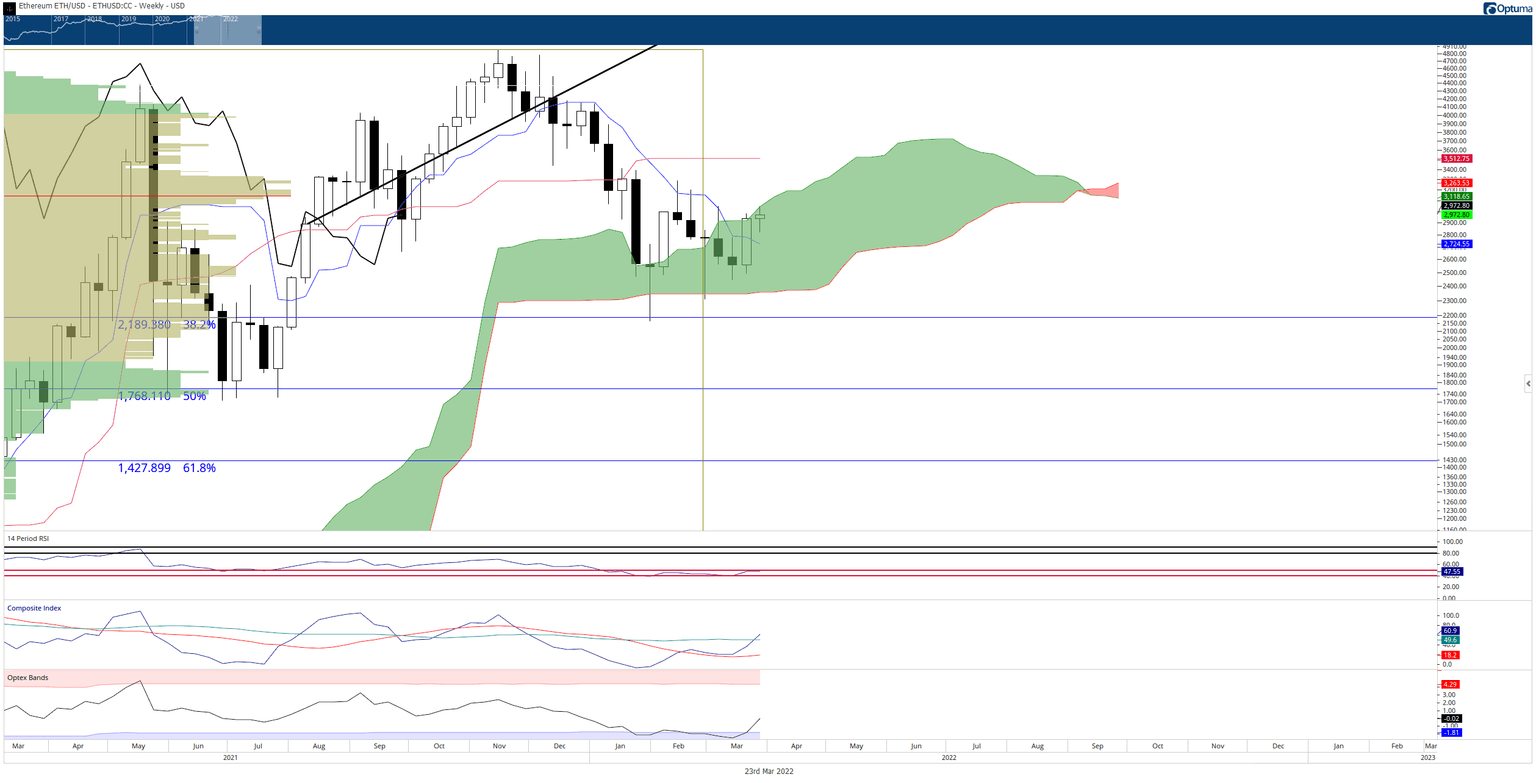

ETH/USD Weekly Ichimoku Kinko Hyo Chart

However, downside risks should not be ignored. The most important price level that Ethereum price needs to surpass is a weekly candlestick close above $3,044 - where the top of the weekly Ichimoku Cloud (Senkou Span A) exists. Failure to close above Senkou Span A could mean a fake-out move higher, giving bears a strong incentive to resume selling pressure on Ethereum.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.